Airtel Money Uganda has partnered with SchoolPay and Sanlam Investments to introduce SchoolPay Savings, a new financial product designed to transform how Ugandan parents save for and pay school fees.

The service tackles a long-standing challenge faced by millions of families: the last-minute scramble and financial anxiety that comes with school fees payments each term.

SchoolPay Savings offers parents a secure, flexible, and rewarding way to gradually set aside money for their children’s education while earning 8% annual interest calculated daily.

Parents can start saving from as little as shs5,000 at any time, with no fixed schedules or minimum balance requirements. The savings are securely invested through Sanlam’s regulated Unit Trust Scheme, managed by Sanlam Investments East Africa Limited and licensed by the Capital Markets Authority of Uganda.

“For many Ugandan families, school fees payments create sleepless nights of financial anxiety,” said Japheth Aritho, Managing Director of Airtel Mobile Commerce Uganda Limited.

“SchoolPay savings changes that story forever. Instead of panic when fees are due, parents can now confidently grow their school fees savings while earning interest, reducing the burden.”

One of the scheme’s most innovative features is zero withdrawal charges when paying school fees directly from the savings wallet—eliminating transaction costs that have traditionally hindered parents from accessing their own funds for education.

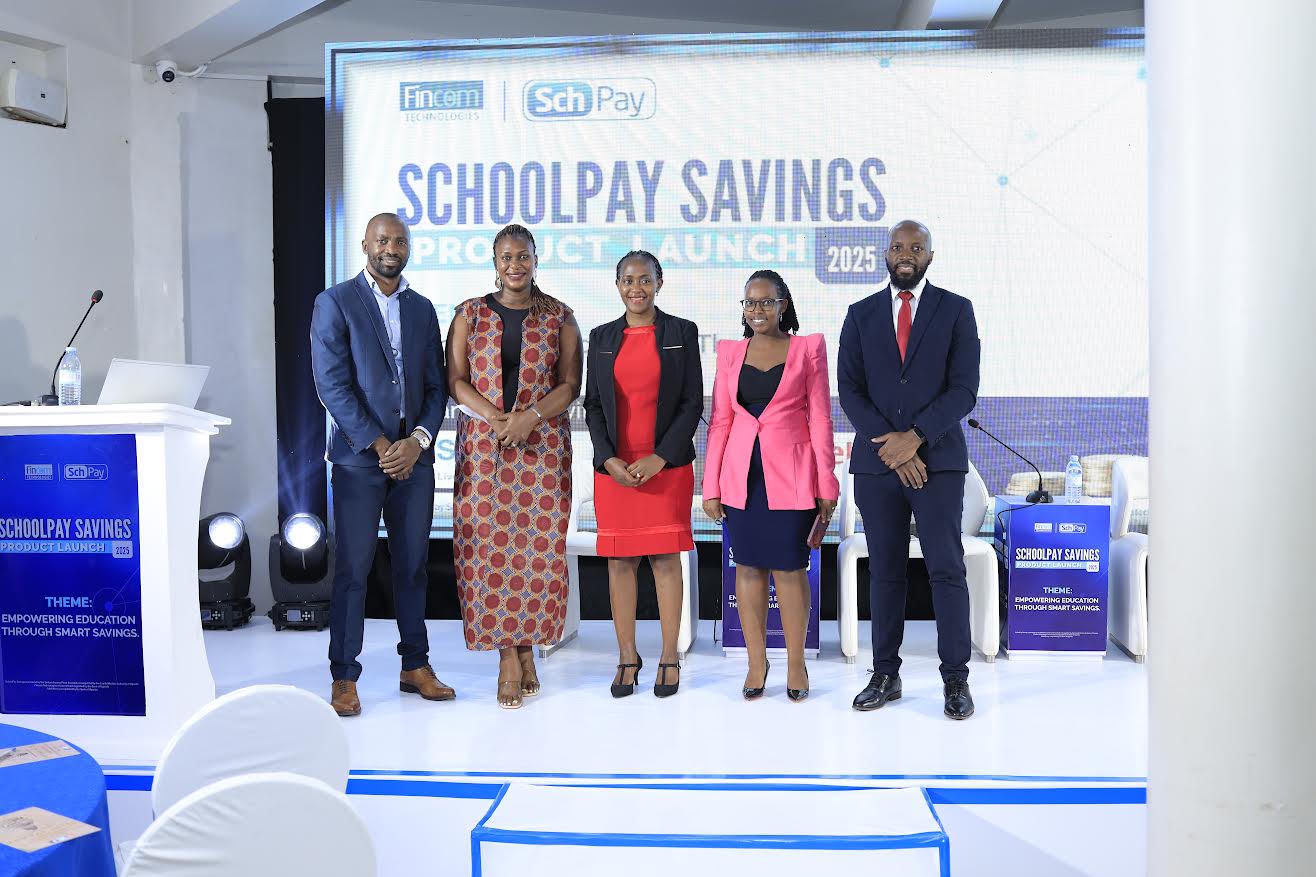

Charity Atukwatsa Mutagamba, CEO of Fincom Technologies (operators of the SchoolPay platform), underscored the partnership’s broader goal: “Our mission has always been to make school fees payments simple, secure, and stress-free. With SchoolPay Savings, we empower parents not just to pay, but to plan ahead and grow their savings—making every shilling work harder for the family and the future of our children.”

The collaboration blends Airtel Money’s nationwide mobile money network, SchoolPay’s established payment platform, and Sanlam Investments’ fund management expertise into a comprehensive educational financing solution.

Key Features of SchoolPay Savings:

-

Save from shs5,000 up to a maximum single transaction of shs5,000,000

-

Earn 8% annual interest, calculated daily

-

Instant withdrawals with full flexibility

-

Zero charges when paying school fees from the wallet

-

Funds secured via a regulated Unit Trust Scheme

-

Simple USSD access via *185#

The product is exclusively available to parents paying school fees through SchoolPay, ensuring a seamless link between saving and payment.

SchoolPay Savings is now live and accessible to all eligible parents across Uganda.