Resilience no longer a choice for insurance, says IRA’s Kaddunabbi

The Chief Executive Officer of the Insurance Regulatory Authority of Uganda, Alhaj Ibrahim Kaddunabbi Lubega has underscored the role of technology and innovation in ensuring resilience of the insurance sector in Uganda.

“Resilience is no longer a choice but a necessity in today's rapidly changing world. Various challenges, including climate change, economic fluctuations, and technological disruptions, continually shape the global landscape. As such, the ability to withstand, adapt and thrive amid these challenges has become the cornerstone of sustainable development,”Kaddunabbi said.

Keep Reading

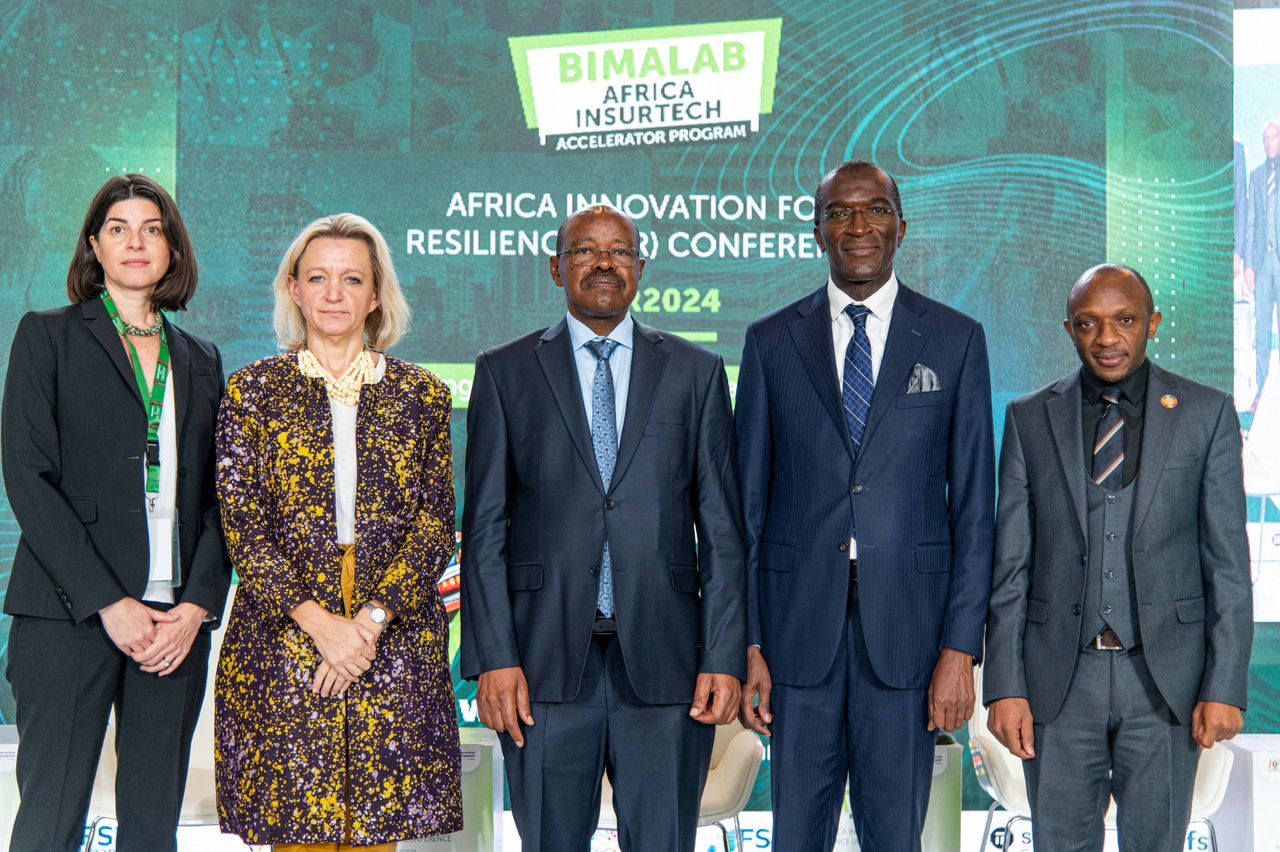

He was on Wednesday speaking during the Africa Innovation for Resilience Conference held at Kampala Sheraton Hotel under the theme, “Harnessing Innovation for Resilience.”

The conference which attracted 16 African countries and 13 insurance regulators was hosted by the insurance Regulatory Authority.

Kaddunabbi said innovation is at the heart of this resilience and it is a powerful catalyst that can transform threats into opportunities and drive sustainable progress.

He noted that digital transformation has proven crucial for sustaining operations and fostering resilience.

“This is evidenced by the growing reliance on technologies such as Artificial Intelligence, predicted to manage 85% of customer interactions by 2030 without human involvement.”

