83% of NSSF beneficiaries had zero financial literacy – report

For the report, NSSF partnered with Enterprise Uganda to implement an assessment survey report 2024 this year on the performance of benefits and perceptions towards retirement to ascertain the level of preparedness by the beneficiaries.

By Pedson Mumbere

As many as 83 percent of National Social Security Fund (NSSF) beneficiaries did not have any form of financial literacy before withdrawing their savings.

Keep Reading

This is according to NSSF National Beneficiaries Survey Report 2024, which says financial literacy mainly reached savers from the central region.

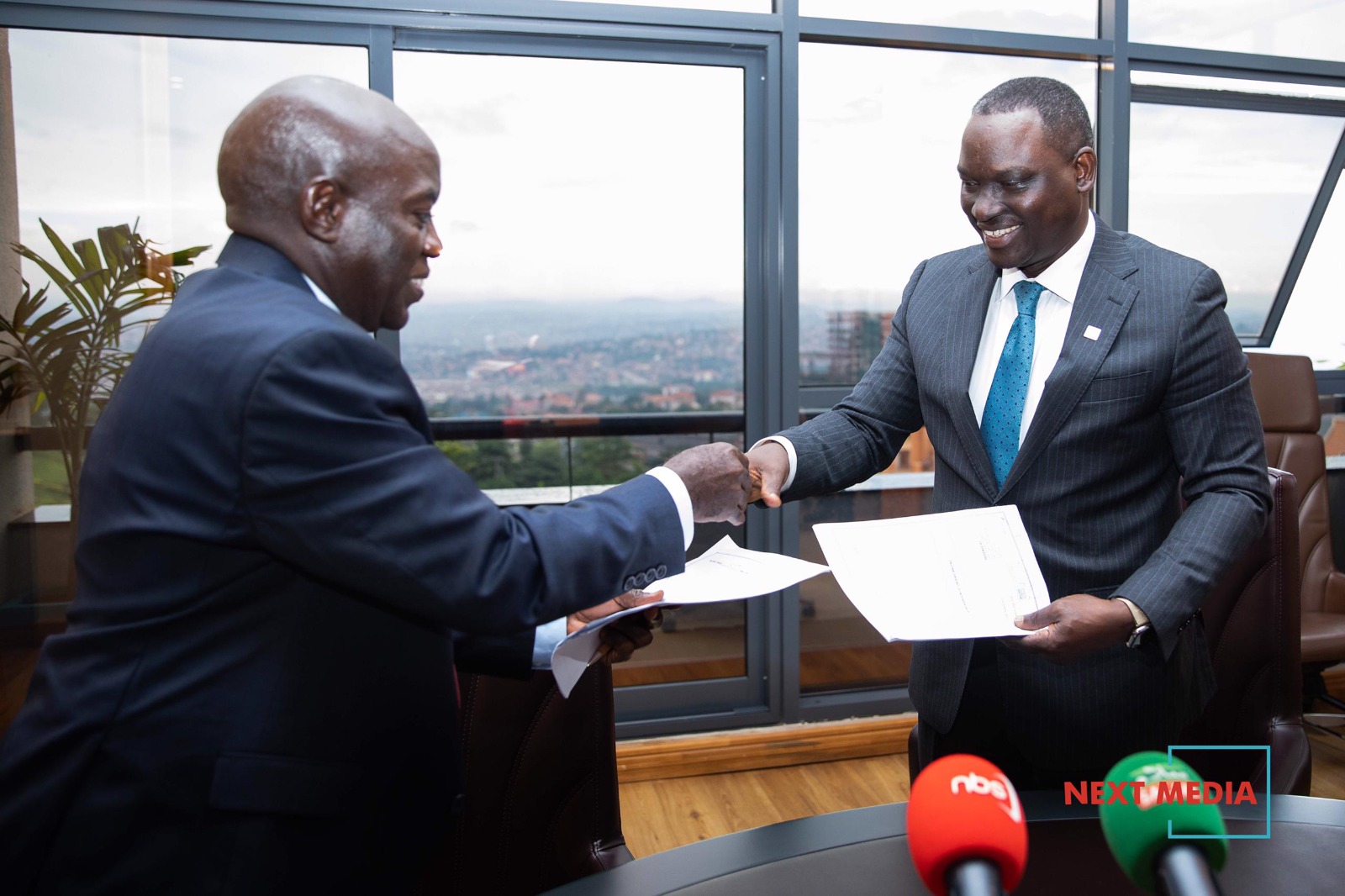

For the report, NSSF partnered with Enterprise Uganda to implement an assessment survey report 2024 this year on the performance of benefits and perceptions towards retirement to ascertain the level of preparedness by the beneficiaries.

Speaking at the report's launch, Patrick Ayota the NSSF managing director, emphasised the necessity of stepping up efforts to increase financial literacy adoption.

"It’s true there is low financial literacy uptake, which calls for a need to enhance it," Ayota said.

The report further indicates that 66.8 percent of beneficiaries did not seek any advice before or after receiving their money.

This points to a fact that most of the decisions made are based on the experience of the beneficiary which has been created over their work life and they see no need further consultations.

The survey says leading reasons for not seeking advice included being sure of what they wanted to do, not trusting anyone and simply not needing advice.

According to the report, the fact that more than six in 10 beneficiaries did not seek professional advice means that even if the availability of financial literacy programmes was made known, some members would still opt out.

"Many thought they had already figured out what they wanted to do and others thought that having a plan drafted already implied an absence of necessity to consult," says the report.

The average amount paid to beneficiaries was Shs24 million and the average age of beneficiaries was 50 years.

However, 60 percent received less than Shs10 Million and 83 percent of the values was shared among just 25 percent of the beneficiaries.

The report gives a jarring conclusion that NSSF benefits are not sufficient for retirement.

Fred Muhumuza. a renowned economist, said that NSSF retires need to be educated on how to multiply the meagre benefits in order to survive on them for longer.

"The majority of the NSSF beneficiaries receive less than Shs10 million, meaning benefits are not sufficient for retirement therefore retires need to be educated on how to multiply the meagre benefits in order to survive,” Muhumuza said.

Additionally, in terms of benefits expenditure priorities, education ranked highest at 40 percent, then buying land and improving a house at 34 percent and 33 percent respectively.

Members who venture into business face the most uncertain prospects due to the high business failure rate especially for new micro enterprises.

Some expressed regrets.