Umeme registers increase in revenue

The audited financial results of UMEME limited indicate an increase in the overall performance of the electricity distributor in the financial year 2022/2023 with revenues increasing by 16.4% to to Ushs 2,196 billion in 2023 compared to Ushs 1,887 billion in 2022 on account of an increase in electricity demand by 9.6%, increase in average tariff as determined by ERA of 5%, and revenues from the provision of electricity distribution construction services.

The cost of sales increased by 15.5% to Ushs 1,450 billion from Ushs 1,255 billion in 2022 with the being the increase in the cost of electricity purchased with 8.8% growth in volume and 4.4% increase in the bulk supply price. The cost of sales related to construction services increased to Ushs 122 billion compared to Ushs 89 billion in 2022.

Keep Reading

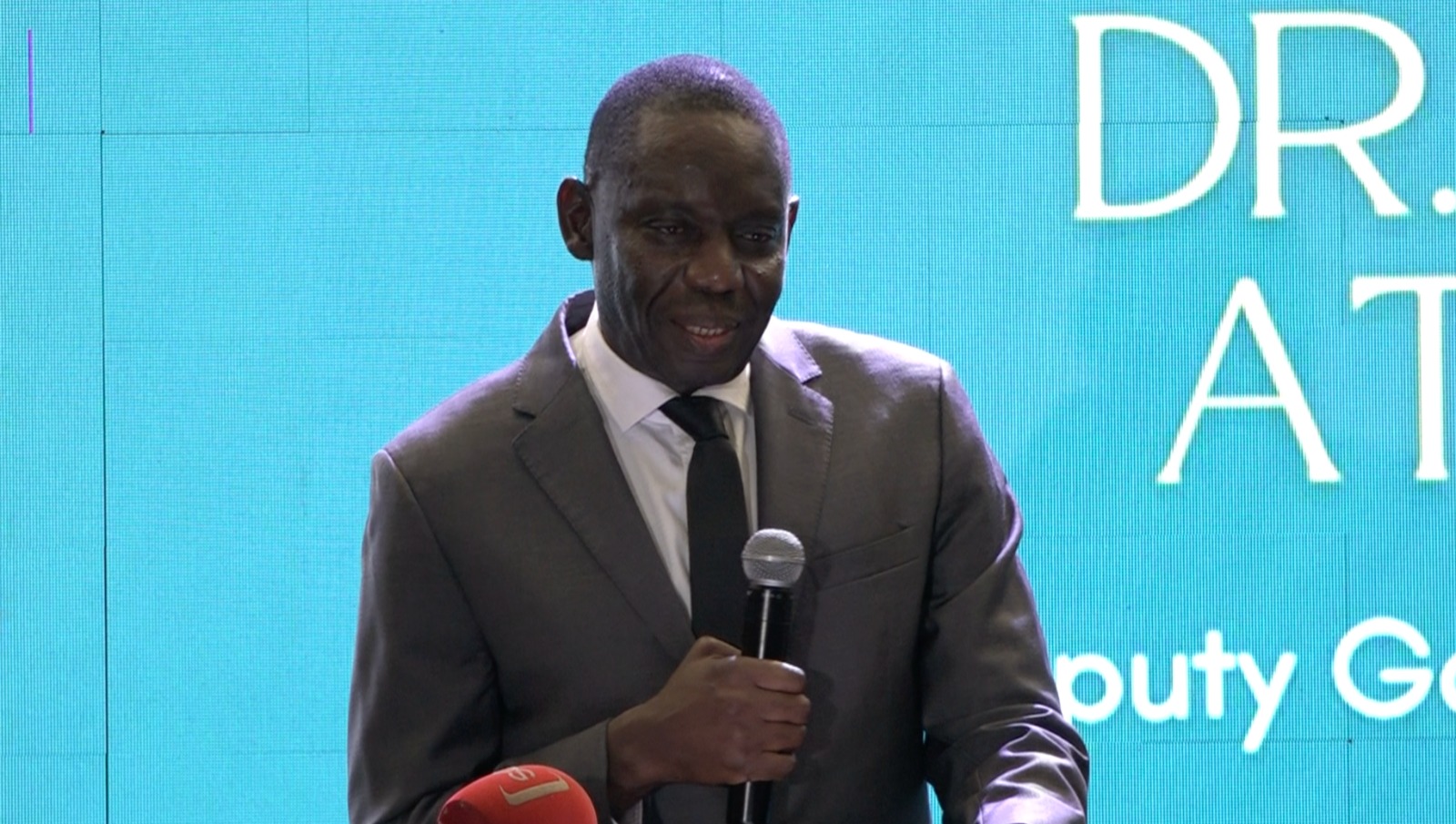

According to Selestino Babungi, the Gross profit increased to Ushs 747 billion from Ushs 632 billion in 2022 on account of an improved distribution margin and operational efficiencies plus a reduction in energy losses, new connections and supply reliability to customers are key drivers in gross margins.

Operating costs increased by 5.8% to Ushs 262 billion in 2023 (2022: Ushs 247 billion), on account of general inflation and increased business operations as Earnings Before Interest Taxation Depreciation and Amortisation (EBITDA): The EBITDA

for the year increased to Ushs 483 billion compared to Ushs 385 billion in 2022. These were driven by improved performance on gross margin and operating costs.

As the natural term of the concession is coming to its end in March 2025, the International Financial Reporting Standards (IFRS) require alignment of the amortization of underlying fixed assets to the shorter of the remaining contract duration or the underlying useful life of the assets that generate economic benefits to the Company. Consequently, the amortization and impairment charge for the year increased significantly to Ushs 442 billion compared to Ushs 160 billion in 2022.

Financing costs at UMEME were reduced by 1.3% to Ushs 45 billion primarily due to term loan principal repayment of Ushs 180 billion during the year despite an increase in blended interest rates from 6.62% to 10.40%.

Uganda Revenue Authority collected 3.9 billion shillings in income tax, due to a reduction in profit before tax, resulting in an effective average tax rate of 25.4% compared to Ushs 67 billion with an effective average tax rate of 31.02% in 2022 and a subsequent Profit after Tax reduced to Ushs 12 billion from Ushs 148 billion in 2022. The significant decline was driven by accelerated amortisation of intangible assets.

For the shareholders, the directors recommend to the members that a final dividend of Ushs 54.2 per ordinary share be paid for the year ended 31 December 2023 subject to deduction of withholding tax where applicable to the shareholders registered in the books of the Company at the close of business on 28 June 2024. If approved, the outstanding dividend will be paid on or about 19 July 2024. Therefore, the total dividend for the year is Ushs 78.2 per ordinary share (2022: Ushs 63.9) inclusive of an interim dividend of Ushs 24.0 per ordinary share that was paid in February.

The publicly listed company’s Total assets as of 31 December 2023 were Ushs 2,347 billion compared to Ushs 2,571 billion in 2022.