CSOs say stringent conditions frustrate SMEs from accessing Covid-19 stimulus package

Civil Society Organisations have asked government to rethink the stimulus package from the Uganda Development Bank that was announced to benefit Small and Medium Enterprises (SMEs).

Addressing journalists on Sunday, Joanita Nassuuna, the Programs Assistant for Women and Economic Justice at SEATINI-Uganda said whereas government announced a stimulus package for SMEs after being hit hard by the Coronavirus pandemic, the same has not reached its intended beneficiaries.

Keep Reading

- > Corruption, delays, and despair: The long walk for compensation for former Coffee Marketing Board employees

- > Sheila Sabune appointed UBL corporate relations director

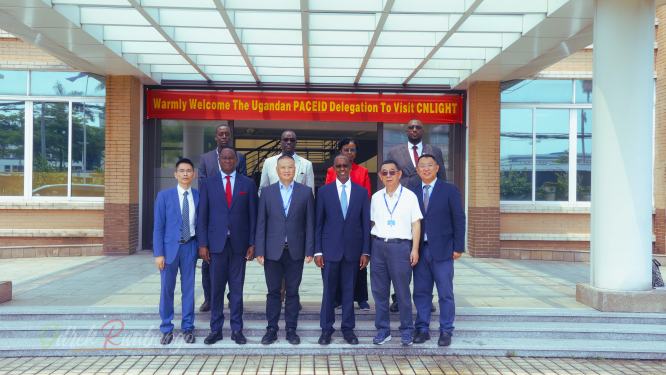

- > PACEID roots for market entry of Ugandan products into China

- > The Care Giver: Movie about need for home-based nursing services premiered

“Of the shs1 trillion that had been committed by the Ministry of Finance, Uganda Development Bank (UBD) received a disbursement of 455 billion in mid-August 2020. In January 2021, UDB stated that it disbursed up to shs242billion to vital sectors of the country and shs192 billion was disbursed to struggling businesses in primary agriculture, agro-industrialization and manufacturing. However, according to a Call for Applications issued by UDB earlier this year, the bank is not lending out money below sums of shs100m to enterprises,” Nassuuna said.

She noted that this is way above the money SMEs would regularly borrow, adding that other stringent conditions put in place by UDB have curtailed access to funds for the stimulus package.

“The demand for feasibility studies or business plans, need to provide a copy of each of the last 2 years audited or drafted, security for the proposed loan, including current valuations of the assets all of which SMEs can hardly conform to are making it difficult for them to access the funds.”

According to Nassuuna, there is concern that the interest rates at which UDB is disbursing its loan at 14.5% and not 12% is not far from what commercial banks are doing, making it difficult for SMEs to apply for the loans.

“This leaves questions on whether there were any packages meant for SMEs and whether the government even had them in mind while designing these packages.”

Recommendations

According to John Walugembe, the CEO for the Federation for Small and Medium Enterprises said as government plans to recapitalize UBD,it should review and address some of the challenges that he said are preventing SMEs from accessing the stimulus package.

“UDB should review the stringent eligibility criteria being used to qualify and disburse the entrusted funds and it should also periodically publish the list of beneficiaries as part of the accountability process to the general public,”Walugembe said.

“UDB should negotiate the loan conditionalities with the Uganda Manufacturers Association (UMA) to allow UMA members access the stimulus package with favorable conditions as opposed to individual members.”

According to the CSOs, the Ministry of Finance should develop a comprehensive stimulus package taking into consideration the SMEs badly hit by the pandemic whereas there should also be transparency in this initiative.