Stanbic Bank, Kakira launch solutions package for Busoga sugarcane out-growers

Small scale sugarcane out-growers in Busoga region will starting this month benefit from a new financing facility designed to help cover their expenses or expand acreage.

Stanbic Bank, in partnership with Kakira Sugar Works Limited (KSW), has rolled out the Sugarcane CVP with the main objective of increasing cane output to meet rising demand for sugar both locally and across East Africa.

Uganda is the largest producer of refined sugar in the East African Community, with annual production nationwide standing at 510,000 metric tonnes as of 2022. Of this, 360,000 metric tonnes are consumed locally and the remaining 150,000 metric tonnes made available for export.

The CVP is expected to boost production capacity which will in turn create more jobs besides the other added benefits to the community in the sugarcane growing areas. On partnering with KSW, Stanbic expressed enthusiasm that the partnership presents a great opportunity for the bank to reach out and provide unsecured financing and financial literacy for more than 7,000 out-growers because KSW has the largest production capacity of about 7,500MT. The others are between 700 to 2,000MT.”

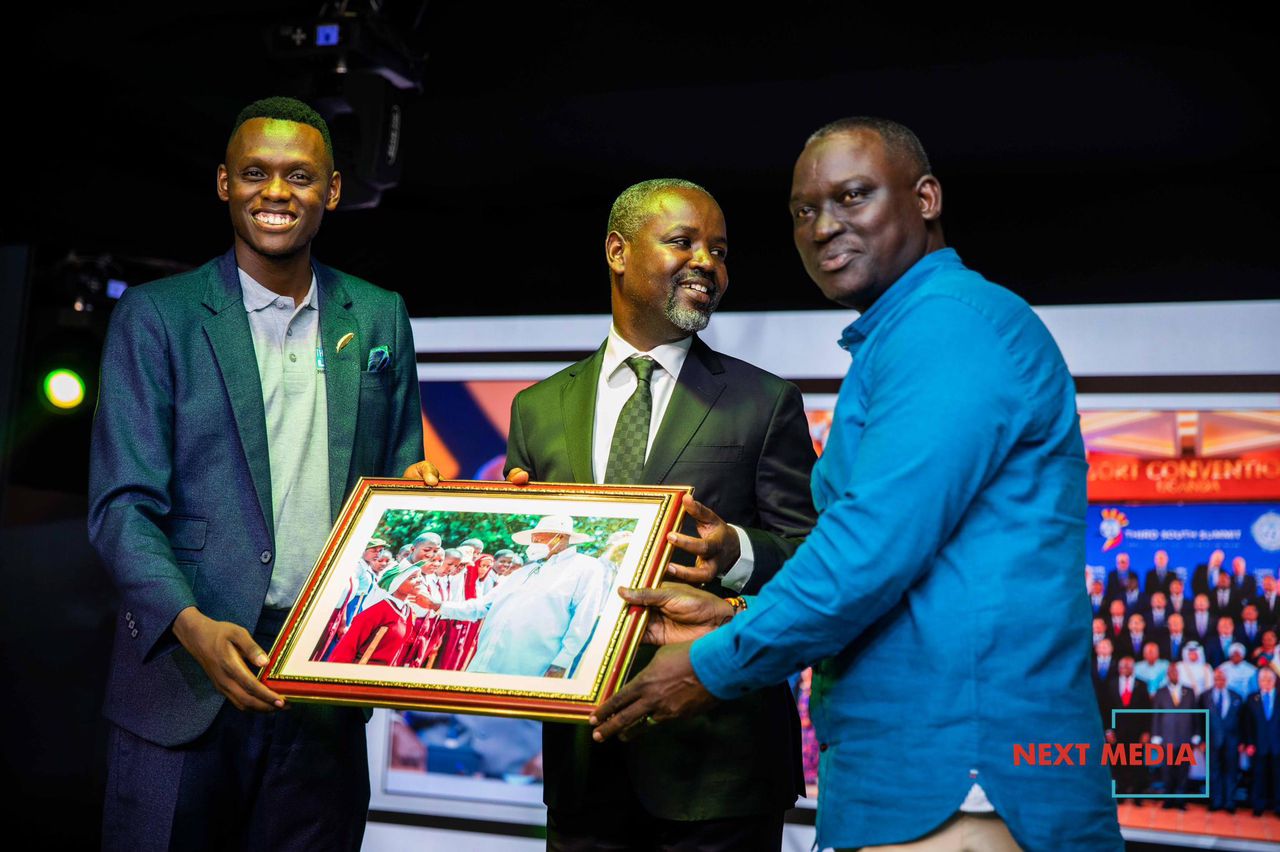

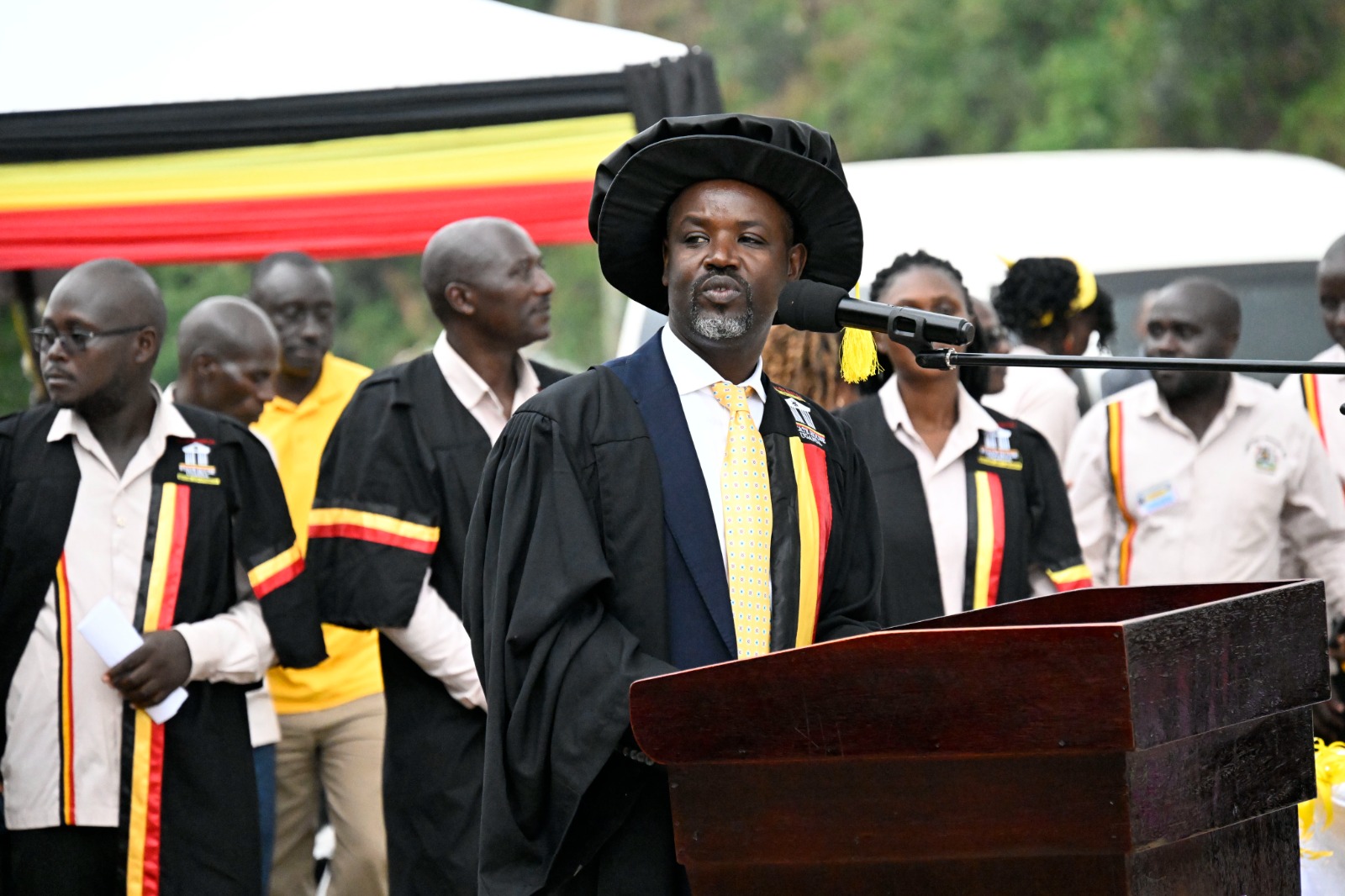

Dubbed the Stanbic’s Sugarcane Farmer Solutions, the offering was launched at Kakira Sugar Factory in Jinja on Tuesday, attended by farmers under the Busoga Sugarcane Growers Association, Stanbic Bank officials and officials from Busoga Kingdom among others.

