MPs to BoU: Which law did you use to close Teefe bank?

MPs on the Parliamentary Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) yesterday quizzed officials from Bank of Uganda on the law they based on to close Teefe bank in 1993.

In the proceedings yesterday, there appeared to be confusion over which law the central bank used to close Teefe bank after it emerged from the documents that they were not sure whether it was the Banking Act of 1969 or the Financial Institutions Statute (FIS), the precursor of the Financial Institutions Act.

Abdu Katuntu, the committee chairperson appeared puzzled as did some other MPs who sought more clarification.

In response the officials said they relied on the FIS, inviting more questions.

The central bank governor Emmanuel Mutebile also said that there was no chance that any of the seven closed banks would be re-opened.

Mutebile made the revelation in response to a question posed by Odonga Otto, (Aruu County) who had wanted to know whether the banks would be re-opened.

Odonga asked: “What plans do you have to reopen Teefe? It is 27 years since Teefe was closed and we are crying foul, and we are playing ping pong on the legal framework used to close the Bank.”

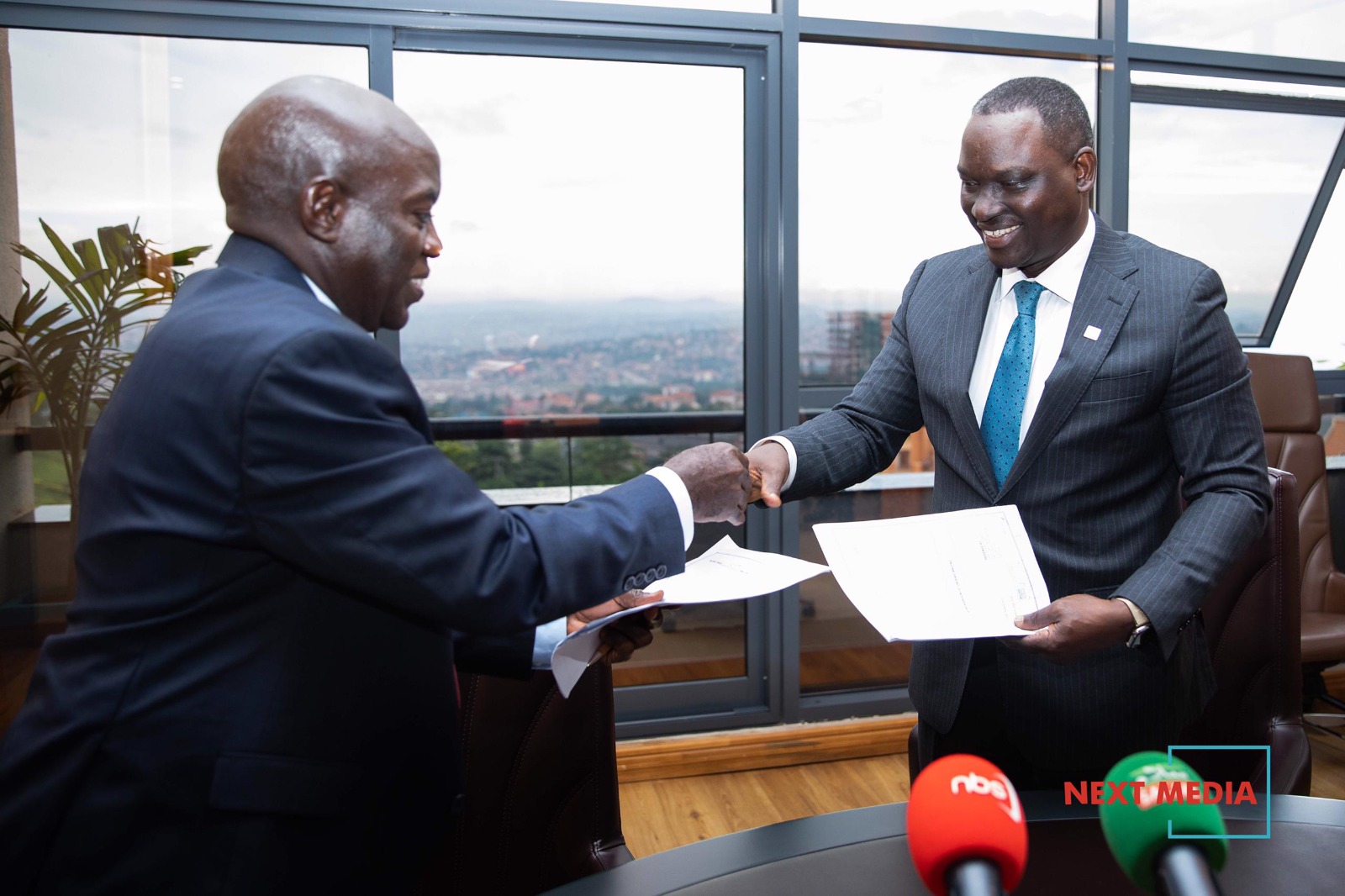

The Governor made the remarks while appearing before the Parliamentary Committee on Commissions, Statutory Authorities and State Enterprises (COSASE) that is currently carrying on a probe into the closure of the Seven defunct Banks.

Mutebile said: “In principle, I would never dream of opening a bank that I closed before.”

To date, seven banks have been closed.

They include: Teefe Bank in 1993, International Credit Bank Ltd in 1998, Greenland Bank in 1999, The Co-operative Bank in 1999, National Bank of Commerce in 2012, Global Trust Bank in 2014 and the sale of Crane Bank Ltd to DFCU in 2016.

The probe into the closure of the seven defunct Banks culminated from a letter by COSASE authored in November 2017, requesting the Auditor General, John Muwanga to undertake a special audit on the closure of these commercial banks by the Central Bank after the controversial closure of Crane Bank.