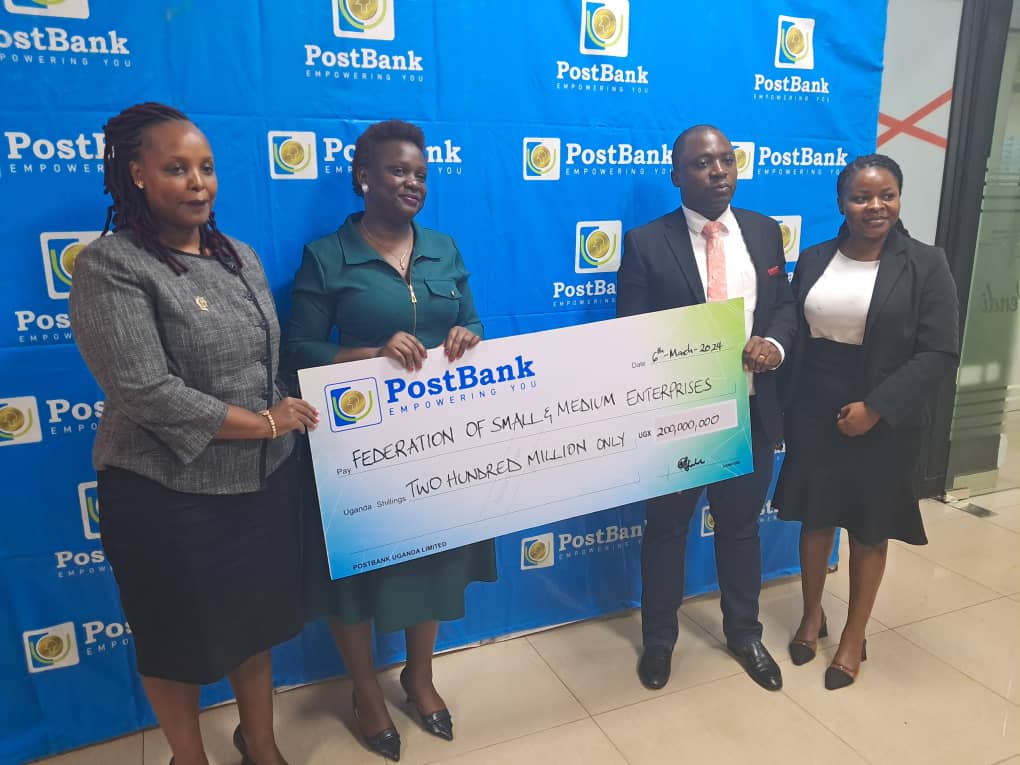

PostBank injects Shs 200 million in value addition, financial literacy training for SMEs

PostBank Uganda has committed an additional Shs 200 million to extend its partnership with the Federation of Small and Medium-Sized Companies (FSME), aimed at equipping SMEs nationwide with value addition and financial literacy skills.

Dubbed "Gattako Omutindo," the program falls under PostBank's financial literacy and skills enhancement pillar.

Keep Reading

It will be carried out in collaboration with the Federation for Small and Medium-Sized Enterprises (FSME).

The partnership between PostBank Uganda and FSME, which began in 2022 with a donation of Shs 80 million, demonstrates their commitment to supporting the socio-economic transformation of Uganda, particularly in the agribusiness sector.

Through the previous program, the bank successfully trained 500 small and medium-sized enterprises (SMEs) in agro-processing, business, and financial literacy in northern and western Uganda.

For the 2024 cohort, the bank has donated Shs 200 million. Together with FSME, they aim to train over 700 SMEs based in Soroti, Koboko, Kabarole, and Kampala districts.

Each training will span five days and will be conducted by experienced trainers from FSME.

PostBank's increased investment in this program reaffirms its commitment to the sustainable growth of SMEs in Uganda, recognizing their critical role in the country's economy.

John Walugembe, the Executive Director of FSME, informed the Nile Post that a total of 500 SMEs were equipped with skills in agricultural value addition and financial literacy. These SMEs have since transformed their businesses into formal enterprises.

In the first cohort, SMEs from selected regions of Arua, Lira, Mbarara, and Kampala were trained, with a particular focus on agricultural products.

Walugembe stated that agriculture serves as Uganda's backbone, and aligned with the government's strategy to promote value addition in businesses, their aim is to uplift the 39% of Ugandans living in abject poverty and facilitate their engagement in the market economy.

"We developed a manual aligned with the National Financial Literacy Strategy and partnered with different agencies, including the National Bureau of Standards. For instance, we trained SMEs in Mbarara on adding value to milk and creating different products like yogurt. In Kampala, we worked with SMEs to add value to fresh fruits and vegetables, and they were able to make tomato sauce and juices," Walugembe explained.

This year, they are continuing with the same campaign.

"We will provide training in Soroti to support SMEs in adding value to millet and in Koboko to add value to cassava. We are identifying specific value chains in specific regions, tailoring our support to the SMEs in those areas," added Walugembe.

He noted that the number of SMEs attending the training has doubled this time.

"Previously, there were 20 participants per technical training, and more attended the financial literacy training," he noted.

The goal is to integrate beneficiaries into the formal system. As part of their training, support will be provided to register their businesses, open bank accounts, and ensure their products meet the required standards.

Walugembe also mentioned that they will follow up with previous trainees to determine what additional support they can offer.

Peter Ssenyange, the Chief Finance Officer at PostBank, emphasized that focusing on Micro, Small, and Medium Enterprises (MSMEs) aligns with Uganda's economic structure, where the majority of SMEs are involved in the agribusiness value chain.

"By equipping Agri-SMEs with essential skills in agricultural value addition, post-harvest handling, Good Manufacturing Practices (GMP), and Financial Literacy, we aim to enhance their productivity, competitiveness, and sustainable business practices," he stated.

The 2024 program will target over 700 SMEs in Soroti, Koboko, Kabarole, and Kampala districts, selected based on their potential for impact. Each training session, facilitated by experienced trainers from FSME, will focus on key aspects of Agri-SME development, including millet and cassava processing, agro-tourism, coffee value addition, and financial literacy.

Priscilla Akora, the Head of Marketing and Communications at PostBank, encouraged all small business owners in these districts to register for the program free of charge at the nearest PostBank branch.