UAP Old Mutual, NSSF tip Ugandans on prospering in retirement

UAP Old Mutual has in collaboration with the National Social Security Fund (NSSF) Uganda, hosted a financial education engagement at the Kampala Sheraton Hotel for customers.

Themed, ‘Prosper in retirement and beyond’, the event targeted customers who are soon to be eligible for midterm and age benefit, as well as those who are almost at retirement age.

Keep Reading

The engagement focused on financial education through promoting investment in insurance and effective asset management strategies critical for achieving long-term financial security especially after retirement.

“The relevance of retirement planning, as a key financial tactic is becoming increasingly noticeable, particularly among adults nearing the age of 45 to 55 years. According to the 2020 Financial Capability Survey by the Bank of Uganda, this demographic cohort tends to consider retirement planning most relevant. As esteemed members of our community with retirement benefits, it is therefore crucial to recognize the importance of prudent financial planning and wealth management. Financial security and knowledge go hand in hand. Coupled with insurance, you can have a proactive approach towards retirement planning and are able to secure a prosperous future for yourselves and generations to come,” Robert Kabushenga, a board director at Old Mutual Life Assurance told the audience.

UAP Old Mutual Insurance General Manager, James Maguru emphasized the pivotal role of insurance in safeguarding financial security.

"Insurance acts as a safety net during unforeseen circumstances and provides an injection of funds that greatly reduce the risk if not totally strip it. It also shortens the time of recovering even beyond the benefit of the financial support. Understanding the diverse insurance products available enables individuals to shield themselves and their families from potential financial hardship,” Maguru said.

Gerald Kasato, Acting Deputy Managing Director, NSSF Uganda, highlighted the significance of prudent investment decisions.

"Effective investment strategies are crucial for maximizing returns and ensuring long-term financial stability. NSSF members should consider diversifying their investment portfolios and seeking professional advice to make informed decisions." He further emphasized the role of education in financial empowerment, saying, ‘Through investing in financial education and empowering individuals with knowledge, we empower them to take control of their future."

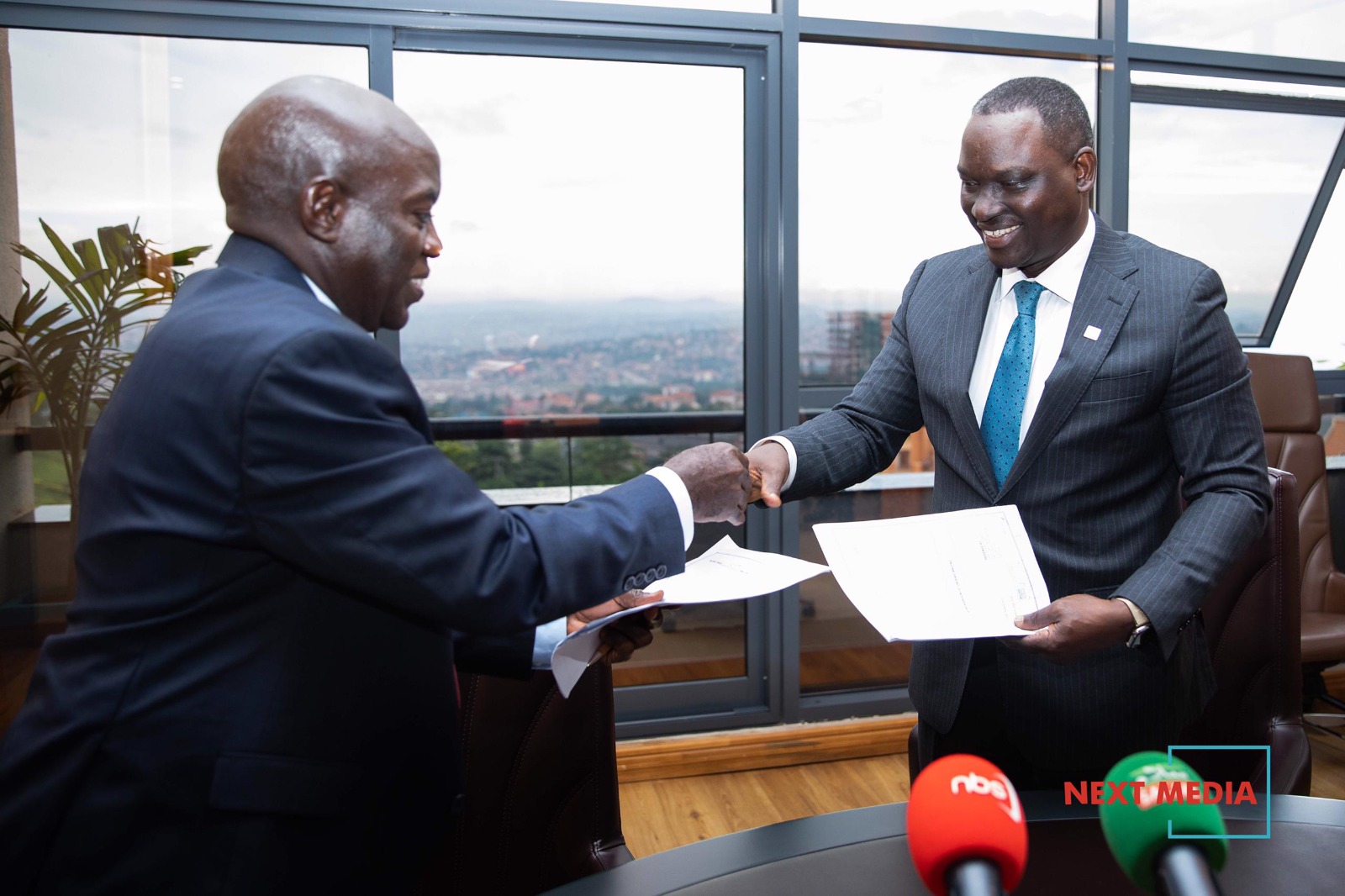

Last month, UAP Old Mutual Insurance partnered with National Social Security Fund(NSSF) to offer financial literacy to Ugandans.

This partnership aims to enhance the financial well-being of individuals through financial education trainings across the country.