Financial planning isn't just about securing immediate needs- experts

Experts have stated that financial planning isn't just about securing immediate needs; it's about building a foundation for long-term stability and growth.

The remarks were made during the launch of Jubilee Life Insurance's Smart Save Plan, a savings product with numerous inbuilt benefits.

Renowned finance literacy analyst Sharon Tumushabe noted that the financial planning conversation is relevant to people across different demographics, regardless of where they are in life.

“If you have people who depend on you, their well-being and future security are paramount. By starting a structured savings plan, you ensure that, no matter what happens, they will have financial support,” Ms. Tumushabe advised.

She added, “In financial planning, time is one of the most valuable assets. The earlier you start, the more you benefit from compound interest, and the larger your fund grows.”

Experts also said that awareness and educating the public about the available savings options in the market are key to cultivating a savings culture in the country.

Jubilee Life chief executive officer Kumar Sumit Gaurav noted that the reasons to save for the future are well-documented and further demonstrated by several cautionary tales all around us, though there’s still a need to regularly address them.

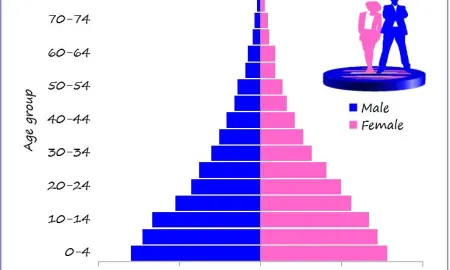

Recent estimates by the Bank of Uganda reveal that only about 3-5% of the 18 million Ugandan workers save on a monthly basis. With Kenya’s saving rate at 23%, Rwanda at 18%, and Tanzania at 13%, Uganda’s situation looks all the more precarious.

Addressing Uganda's low savings culture requires robust educational campaigns and the introduction of innovative solutions from players in the financial sector.

“Our new Jubilee Smart Save Plan is designed to empower our customers to meet crucial financial needs while offering a competitive return on investment. Whether it's funding education, securing business capital, or purchasing a home, this solution will ensure that our customers' savings work as hard for them as they do,” said Mr. Gaurav.

Besides inculcating a consistent saving discipline, customers also need guidance to navigate the available solutions and opportunities in the market.

“We acknowledge the need to offer personalized financial advice as we walk with our customers on their journey towards achieving their goals. We are committed to investing our efforts in empowering our customers in this regard. We are confident that a joint effort alongside other sector players will turn the tide of the savings culture in the country.”

Dorcus Kuhimbisa, Chief Operating Officer of Jubilee Life Insurance, emphasised the need for broader support from political and governmental entities to boost the uptake of insurance products.

"The uptake of insurance is not solely the responsibility of service providers. It requires substantial support from political players and the government at large," Kuhimbisa stated.

She highlighted the persistent struggles with national health insurance schemes, which she believes could expose more people to the benefits of insurance.

Kuhimbisa pointed out that while service providers are making strides independently, the journey is fraught with challenges.

"Our business partners, such as bank assurance agents, face the uphill task of convincing customers to trust that their investments will yield returns," she said.

This skepticism is exacerbated by the lack of visible governmental support in areas like health insurance and pension schemes.

Kuhimbisa also highlighted practical barriers, such as clients lacking national IDs or access to mobile phones and affordable internet. These issues limit the market reach and skew the target audience towards more accessible demographics.

For Kuhimbisa, increasing insurance penetration beyond the current 1% requires a multifaceted approach.

She called for partnerships that leverage media reach and regulatory support to build public trust in insurance products.

"If we can learn how to leverage such solutions and embed regulatory and government support, it will be easier to build trust in insurance. It will be cheaper to deliver insurance, and consumers will have faith to buy more products from the service providers they trust," she said.