Tough times for borrowers as BoU raises lending rate

It will not be business as usual for borrowers who will now need to dig a little bit more into their pockets after Bank of Uganda increased the Central Bank Rate to 7.5 percent.

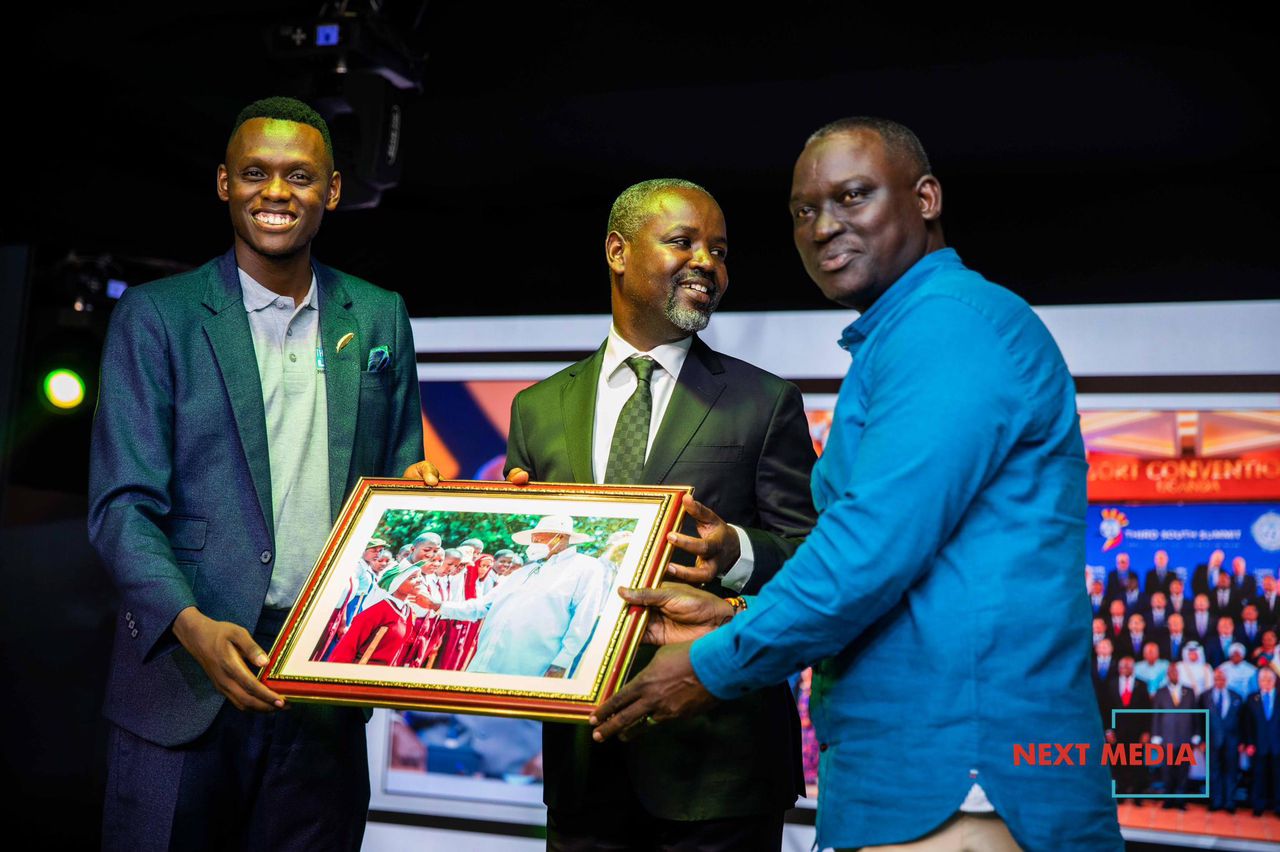

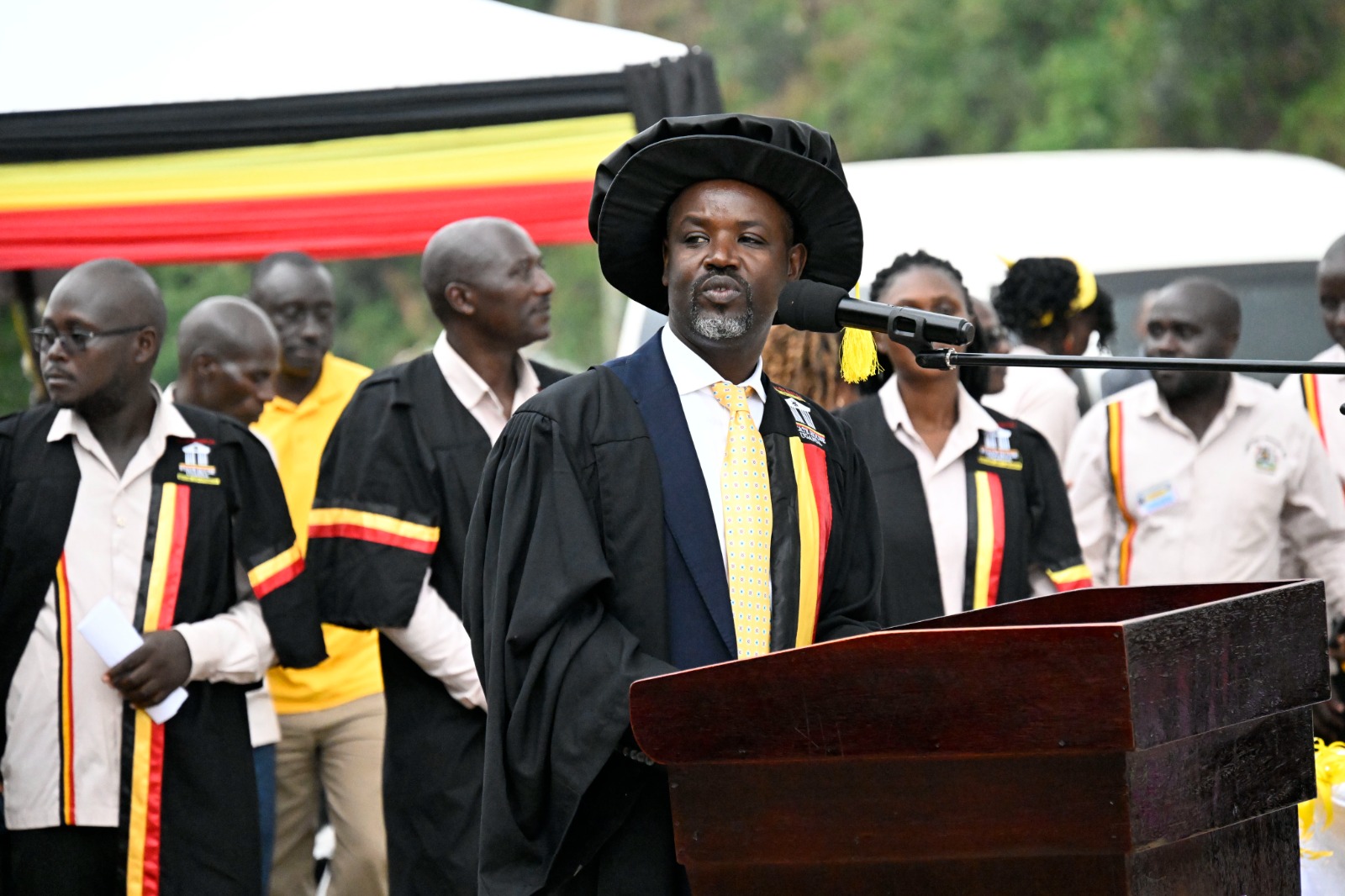

In a statement released on Thursday, the Deputy Governor, Michael Atingi-Ego explained that recent developments in the world have seen inflation rise rapidly and that this is spreading broadly across the basket of consumer goods and services.

Keep Reading

“The weakening of the Uganda Shilling against the US Dollar coupled with rising prices for food and energy have worsened the inflation outlook. Higher business costs are likely to spread into consumer prices thereby pushing inflation higher in the coming months,” Atingi said.

Therefore, in a bid to correct this worsening situation, BoU has decided to increase the Central Bank Rate to deal with the issue of excess liquidity in terms of money in the market but also try to control the skyrocketing prices.

“Accordingly, the Monetary Policy Committee has increased the Central Bank Rate to 7.5 percent,”Atingi said.

He warned that the BoU will continue raising the lending rate until inflation is firmly contained around the medium term target.

The development means borrowers will now pay more for loans.