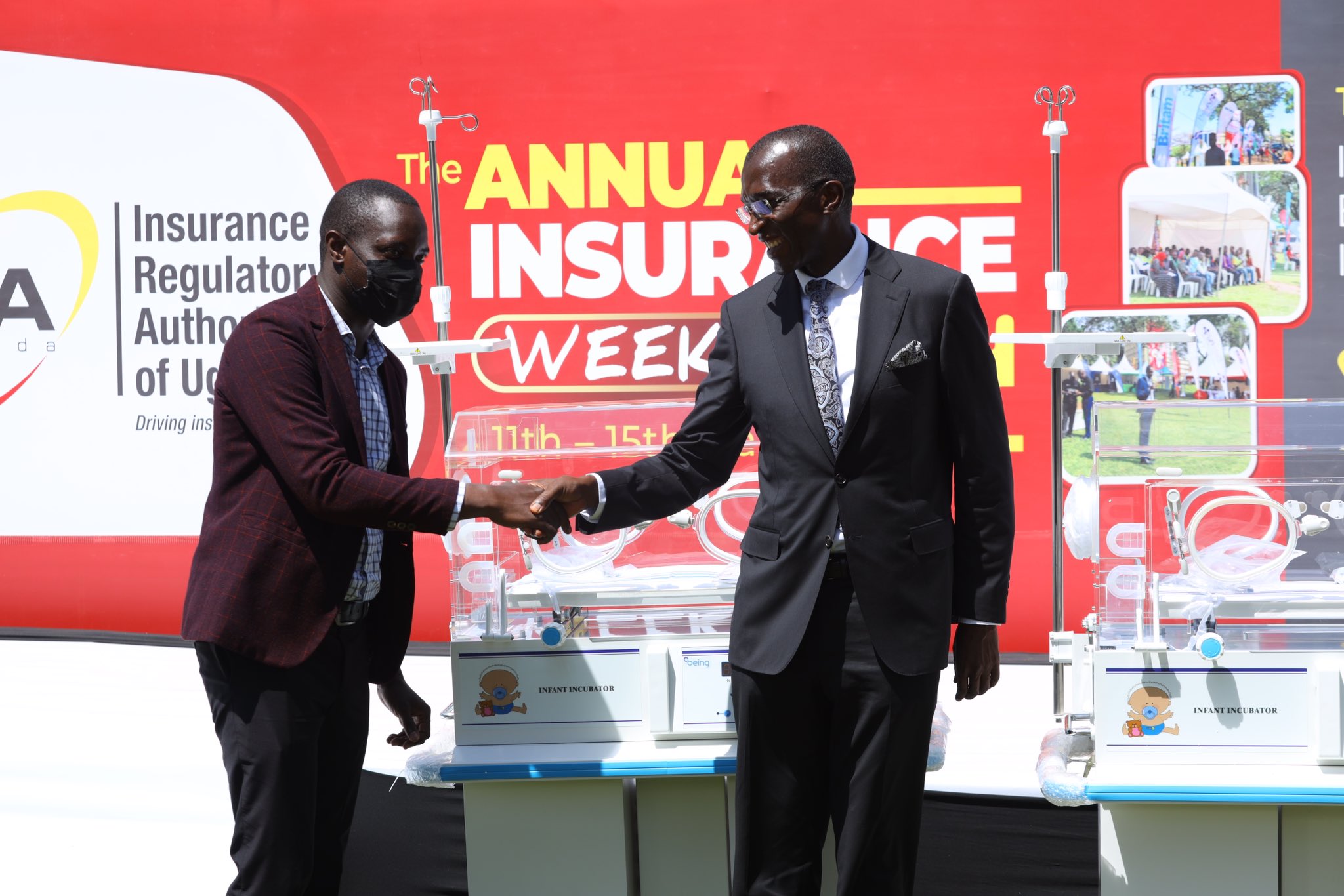

Kaddunabbi said the Insurance Regulatory Authority’s initiatives, such as establishing the regulatory sandbox and successfully implementing the InsureX incubator program, exemplify dedication to fostering an environment that nurtures and supports innovative solutions.

“Launched in December 2020, the Insurance Regulatory Sandbox provides a safe yet flexible environment for companies to test and refine their insurance-related ideas without the constraints of regulatory limitations. This initiative allows companies to identify and mitigate risks early in development. We have received numerous inquiries from FinTechs and aspiring tech innovators, with several being admitted.”

“By embracing novel ideas and empowering visionaries, IRA has demonstrated its understanding of the pivotal role innovation plays in driving the insurance sector's growth and enhancing the lives of our citizens.

The British High Commissioner to Uganda, Kate Airey underscored the role of technology in driving insurance penetration on the African continent.

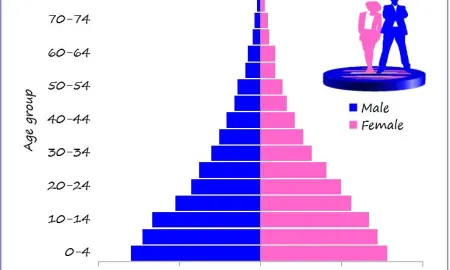

She said combining insurance with technology offers a huge opportunity for growth for the sector and riving penetration levels which are still low in Africa.

The state minister for Finance, Amos Lugoloobi said the growth of the insurance sector has ripple benefits to the entire economy.

He noted the Ugandan government is committed to fostering growth of the insurance sector as a catalyst to spur growth of the other sectors of the economy.