Insurers pay claims worth Shs242bn in six months

Insurance companies paid out claims worth shs242.49 billion to customers in the first six months of the year 2022, the regulator, Insurance Regulatory Authority has said.

By shouldering the risk, an insurance company pledges to pay out money defined as a claim to a customer on the off chance that the insured occurrence.

Keep Reading

A claim in this regard is a formal request to your insurance provider for reimbursement against losses covered under your insurance policy.

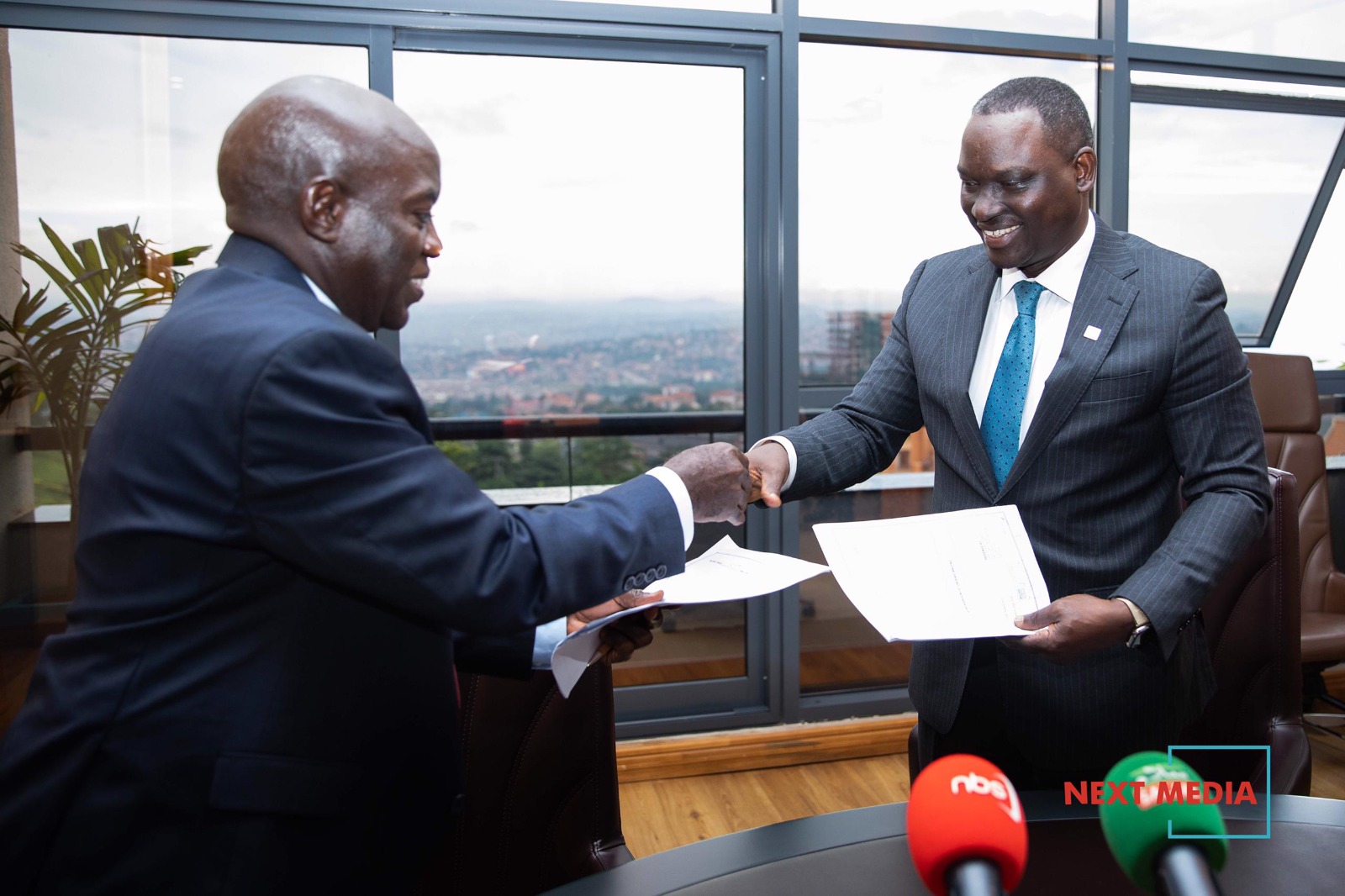

Speaking on Thursday, IRA Chief Executive Officer, Ibrahim Kaddunabbi Lubega said insurance companies paid out more claims between January and SJune 2022 compared to the same period in 2021.

“It is impressive to note that gross claims paid on account of both life and non-life including HMOs accounted for 34.1% at half year, equivalent to shs242.49 billion compared to 27.2% at half year in 2021,” Kaddunabbi said.

He noted that the consistent growth is a sign of increased commitment by players to honour their obligations, adding that this ensures the public confidence for the industry also goes up.

Premiums

According to Insurance Regulatory Authority, the shs242.49 billion in claims payouts was as a result of the shs711.63 billion generated in premiums in the first six months of the year.

Of this, non-life business also known as general insurance companies contributed the biggest percentage at 58% equivalent to shs406.37 billion, growing at 3.95% from the shs390.93 billion during the same period in 2021.

“Life insurance business on the other hand generated shs242.74 billion representing a 32.13% growth from the shs183.72 billion during the same period in 2021,” Kaddunabbi said.

During the same period, Health Membership Orgnisations(HMOs) contributed shs21.97billion but this was a 12/55% decline compared to the previous year.

However, the IRA boss was quick to explain that the decline remains a recurrent effect of acquisition of one of the biggest HMOs, IAA which was taken over by Prudential Life Assurance.

The performance report for the first six months of 2022 indicates that brokerage distribution channels collected premiums worth shs186.36 billion which accounted for 26.19% of the total insurance premium for the half year whereas bancassurance distribution channels helped insurance companies collect shs62.13 billion , representing a 27.0% growth but also 8.73% to the total industry premium.

The Insurance Regulatory Authority Chief Executive Officer, Ibrahim Kaddunabbi Lubega noted that during the first six months of the year, the industry saw the operationalization of the Insurance Appeals Tribunal, digitization of the insurance complaints management at IRA’s complaints bureau and the operationalization of the localization of the marine insurance

Outlook

The insurance regulator says that as the economy continues to harden amidst challenging state of affairs like the high cost of living and reduced disposable income, it will continue to impact negatively on a number of sectors including insurance.

“However, based on the resilience the sector has demonstrated in addition to expected government releases of for public infrastructure , we project the sector to remain on a positive growth trajectory of about 15% in the next quarter , declining to about 12% by the end of the year,” Kaddunabbi said.