Reports call for policy overhaul to address underutilised capacity in manufacturing sector

Many manufacturers are forced to import raw materials due to the substandard quality, limited availability, and inconsistency of locally sourced alternatives.

New reports have revealed that Ugandan manufacturing enterprises are operating at only 54.4 percent of their capacity, indicating a significant underutilsation of resources and unrealised production potential.

This revelation follows the release of two reports on capacity utilisation and cost center analysis of manufacturing firms in the country.

The studies are a result of a collaboration between PSFU, Uganda Manufacturers Association (UMA) and Uganda Small Scale Industries Association (USSIA) to investigate constraints to full capacity utilisation and the cost drivers.

"Out of the 22 sectors analysed, 10 operate above 50 percent capacity, while the rest operate below," the report says. "This implies that sectors such as wood and wood products drive the national average above 50 percent.

"However, the sectors at the bottom of the capacity utilisation ranking are construction with only 24 percent, followed by cosmetics (31.3 percent) and agricultural products (33.4 percent)."

According to the report, the primary reason for this underutilization is the lack of effective demand for locally manufactured goods.

"This suggests that there is a significant amount of redundant or unutilised capacity among manufacturing firms in Uganda, where substantial resources have been invested. Therefore, there is an urgent need to implement relevant policies to unlock the unutilized production capacity," the report further read.

Peter Kasirye (L) from Uganda Small Scale Industries Association, Ms Sarah Kagingo (centre) and Mr Kalibbala from Uganda Manufacturers Association (UMA).

Peter Kasirye (L) from Uganda Small Scale Industries Association, Ms Sarah Kagingo (centre) and Mr Kalibbala from Uganda Manufacturers Association (UMA).

The study highlighted that domestic manufacturers face stiff competition from imported products due to their own high production costs. Additionally, high taxes and macroeconomic challenges further exacerbate the situation.

One of the major cost drivers identified in the study is the high expense of raw materials.

Many manufacturers are forced to import raw materials due to the substandard quality, limited availability, and inconsistency of locally sourced alternatives.

This reliance on imports is compounded by steep import duties and associated expenses.

"According to the report, firms reported that they cannot produce more than what is needed in the market due to the risk of wastage, further worsened by the taxes, such as stamp duty, levied during storage," the report stated.

The study also revealed that electricity presents a significant challenge for Ugandan manufacturers, with frequent power outages disrupting production, especially during peak hours.

Some firms are compelled to rely on costly generators, which further inflate operational costs.

The high tariffs for electricity also undermine the competitiveness of Ugandan manufacturers on the global stage.

Logistical hurdles further complicate matters, with inefficiencies plaguing the Ugandan transport and logistics sector.

Fragmented logistics services, coupled with high transportation costs, pose significant barriers to manufacturers.

Compared to their Kenyan counterparts, Ugandan logistics companies face higher taxes, user fees, and road transport inefficiencies.

Sarah Kagingo, vice chairperson of the Board of Directors of PSFU, emphasised the importance of collaboration between the private sector, public sector, academia, and development partners in addressing critical issues affecting manufacturing.

"We are sharing the key findings of the capacity utilization and cost center analysis studies for both large and small manufacturers in Uganda," said Kagingo.

Kagingo outlined PSFU's proposals to address these challenges, including the establishment of a Competition Commission, expediting the issuance of Local Content regulations, and strengthening dispute resolution mechanisms within the East African Community.

Kagingo urged stakeholders to use the findings to inform policy formulation and the development of National Development Plan IV, highlighting the readiness of the manufacturing sector to engage further in implementing the recommendations.

Stephen Mpagi Kalibbala, representing the Uganda Manufacturers Association (UMA), stated that Ugandan manufacturers have played a pivotal role in the country's economic growth, contributing to a GDP of USD 50 billion.

"The manufacturing sector alone contributes to 16.9 percent of the GDP, making it the largest sub-sector in Uganda's economy," emphasized Kalibbala.

Kalibbala stressed the alignment of the workshop's studies with UMA's strategic plan, highlighting the importance of evidence-based research in influencing policies and advocating for the manufacturing sector's interests.

"These studies empower both the government and private sector with evidence-based information to better plan and execute business strategies," asserted Kalibbala, emphasising the importance of collaborative efforts between stakeholders.

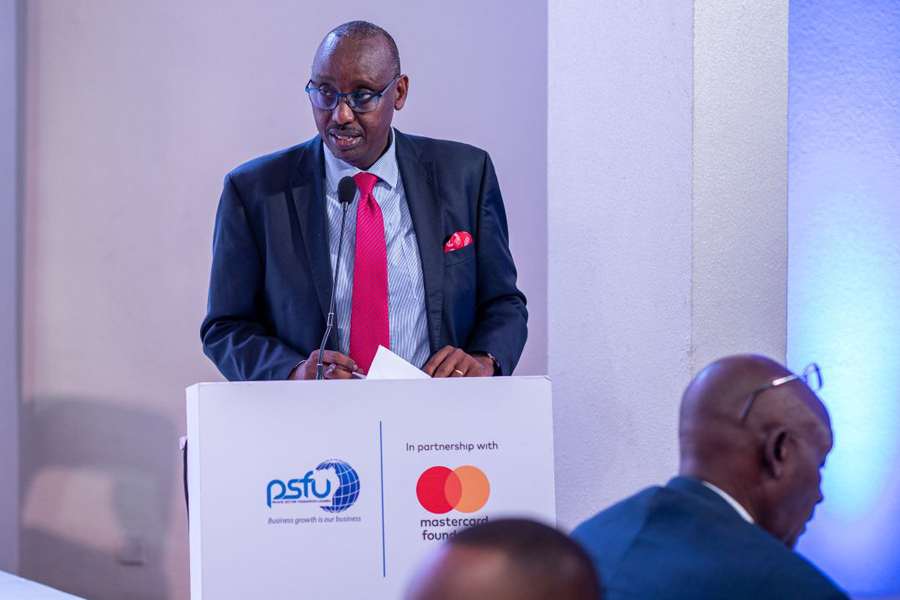

Officials from UMA, PSFU and Mastercard Foundation after discussions on the report

Officials from UMA, PSFU and Mastercard Foundation after discussions on the report

Stephen Asiimwe, chief executive of the Private Sector Foundation Uganda (PSFU), acknowledged the significant contribution of manufacturing to Uganda's industrial sector GDP but noted that it has experienced slower growth compared to other sectors, averaging 3.3 percent between 2015/16 and 2020/21.

Asiimwe highlighted its relatively stable performance during the challenging period of the Covid-19 pandemic.

"With Uganda actively participating in regional economic integration initiatives, the manufacturing sector presents opportunities for employment creation and poverty reduction," he said.

To harness these opportunities, PSFU, in collaboration with founding members UMA and USSIA, conducted studies on capacity utilization and cost center analysis with the aim of informing policy formulation for the sector.

In response to these challenges, the PSFU and the Uganda Manufacturers Association (UMA) have formulated a series of recommendations aimed at addressing these obstacles.

These proposals include stimulating demand through fair competition enforcement, expediting the issuance of Local Content regulations, and strengthening dispute resolution mechanisms within the East African Community (EAC).

Additionally, measures to reduce the cost of raw materials, address electricity issues through infrastructure upgrades and exploration of renewable energy sources, streamline logistics through multimodal transport systems, and facilitate access to finance have been put forth.