“Today, we have launched an exciting new deal for the sugarcane farming industry, at Kakira Sugar Limited. The deal is to help sugarcane players to exploit the existing opportunities to expand their businesses by providing a variety of personalised services and products to help them manage their finances as they start the journey towards accomplishing their dreams,” Stanbic Bank’s Mathias Jumba said in Jinja.

He explained the Sugarcane Farmer Solutions to the farmers in attendance, reiterating Stanbic Bank’s purpose. “Uganda is our home, we drive her growth. We have grown and ensured the growth of our customers as well.”

Addressing the problem raised by sugarcane farmers that they were being charged very high interest and extremely stringent payment terms from other places where they get money, Jumba stated that Stanbic’s Sugarcane Farmer Solutions will solve that because the Bank understands farmers and their different earning cycles.

He pledged that the Bank would not let its plans end on paper, but let the farmers feel the impact. Our Sugarcane Farmer Solutions are not just about providing money but also financial literacy to help farmers grow,” he stated.

Stanbic Bank also pledged to solve the problem of turnaround time for sugarcane farmers. “We understand that money is needed quickly to meet the season demands. Farmers will be able to get the money in a very short time after application,” Jumba said.

Busoga Kingdom’s minister for Foreign Affairs, Owek Joan Machora Kittio, advised the farmers who get impatient when prices drop and end up burning their sugarcane to restrain from the habit. “People should understand how to be adaptive to change and not give up.” This is the “It Can Be” spirit that we stand for,” the minister stated.

Speaking on behalf of the farmers, Abubaker Ojwang Omboko stated that they are 10,000 sugarcane farmers under Busoga Sugarcane Growers Association (BSGA). He expressed excitement about the solutions that will be provided by Stanbic Bank,”

