Why you should worry after Central Bank raises lending rate

With this latest increase in the CBR, Ugandans are bracing themselves for potential economic challenges ahead.

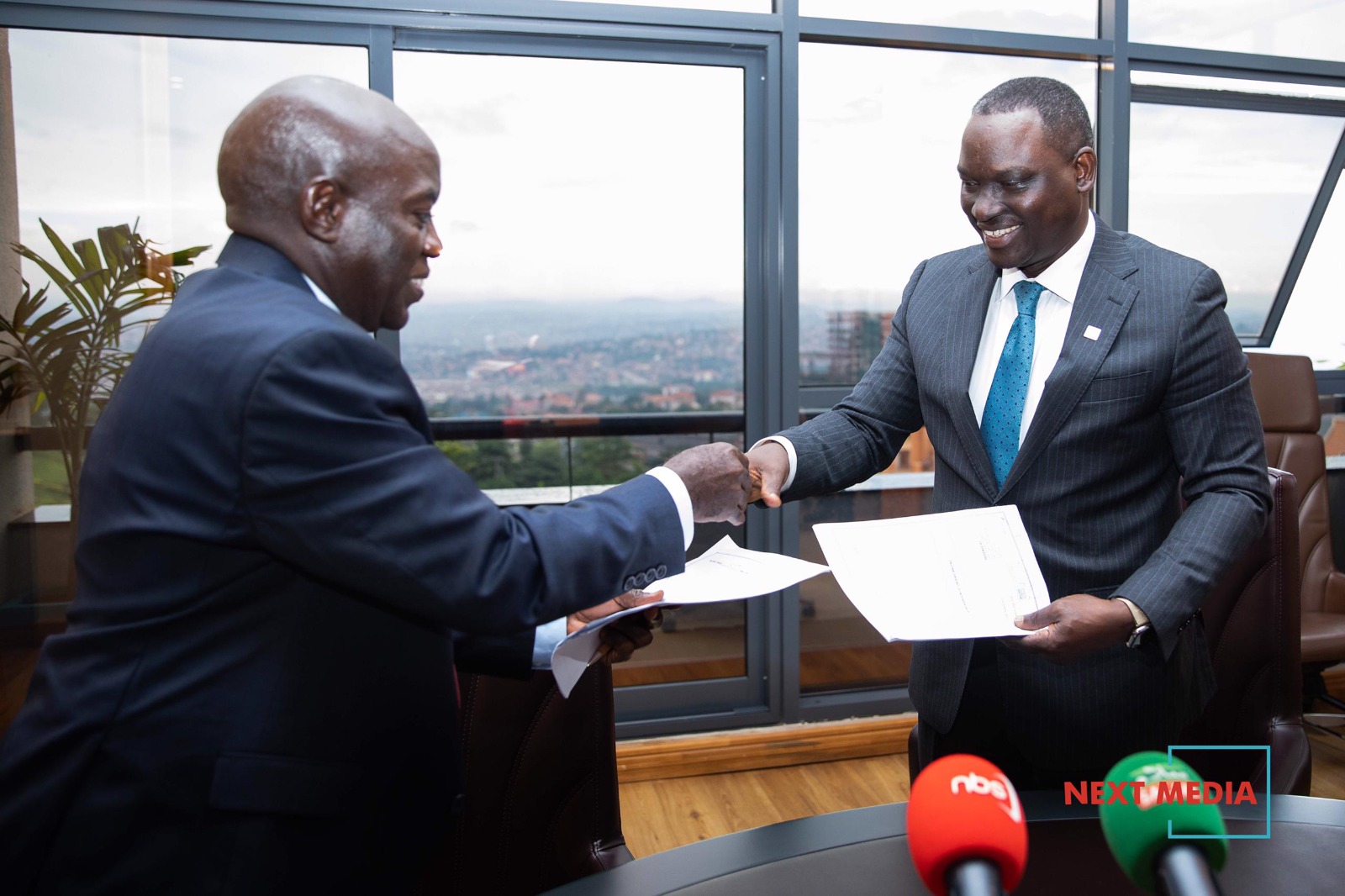

Bank of Uganda (BoU) has recently announced an increase in the Central Bank Rate (CBR) by 25 basis points to 10.25 per cent, a move that has sparked concerns among Ugandans about its implications on their daily lives and businesses.

According to Bank of Uganda, the increase in CBR is expected to contain the future path of prices around the 5 percent target.

The CBR is a crucial tool used by central banks to regulate monetary policy, influencing interest rates across the economy.

With this latest increase in the CBR, Ugandans are bracing themselves for potential economic challenges ahead.

One of the immediate effects is likely to be felt in the cost of borrowing.

As the CBR increases, commercial banks typically follow suit by raising their lending rates.

This means that individuals and businesses seeking loans will face higher interest payments, which could lead to reduced borrowing and investment activities.

CBR is not like open market operations, the former is a perceptual signal while the latter is reality.

As CBR increases, the commercial banks will correspondingly raise their lending rates, and when the CBR reduces, commercial banks will not reduce their lending rates.

For businesses in Uganda, the impact of the CBR hike could be particularly severe. Many businesses rely on loans to finance their operations and expansion plans.

With higher interest rates, the cost of capital increases, squeezing profit margins and potentially stifling growth prospects.

Small and medium-sized enterprises (SMEs), in particular, may find it harder to access affordable credit, hindering their ability to compete and thrive in the market.

As businesses face high borrowing costs, they may be compelled to increase prices of their prices to maintain their profitability.

Moreover, the increase in the CBR could also lead to a slowdown in consumer spending.

Higher borrowing costs can deter individuals from taking out loans for big-ticket purchases such as homes, cars, and appliances.

This reduction in consumer spending could further dampen economic activity and weigh on overall growth.

While the BoU's decision to raise the CBR is aimed at curbing inflationary pressures and stabilising the Shilling, there are alternative measures that could be explored to achieve these objectives without resorting to hiking interest rates.

One such approach is through open market operations, where the central bank buys or sells government securities to regulate the money supply in the economy.

By adjusting liquidity levels, the central bank can influence interest rates without directly altering the CBR.

Additionally, enhancing communication and coordination between monetary and fiscal authorities could help in achieving macroeconomic stability.

Implementing prudent fiscal policies, such as controlling government spending and improving revenue collection, can complement monetary policy efforts in taming inflation and supporting currency stability.

In conclusion, while the increase in the CBR by the Bank of Uganda may raise concerns among Ugandans, it is essential to recognise that such measures are often necessary to maintain economic stability and control inflation.

However, policymakers should also explore alternative strategies to mitigate the adverse effects of higher interest rates on businesses and consumers, ensuring that the economy remains resilient and inclusive in the face of evolving challenges.

____________________________________________

Chark Benson (MBA)