Northern Uganda farmers, agribusinesses benefit from UK govt's NU-TEC project

Officials from the NU-TEC project funded by the UK government have said in the past three year, there have been immense achievements for agribusinesses and farmers in Northern Uganda.

Funded by the Foreign, Commonwealth and Development Office(FCDO) of the UK government and implemented by Mercy Corps, NU-TEC project offers opportunities for access to affordable financing for agribusinesses and farmers operating in Northern Uganda through Equity Bank.

Keep Reading

Speaking on Thursday, Paul Kweheria, the Team Leader of NU-TEC Financial Services said they have ensured transparent lending, gender inclusiveness as well as promotion of climate smart agriculture focusing mainly on women and youths in Northern Uganda.

“There was an addition of six new agribusiness products and as a consequence, Equity bank has expanded its agricultural lending market leading to 323% increase since the launch of the programme. Over the past 3 years 161,500 individual farmers have been supported with increased and improved access to climate information, markets, improved climate-resilient inputs and sources of financing and diversified livelihoods or income sources,” Kweheria said.

"The target (82,800) was exceeded by 158%. Almost one in five (18%) households in the North saw their real incomes go up by at least 15% since the programme started, despite Covid."

He noted that new channels to market development such as agribusiness assemblies and symposiums have been introduced and as a consequence the bank has increased its risk appetite and appreciation of the agriculture sector in terms of where businesses opportunities are.

“The transformation of agribusiness lending unit is now leading Innovations in agri-lending for Northern Uganda, helping agribusinesses grow profitably and raising incomes of farming households linked to the financed businesses.”

He however noted a number of challenges including limited financial literacy among farmers and agribusinesses, long turnaround time between assessment and disbursement of loan facilities, limited ownership of the required securities among agribusiness and limited access to financial services among women.

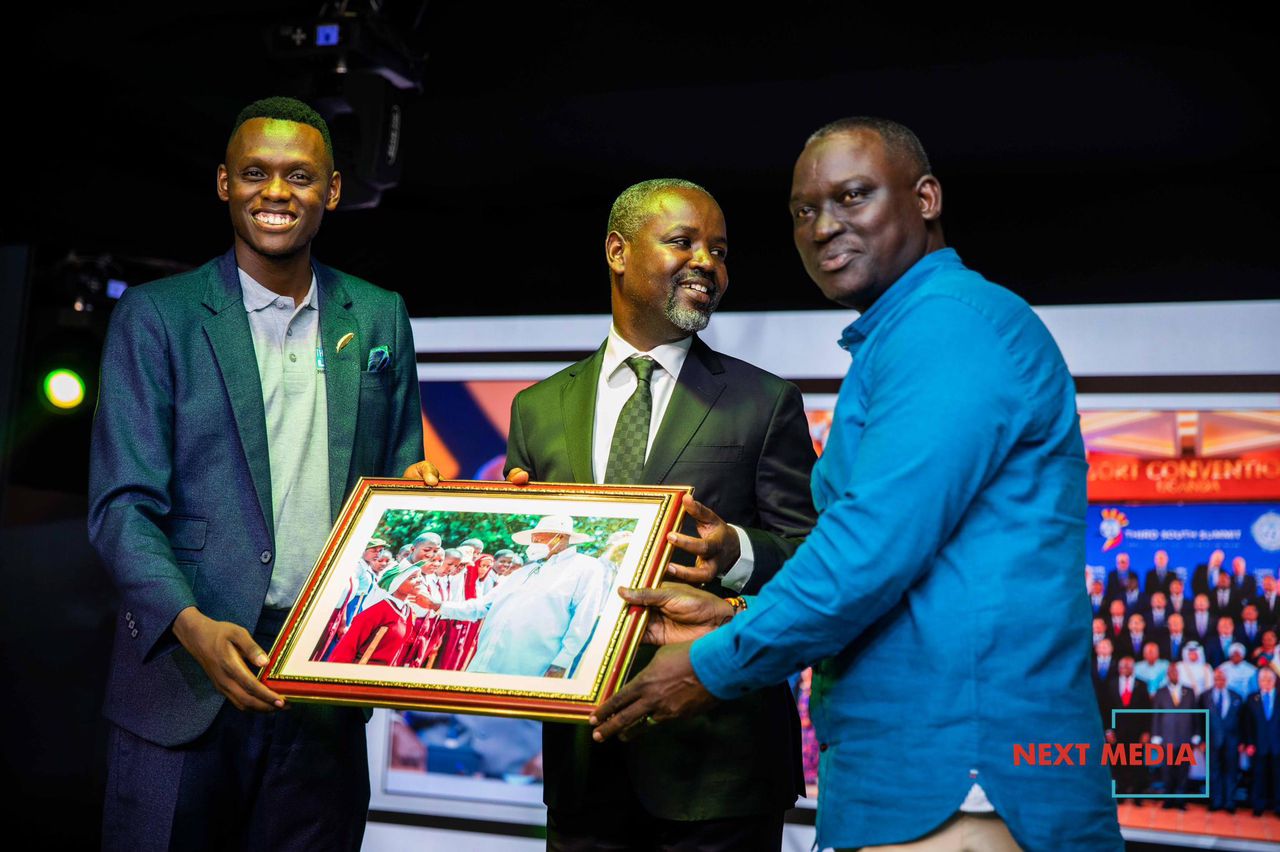

Speaking at the same function, Equity Bank’s Executive Director, Anthony Kituuka said agriculture remains a key sector in Uganda’s development, adding that financing it is key.

“Agriculture remains a key sector in our economy and at Equity, we chose to invest in up-scaling smallholder and medium-holder farmers because they play a key role in the growth of the economy. With the new and improved agri-lending products like the Structured Commodity Financing, farmers and agribusiness SMEs are effectively managing their liquidity and mitigating against risks related to the production, purchase and sale of farm outputs,”Kituuka said.

According to Jordan Martindale, the Growth and Economic Management Team Leader at Foreign, Commonwealth and Development Office said the UK government is committed to continuing with support to Uganda.

“Agriculture sector has a lot of risks and there is a lot that needs to be done to minimize the risks. Uganda has a big population of women and youth and one of the ways to employ them is through agriculture,”Martindale said.

She noted that as part of these efforts, the UK government has injected sshs185 billion in the agricultural sector in Uganda for the next four years .