“It has always been our dream to partner with a financial institution which can drive us to our dreams. Stanbic Bank has all we need to help us reach our dreams and we are excited about these” he stated.

The new Sugarcane CVP is a further step in a test and learn journey that Stanbic Bank started in 2018 by lending within select informal ecosystems, specifically within the agriculture sector.

Part of the offerings under the Sugarcane Farmer Solutions include the Everyday Banking Account that allows customers to transact at any time and without incurring monthly charges. The account also features contactless Visa Card to make online and in-store purchases, access to Internet and Mobile Banking to monitor account and an option to make utility payments. The CVP offers the FlexiPay wallet and business solution which allows farmers to send, receive money, and make payments for goods and services at no charge.

The Bank is also offering farmers unsecured loan amounts up to UGX 100 million, with a loan tenor up to 24 months at a competitive interest rate at 2% per month at the current prime rate.

Under the Sugarcane CVP, the bank will also offer a health cover for farmers and their families from as low as UGX 600,000 per person annually with Stanbic MediProtect. The health cover caters for Inpatient, Outpatient, Maternity, Dental and Funeral cover for immediate family, dependents, and extended family members with no age limits.

Furthermore, Stanbic will organise financial fitness sessions at no charge for farmers. The sessions will be conducted in English and local languages by experts, providing training in areas like how to create and build a business, saving and investments, managing expenditure budget, debt management and how to protect their wealth.