Concern as Alebtong locals fail to make use of low interest funds provided by Islamic Dev't Bank

The Federation of Small and Medium-Sized Enterprises (FSMEs) has expressed concern over the low uptake of a Shs3 billion fund provided by the Islamic Development Bank to support businesses and enterprises through Uganda's Local Economic Development Policy.

This funding, intended to stimulate economic growth at the district level, has seen limited use in Alebtong District, with only 18 people accessing a total of Shs169,816,000, leaving Shs2.8 billion idle at the Micro Finance Support Centre.

Keep Reading

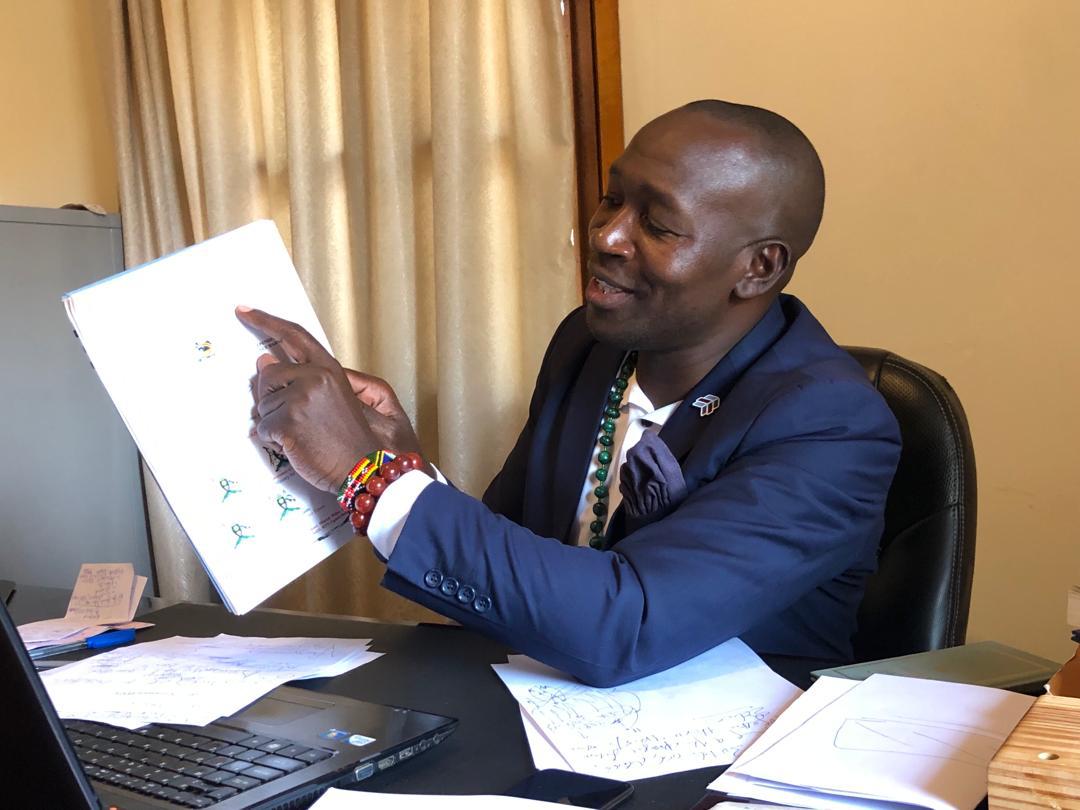

John Walugembe, Executive Director of FSMEs, attributed the low uptake to insufficient government sensitization and criticized the criteria used to access the funds.

"There needs to be a more comprehensive outreach program to ensure local businesses are aware of the available resources," Walugembe said.

"The current criteria for accessing these funds may not be suitable for all enterprises, indicating a need for review." he added

The Local Economic Development Policy, funded by the Islamic Development Bank, aims to recapitalize local businesses and enterprises by offering loans through the Micro Finance Support Centre.

However, the lack of awareness and complex application procedures have impeded the successful distribution of these funds.

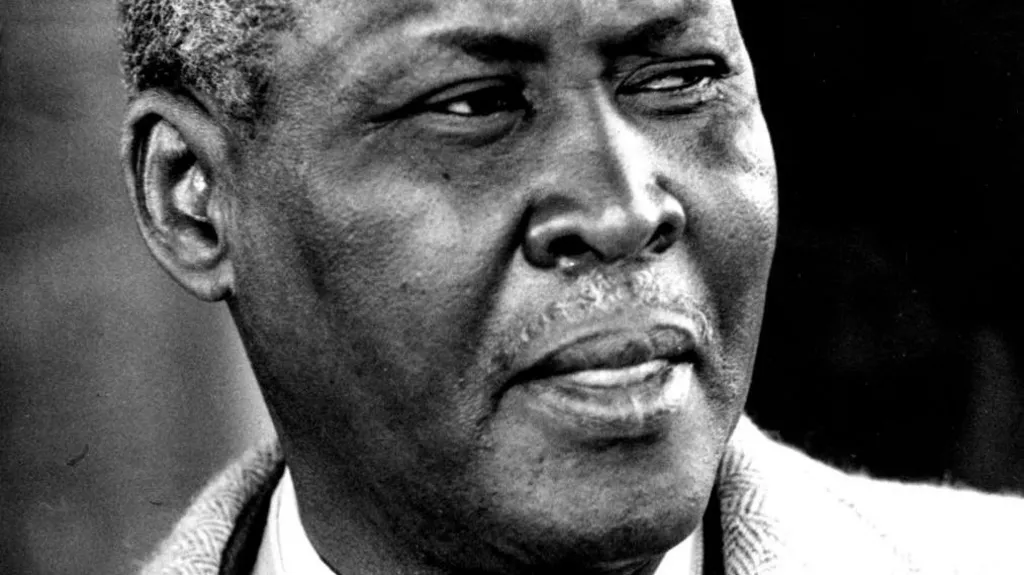

Raphael Magezi, Minister for Local Government, echoed Walugembe's concerns, indicating that the government will address the issues hindering the uptake of the funds.

"We are aware of the challenges faced by local businesses in accessing these loans,"

Magezi said. "We will work with relevant stakeholders to revise the criteria and ensure more businesses can benefit from this fund." he added

With only one year left in the five-year project, stakeholders are urging the government to take swift action to ensure the remaining funds are utilized to stimulate economic growth in Alebtong and other districts.

"This fund is a crucial opportunity to boost local businesses," Walugembe emphasized.

"We cannot afford to let these resources remain untapped when so many enterprises are in need of support."

As the project deadline approaches, the government, along with FSMEs and other partners, will need to focus on simplifying the loan application process and increasing outreach efforts to ensure the remaining Shs2.8 billion is used to support small and medium-sized enterprises in Alebtong and other districts across Uganda.