Hundreds benefit from DTB-backed enterprise symposium

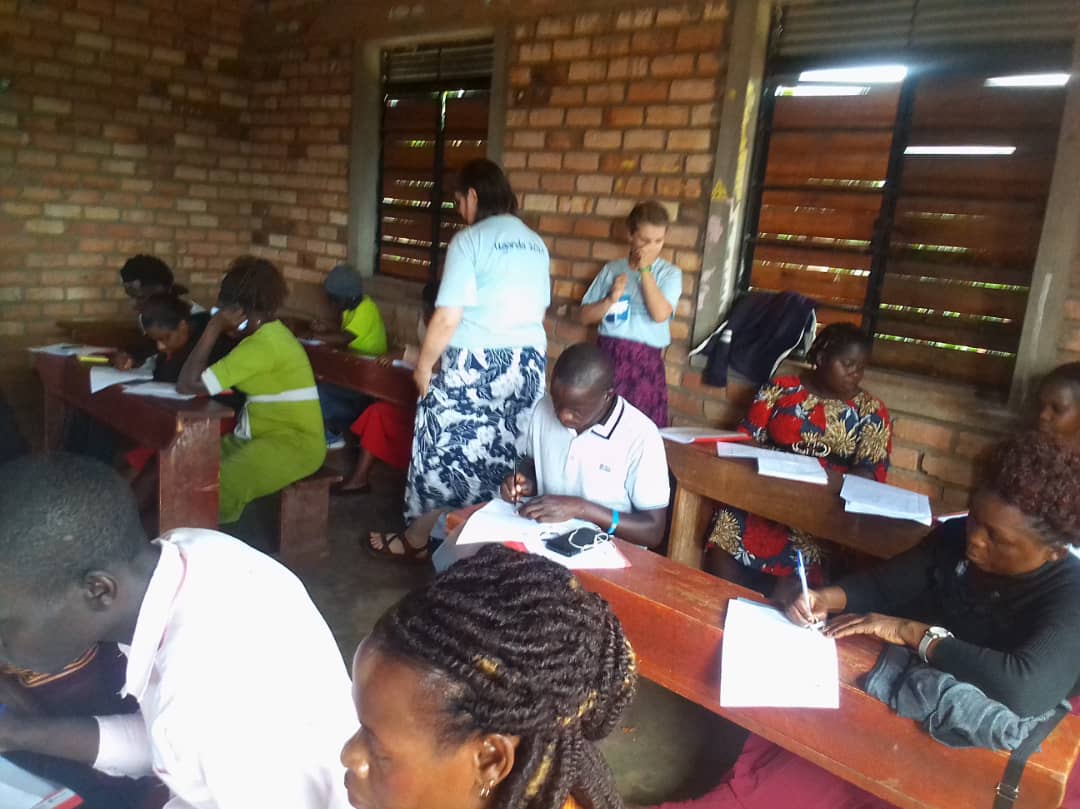

Hundreds of Micro, Small, and Medium Enterprises (MSMEs) have benefited from a financial symposium to equip entrepreneurs with essential knowledge for business growth.

The event, held in collaboration with Diamond Trust Bank (DTB), highlighted the importance of streamlined financial practices and strategic business insights.

DTB’s head of retail banking Benson Otema challenged participants to dig deep and reexamine their business motives, build unique selling propositions and solid steps for their business and financial success.

"Why are you in that business? Because when you understand why, you can easily grow and make money," Otema said.

He also highlighted the disadvantages of informal business structures, which he said are seen as high-risk businesses by financial institutions, leading to high costs of capital.

"One of the reasons why businesses don’t benefit from banks is because they are so informal," Otema said.

"Banks consider many factors in pricing the loan, and informality is one of the biggest ones. No one can trust an informal customer."

Sylvia Kirabo, principal public relations officer of Uganda National Bureau of Standards (UNBS), encouraged MSMEs, particularly in small-scale manufacturing, to obtain the UNBS quality mark (Q mark) to enhance market competitiveness.

Kirabo outlined the straightforward certification process facilitated by URSB, stressing that formal business registration is a prerequisite for obtaining the Q mark.

"When you get that quality mark, the market for your goods expands because you supply to all the big supermarkets and can even explore export opportunities," she said.

David Bahati, the state minister for industry, identified critical barriers hindering MSME growth, including lack of working capital, informal operations, and inadequate innovation.

Bahati said it was necessary to have affordable working capital for business expansion amidst the challenge of high borrowing costs.

"MSMEs need working capital to expand but then money is expensive for them. The cost of money is around 24 percent, while the internal rate of return in the country is at 14 percent," Bahati said.

He also addressed the misconceptions surrounding formalization, particularly the fear of taxes that deter entrepreneurs from registering their businesses formally.

"Not formalizing is actually a significant barrier to business growth. I therefore, urge businesses to embrace formal registration to unlock growth opportunities and regulatory benefits,” he said.

He called on MSMEs to adopt strategic financial practices, formalize their operations, and leverage quality certification to enhance market competitiveness.