Uganda gets shs1.9trn from IMF to help mitigate Covid-19 economic impact

The International Monitory Fund (IMF) has approved US$491.5 million (Shs1.9 trillion), under the Rapid Credit Facility, to help Uganda mitigate the economic impact of the coronavirus pandemic pandemic.

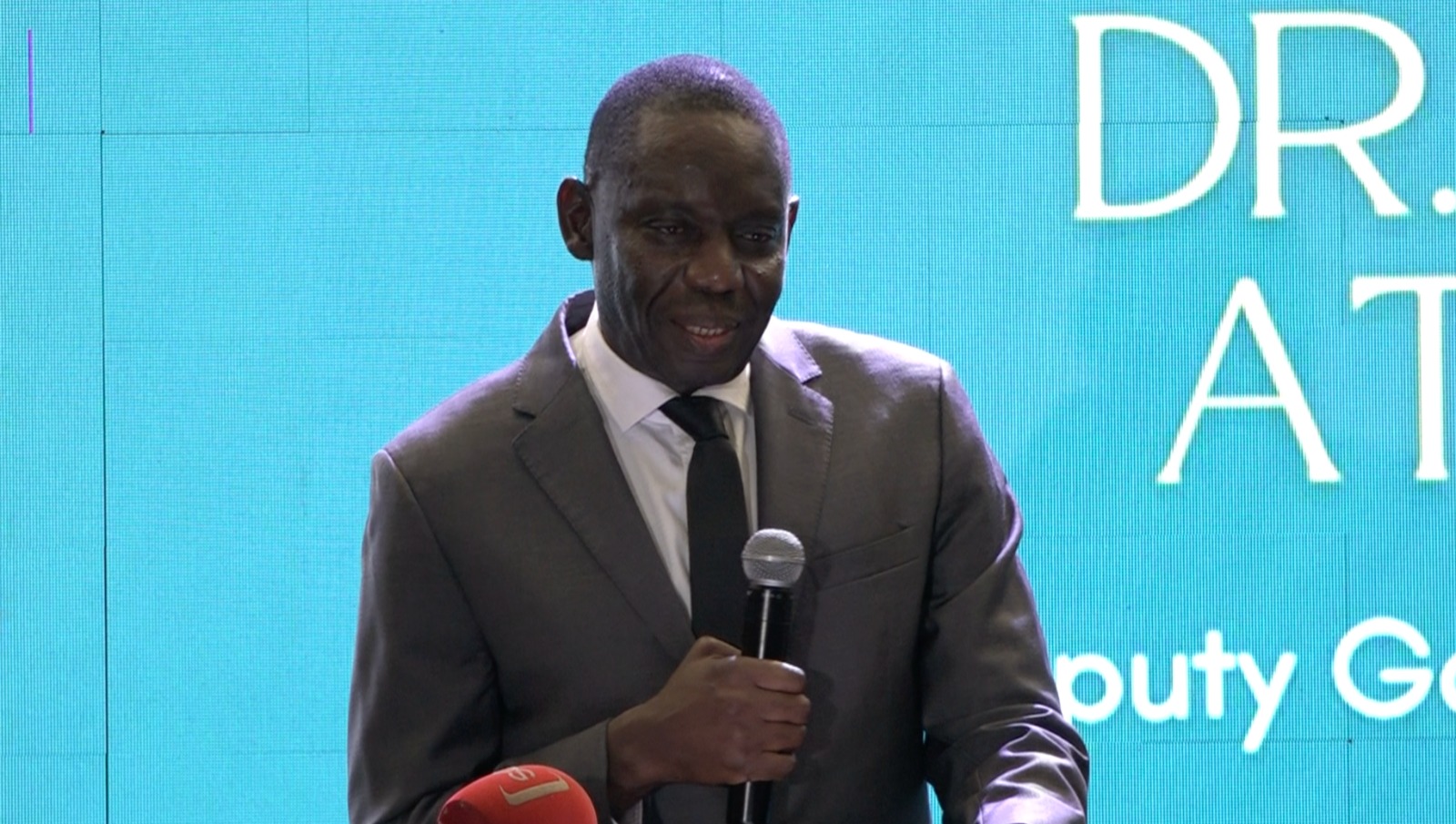

“The global COVID-19 pandemic is expected to severely hit the Ugandan economy through several channels, with detrimental effects on economic activity and social indicators. The external and fiscal accounts are expected to deteriorate, creating substantial urgent external and fiscal financing needs,” said Tao Zhang, the IMF Deputy Managing Director and Acting Chair,

Keep Reading

“To limit the pandemic’s human and economic impact, the authorities have promptly adopted bold preventive measures to contain the spread of the virus, and scaled up health spending to strengthen the health system’s capacity. Interventions to support the more vulnerable have also been introduced. In addition, the Bank of Uganda has swiftly introduced policy measures to support liquidity, preserve financial stability and support economic activity. “

According to IMF the Ugandan economy has been hit hard by the coronavirus pandemic and sector like tourism, transport, tourism, construction, manufacturing and agriculture have been greatly affected.

The international body also insists this state of affairs has put significant pressures on revenue collection, expenditure, reserves and the exchange rate, creating urgent large external and fiscal financing needs and hence the need for an intervention .

The IMF Deputy Managing Director said Ugandan authorities should step up social protection programs to cushion the impact on the vulnerable population and to protect health spending allocations over the medium term.

“A temporary widening of the fiscal deficit is warranted in the short term to allow for the implementation of the response plan. Despite a temporary worsening of debt indicators and heightened vulnerabilities, public debt is expected to remain sustainable. The authorities remain committed to ensuring debt sustainability, including through their efforts to enhance revenue collection and strengthen public investment management.

“The authorities are committed to managing transparently the resources received and will strengthen transparency and accountability. They plan to report separately on the use of the funds, undertake and publish an independent audit of crisis-mitigation spending and publish large procurement contracts.”

The Minister of Finance, Matia Kasaija recently told parliament that Uganda’s growth rate had gone down from 6.0 percent to between 5.2 and 5.7 percent.

The Minister also said over 780,000 people would be pushed into poverty due to the effects of the current pandemic.