UAP Old Mutual partners with NSSF to offer financial literacy

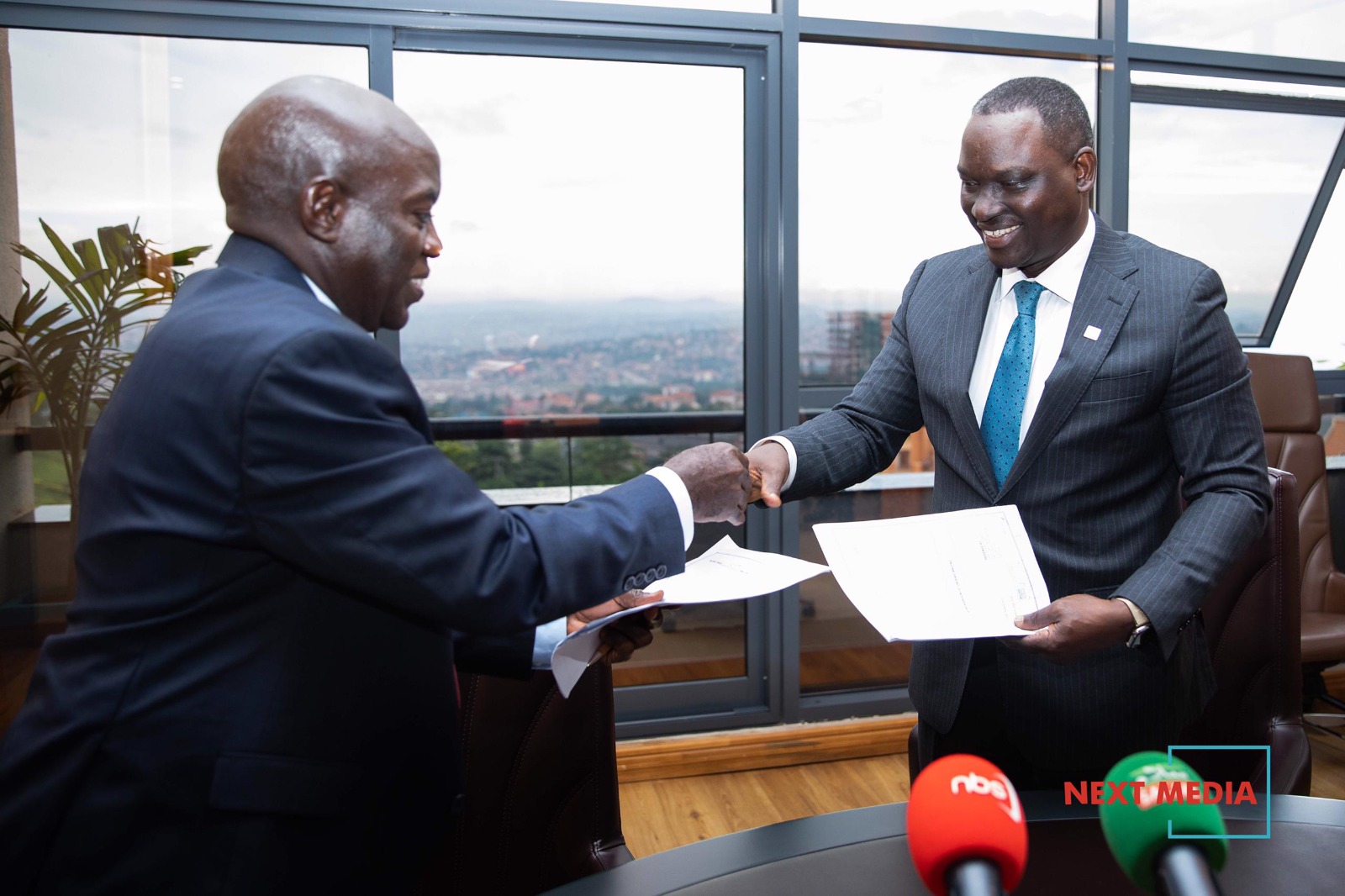

UAP Old Mutual Insurance has partnered with National Social Security Fund(NSSF) to offer financial literacy to Ugandans.

Caroline Owomuhangi, a Marketing and Communication Specialist at UAP Old Mutual Insurance said financial literacy has been recognized as a critical factor in improving the quality of life and enhancing financial inclusion.

Keep Reading

“In line with this, UAP Old Mutual Insurance has established an integrated approach that ensures that customers receive holistic financial services throughout their lifetime. Financial education is one of our sustainability pillars. We are committed to equipping individuals with essential knowledge and tools for sound financial decision-making, fostering a culture of financial security,”Owomuhangi said.

“While generally known to be a measure to cushion oneself against unforeseen future misfortunes, the insurance sector has over time shade its skin revealing its multifaceted offerings including mitigating financial risks. It is therefore our mission to safeguard our customers’ financial well-being and provide them with peace of mind in the face of life's uncertainties.”

She explained that the partnership will see UAP Old Mutual and NSSF hold financial literacy trainings within Kampala but also regionally across the country.

We believe in providing financial solutions during our customers’ lifetime. We know people have challenges in terms of finances, budgeting, saving and investment and we have solutions for this in terms of investment and insurance. Insurance is important in providing funds when you get challenges.”

Geoffrey Sajjabi, the Chief Commercial Officer at NSSF underscored the role of the partnership with UAP Old Mutual.

“When you are broke and think about your NSSF benefits, know you haven’t planned. If your car gets broken and you wish you could get a million from NSSF, your child is sent home for school fees and you think about your NSSF benefits, know that you haven’t planned for your future. There are companies to help you in this and this is where UAP Old Mutual Insurance comes in,” Sajjabi said.

“Players like UAP offers you different options. I have never looked at insurance companies like UAP Old Mutual as competitors because they can offer certain products that we can’t and we can also offer certain thinks they can’t offer. People’s challenges are very many and we need more players to help our people save and invest but also stop looking at NSSFas the only way of saving and investing.”