DFCU rushes to exit Meera Investment properties, avoiding a legal battle

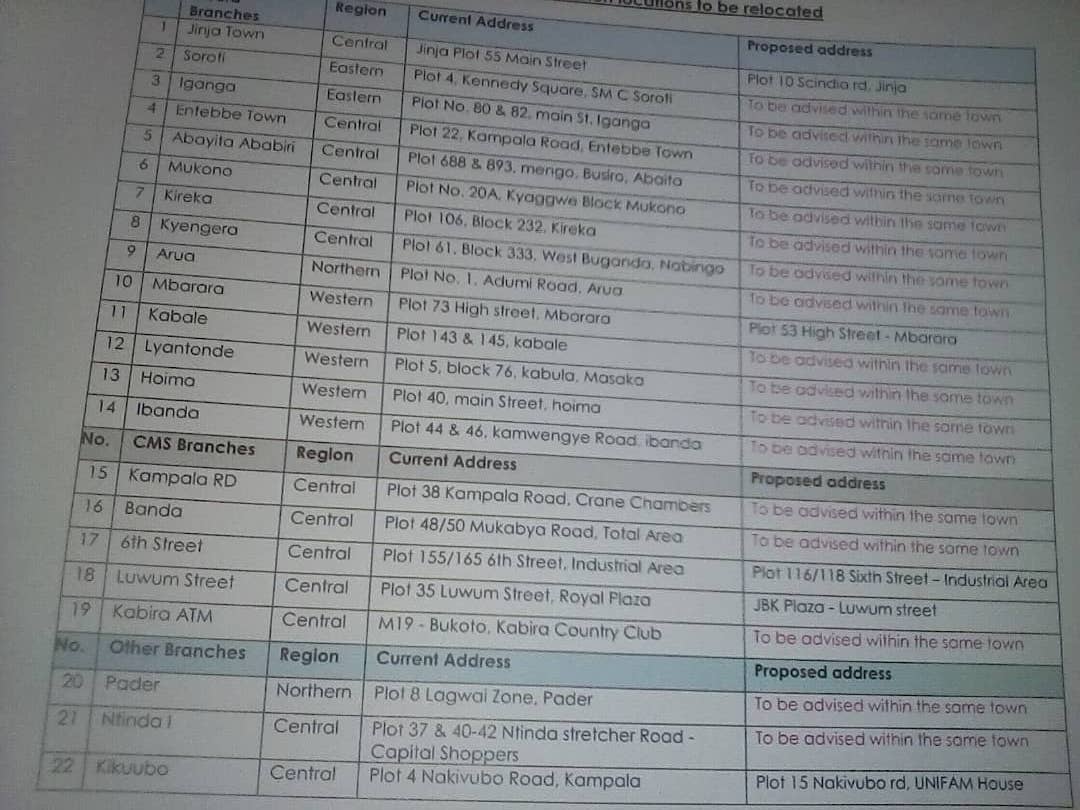

DFCU Bank has sought the services of a consultant to help them come up with a relocation plan from 22 properties that belong to Meera Investments Limited, which is part of the Ruparelia Group of Companies.

Meera Investments had sued DFCU demanding unpaid rent arrears totalling to billions of shillings.

It now appears that they are not ready for the legal battle and have decided to jump before they are pushed.

The move comes after it was revealed in August that DFCU had moved to transfer some of the properties into its names. Lawyers described this move back then as illegal.

The bank has been operating its business in buildings/properties belonging to Meera Investments Limited since it acquired Crane Bank Limited in 2017.

In a bid document seen by The Nile Post, the bank wants to hire a consultant to advise them on how they can relocate from the properties.

According to the document, the bank said in part: "...due to current trends in design setup, wear and tear overtime and other unavoidable business conditions, dfcu Bank would like to relocate twenty two (22) business locations across the country to new premises within the same localities."

A list of the branches to be relocated

A list of the branches to be relocated

The dispute

Bank of Uganda on October 20, 2016 closed Crane Bank Ltd, previously one of the best performing banks at Shs 200 billion to dfcu Bank.

The dfcu Bank received some of the assets and liabilities of Crane Bank and started to operate in different branches whose ownership belonged to Meera Investments Ltd.

Between 2012 and 2016, Meera leased the 46 properties to Crane Bank on different terms with the leases being duly registered as encumbrances on Meera’s freehold and mailo interest.

The lease titles were subsequently processed and issued to Crane Bank.

Crane Bank agreed to pay US$6,000 as ground rent for each of the properties effective on or before the January 1, of every year to the property owners (Meera Investments).

The lease agreements, court documents show, provided that Meera had the option to review the ground rent after the expiry of three years.

On January 24, 2017 Bank of Uganda announced that it had transferred all the assets and liabilities of the bank to dfcu Bank.

But lawyers said this was an illegality because the consent of the owner was not sought.

They argued that at the execution of the transfers in favour of dfcu and at the time of causing the transfer of the leasehold interest into the names of dfcu, the registration of Meera as the proprietor of the freehold and mailo was and is still intact.

[embed]https://nilepost.co.ug/2019/08/12/dfcu-accused-of-trying-to-take-over-meera-investments-properties/[/embed]