Museveni directs the Attorney General to draft legislation prohibiting National ID as loan collateral

President Museveni has instructed the Attorney General to develop legislation to prohibit the use of National Identification Cards as collateral for loans by money lenders and other financial institutions.

During a meeting with members of the Central Executive Committee (CEC) of the National Resistance Movement (NRM) at State House, Entebbe, President Museveni addressed various issues concerning the party.

Keep Reading

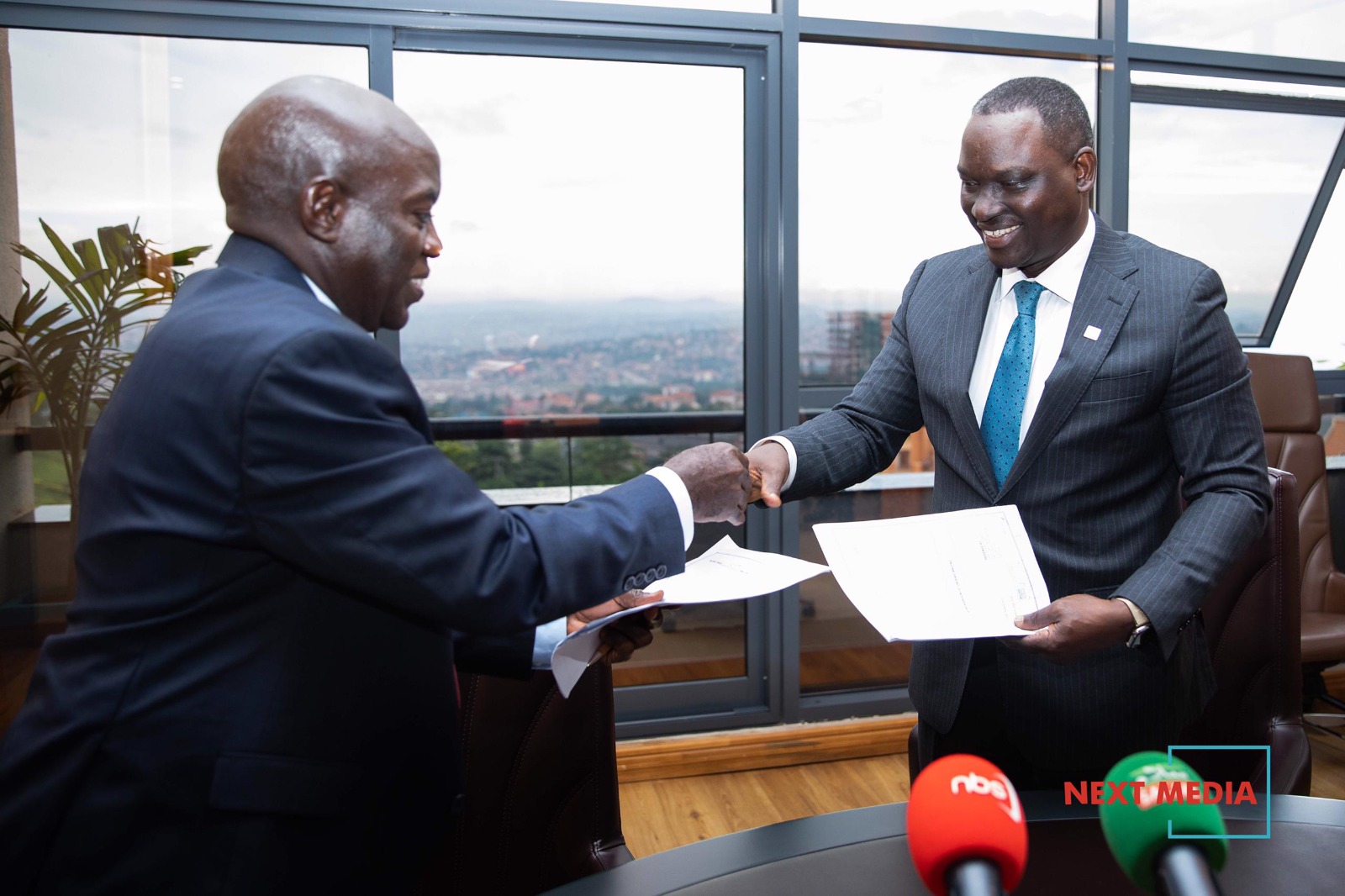

The party's secretary general, Richard Todwong, presented a report on the recently concluded party registration process, highlighting concerns such as the unlawful practice of money lenders confiscating national identity cards from Ugandans.

Acknowledging these issues, President Museveni emphasized the need to safeguard citizens' rights and directed the Attorney General to expedite the enactment of laws to protect individuals from the misuse of their national IDs and passports as loan collateral.

"I thank NRM members for their participation in the program," President Museveni tweeted.

"Many NRM leaders in the villages had pledged their national IDs to money lenders. To address this, the president directed the Attorney General to ensure immediate legal measures are taken to protect citizens from such exploitation," said Emmanuel Dombo, NRM's Director of Information and Publicity.

Godfrey Ssuubi Kiwanda, NRM the vice chairperson of the central region, expressed excitement over the significant turnout, with 18 million NRM memberships registered.

In 2023, lawmakers supported the National Identification and Registration Authority (NIRA) in warning money lenders against withholding National Identity Cards as collateral, citing violations of cardholders' rights to access government services. NIRA emphasized that national IDs remain the property of the Government of Uganda and cautioned against their use as loan security.

The Security Interest in Movable Property Act, 2019, which came into effect in March 2019, broadened the range of assets accepted as loan collateral beyond traditional forms such as land and houses. The Act allows borrowers to pledge movable assets like home appliances, treasury bills, animals, and crops as security for loans. Notably, the Act permits the use of crops in the field as collateral, granting priority to the lender's rights over those of the landowner in certain circumstances.