Stanbic bank in campaign to offer financial management skills to employees

Stanbic bank has announced a three-month campaign in which it will offer financial management lessons to employees of different companies around the country.

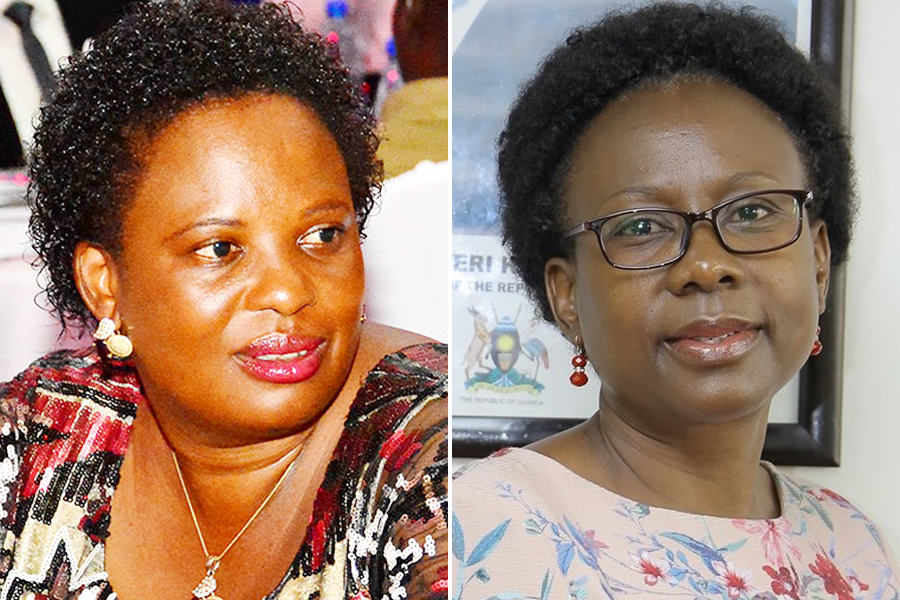

According to Sylvia Atuhairwe, the head of employee value banking at Stanbic, the training will be conducted through human resource managers for the various companies and corporate organisations.

Keep Reading

“We know the economic situation is quite volatile at the moment where people are living in a situation where interest rates have been going up in the market. We have therefore come up with this campaign, specifically for salary earners to be able to get financial management training,”Atuhairwe said.

“This training helps look at different aspects of adjustment that the salary earners should go through from the time of earning their salary until retirement. We need to train them on how to earn the money but also how to save, invest and spend it wisely.”

She explained that as part of the campaign, they have extended tailor made loan facilities.

“We have come up with affordable loans but also to teach the salary earners to borrow for something responsible and something they have carefully thought about. We are not an institution that just gives people money. We have extended our loan tenure to 84 months to help those struggling with paying to many loans to consolidate them into one and pay flexible installments which reduces the stress on their end.”

The head of employee value banking at Stanbic said the bank has also increased it’s the maximum amount for its unsecured loans from shs150 million to shs250 million.

“This means individuals who want to consolidate their loans and those who want to borrow can be able to access these loans of higher amounts. All these will be on top of training them in financial management.”

According to Damalie Kairumba, the manager for home loans at Stanbic, the bank has also come up with an initiative “to address the housing gap” in the market.

“We have done research and over 48% of the customers who take loans now do so to either buy land or construct. Therefore, our home loan offering is to be able to make go to customers whose need is construction which comes with a flexible loan tenure of up to 25 years. This means you can be able to get more money and can do something you can start and complete as opposed to running to several cases to borrow money and end up being stressed.”