I won't allow Uganda to be mortgaged on my watch, says Kasaija

The Minister of Finance and Economic Development, Matia Kasaija, has emphasised the need for substantial funding to address critical sectors such as security, water, roads, education, and health.

His remarks came during the inauguration of Goldmine Finance Limited's third branch in Kabalagala, Kampala.

Keep Reading

He reiterated his stance on avoiding excessive borrowing, expressing concerns over the detrimental consequences witnessed in other nations.

"I have many burdens, security, water, roads, education, health and many others," stated Kasaija, highlighting the diverse array of challenges demanding financial attention. He further emphasized, "I need money and I don’t want to borrow too much."

Drawing on his observations of global economic trends, Kasaija cautioned against the pitfalls of heavy borrowing.

"I have seen countries through experience, people who have borrowed they have got a real serious problem," he said, alluding to the adverse effects of indebtedness on national economies.

"I don’t want to Mortgage Uganda, no as long as I am the minister of Uganda. Let others do it but not Kasaija,” he stated.

He emphasized the impacts of the COVID-19 pandemic on Uganda's economy, noting a potential growth rate setback.

"The economy is doing well but with a bit of inches. If it wasn’t for COVID-19, I think the economy would be growing about 8% by now because we lost two years. Two years is quite a period,” he stated

Kasaija highlighted the substantial effect of the pandemic on the nation's growth trajectory.

"We are growing at about 6% now; we are aiming at 7% next financial year,” he said reflecting on the current growth rate.

Despite the challenges posed by the pandemic, he expressed optimism about Uganda's economic prospects, aiming for a higher growth target in the upcoming fiscal period.

Encouraging business expansion, Kasaija urged entrepreneurs to extend their operations to rural areas, emphasizing untapped potential.

"As business picks up, business people should extend their branches to the rural areas, there is wealth in the rural areas because we must move together,” he stressed,

The minister emphasized the need for balanced development between rural and urban regions.

In a call for responsible lending practices, Kasaija advised financial institutions to monitor their clients' progress diligently.

He cautioned against negligence towards borrowers' welfare,

"Some of these government banks, you borrow money and when you borrow money, they are not bothered about you as long as you are repaying whether you are repaying to collapse or to freeze, they don’t care," he noted

Kasaija emphasized the importance of genuine concern for customers' financial well-being.

"My advice is that financial institutions should continuously check their customers to see whether they are progressing or stagnant before they come to cry to you,” he said

He emphasized the necessity for proactive customer engagement to ensure sustainable financial practices.

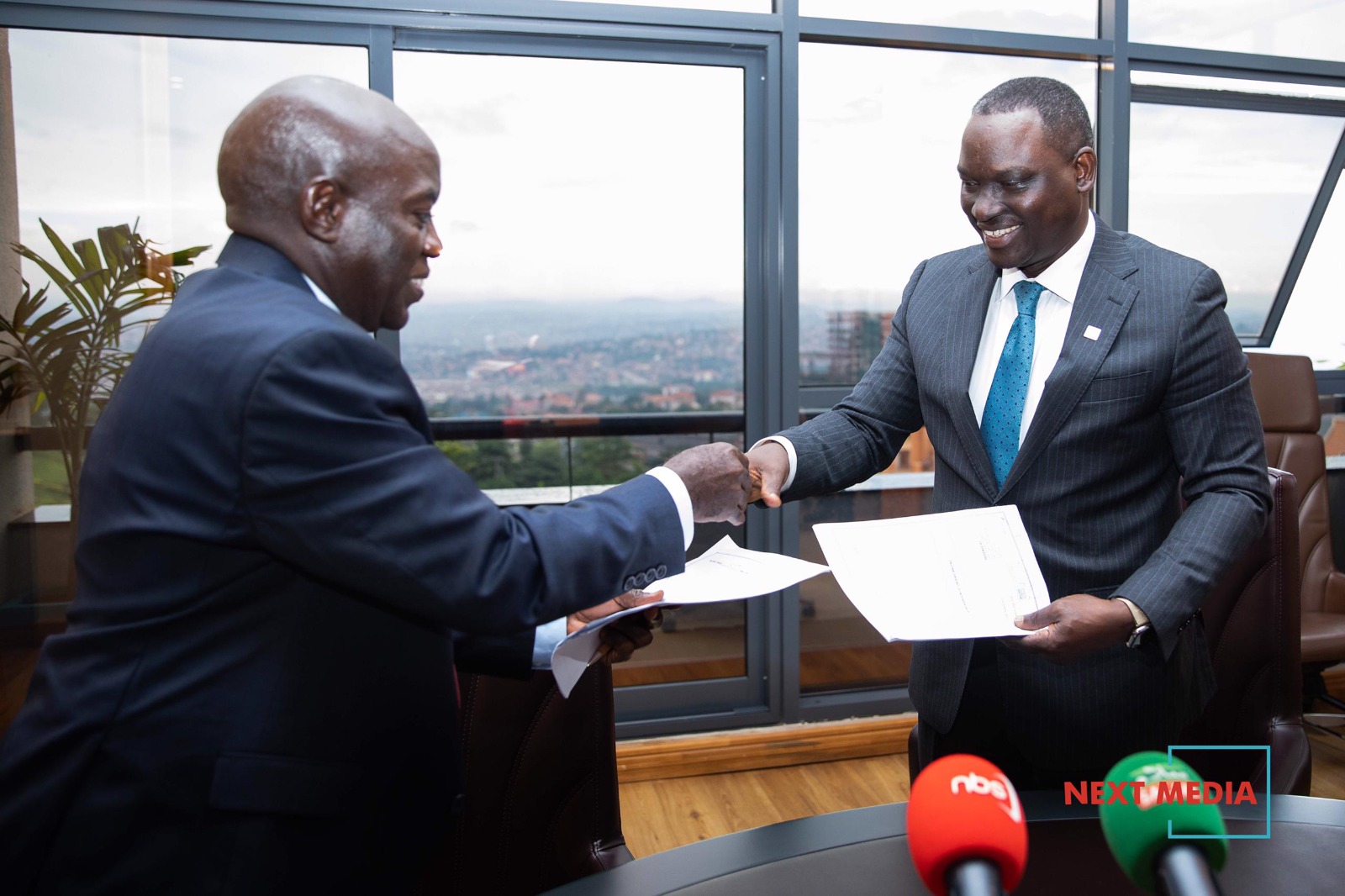

Allan Tayebwa, Managing Director of Goldmine Finance, emphasized the necessity for enhanced professionalism and financial literacy within the sector, stressing the significance of conducting business operations professionally.

"Many of us don’t know the simple principle of separating your money from the business money and separating yourself from the business; that is one of the biggest challenges that many people are still grappling with. How to raise capital is also another challenge," he remarked, underlining prevalent hurdles in the industry.

Tayebwa expressed enthusiasm regarding the expansion of Goldmine Finance's reach to Kabalagala, highlighting the aim to provide enhanced accessibility to their financial products and services to customers and the general public.

"Our new branch reflects our commitment to delivering innovative financial solutions and personalized services to meet the evolving needs of our customers," he emphasized.

He further elucidated that the Kabalagala branch will offer a comprehensive array of financial services, encompassing personal and business loans. Additionally, Tayebwa announced that Goldmine Finance will introduce enticing promotions for new customers visiting the Kabalagala branch to commemorate this significant milestone.