What happens when you send mobile money to a dead person?

Some of you have sent money to the wrong numbers, made a phone call to telecom to have the money reversed, while others will call the person and plead with them to return the money.

In December last year, a Ugandan in Sweden while attempting to send money to a relative in Uganda, mistyped one digit and the money ended up with another party.

Keep Reading

- > Broken Promises and Barren Fields: Serere Farmers Vent Frustration

- > Uganda's Intellectual Property Landscape: Progress and Challenges

- > Keddi Foundation Extends Relief Aid to Flood-Affected Residents, Market Vendors in Entebbe

- > Understanding the Role of RDCs in Uganda: Mandates and Responsibilities

Shs5m through Pegasus mobile money wallet all ended up with someone far from the intended target. Putting in mind that the money would all be lost, he started making calls to the recipient and pleading to have the money refunded.

Well he succeeded, and so are many success stories of money sent to wrong numbers, but have you sent money to someone who died and their number won't be in service again? What happens?

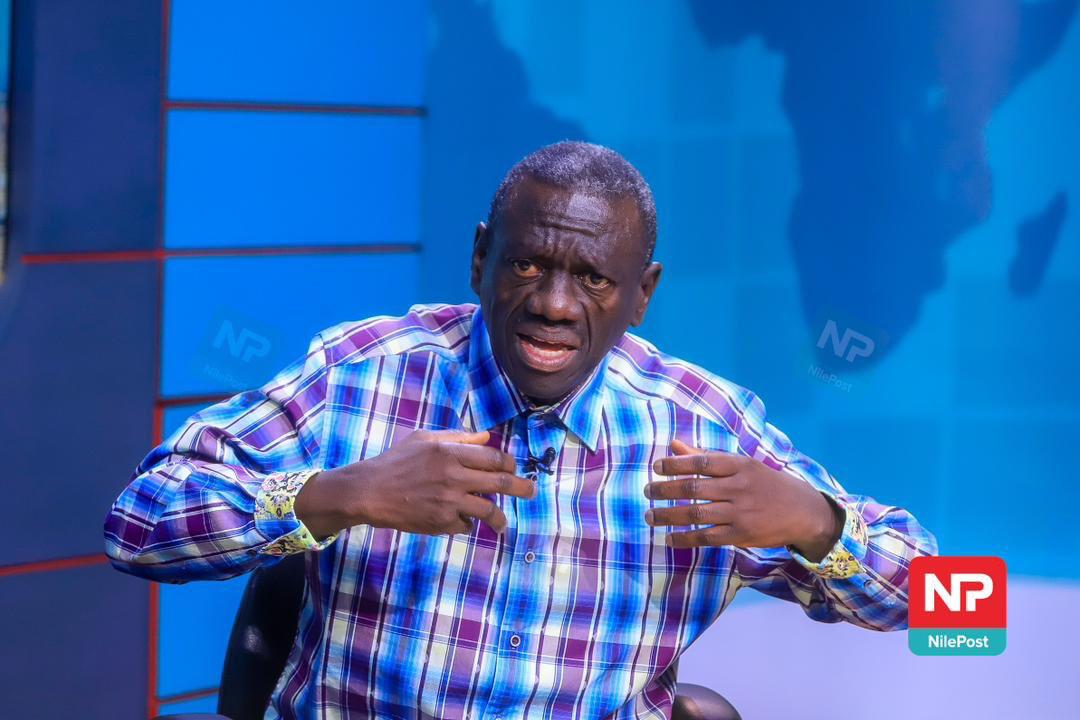

Linda Nabusayi, the presidential press secretary recently sent money to her deceased brother by mistake, and retrieving has become a headache.

“I erroneously sent money meant for my niece to her late father's number which she could not access, “she lamented.

Nabusayi says that she tried all means of retrieving the money but the process is tedious enough.

“MTN says I should get letters of administration of my brother’s estate, his death certificate, LC1 letter, police letter or I can’t get money back. Where does this money go?” she wondered.

But first what happens to the number of the deceased?

Your number is only yours while you still live and once you die, it shall be passed onto the next available live person.

Telecoms have a specified time they expect you to be active on your line. For instance, until 2016, it was required that a person is active at least once, in 90 days, failure to do so would lead to revocation of their number.

In an interview with Daily Monitor in 2016, Airtel Uganda compliance manager Peter Ntumwa Kalulwe said that once someone is disconnected, their mobile money account will be transferred onto an internal account and the number thrown back onto the market.

So what happens to the money?

Telecoms have a mechanism to maintain the money of the deceased for as long as possible until that specific time when someone, most likely their next of kin will come and claim it.

How do you claim it if you sent it to the number?

If you happened to send to the number of the deceased whom you are not attached to in any way, then that is it, you will NOT b able to recover the monies.

However, under scenarios where you are aware the person is deceased, you will be required to contact the next of Kin to the deceased for letters of administration fully signed as required from the Administrator General, a death certificate, identification of the new estate manager as per letters of administration, letter from estate manager to the telecom instructing you to partake of the deceased mobile money.

In case you can’t?

In case you are unable to provide the requirements, there is no other way you will get the money, hence start counting your losses.

So where does the money go then?

Previously many people were operating mobile money accounts without registering with their national IDs, it, therefore, became an honesty issue between the telecoms and the government to either declare and refund the money or not?

But who says things have changed? In February last year, a one Gideon Tugume dragged telecom companies to court, accusing them of stealing from the deceased.

Tugume asked the court to order MTN, Airtel, Africell, and UTL to display in media all mobile money balances on dormant SIM cards for the deceased.

According to Tugume, many Ugandans and non-Ugandans have passed on leaving money and air time deposits on their SIM cards.

If the court suit is to go by therefore, many telecom companies are enjoying unclaimed mobile money deposits, without declaring it to government.

Or if they declare it to government, how then do government officials in that specific department account where there are no witnesses?

We have seen people embezzle money for the sick, for the alive, what makes it hard to embezzle that of the deceased? Moreover unclaimed?

What the law says

According to the Financial Institutions Act of Banks 2014; Part 119 spells out actions to be taken on unclaimed balances.

(1) Whenever any current or savings account has not been operated for a period of

two years or a time deposit account has not been operated for a period of two years after the date of maturity of the deposit, no withdrawals shall be allowed on the account except with the permission of two officers of the financial institution out of a number of signatories authorized to grant the permission.

(2) An account referred to in subsection (1) of this section shall be

transferred to a separate register of dormant accounts in the books of the financial

institution and a notice in writing of that action shall be given to the depositor at his or her last known address.

(3) Where any account which is transferable under subsection (2) of this

section is subject to a service charge, the charge may continue to be levied up to the date on which the account has been transferred to the separate ledger of dormant accounts; except that no charge shall be levied beyond two years.

(4) Where an account is transferred to a register of dormant accounts and

the account has been on the register for three years, the institution shall advertise in the print media the fact that it has been on the register for three years.

(5) Any account may be transferred out of the register of dormant accounts

if the depositor or, if the depositor is dead, his or her legal representative, makes

such request.

“Unclaimed balances shall after a period of five years from the date of the advertisement be transferred to the Central Bank and the Central Bank shall employ them to offset costs of supervising financial institutions or as may be prescribed.”

The Act continues and stated that: “The Central Bank shall refund any unclaimed balances to the depositor of those balances with the financial institution or, if the depositor is dead, his or her legal representative if a request is made after the dormant account has been transferred to the Central Bank.”