Uganda's SACCOs Face Regulatory Maze

Conflicting laws are confusing Uganda's Savings and Credit Cooperative Organizations (SACCOs). Two separate regulations, the Cooperative Societies Act and the Tier 4 Microfinance Institutions Act, leave SACCOs unsure of which authority to follow. This lack of a single regulator creates uncertainty about reporting lines, with SACCOs stuck between the Uganda Microfinance Regulatory Authority and the Bank of Uganda.

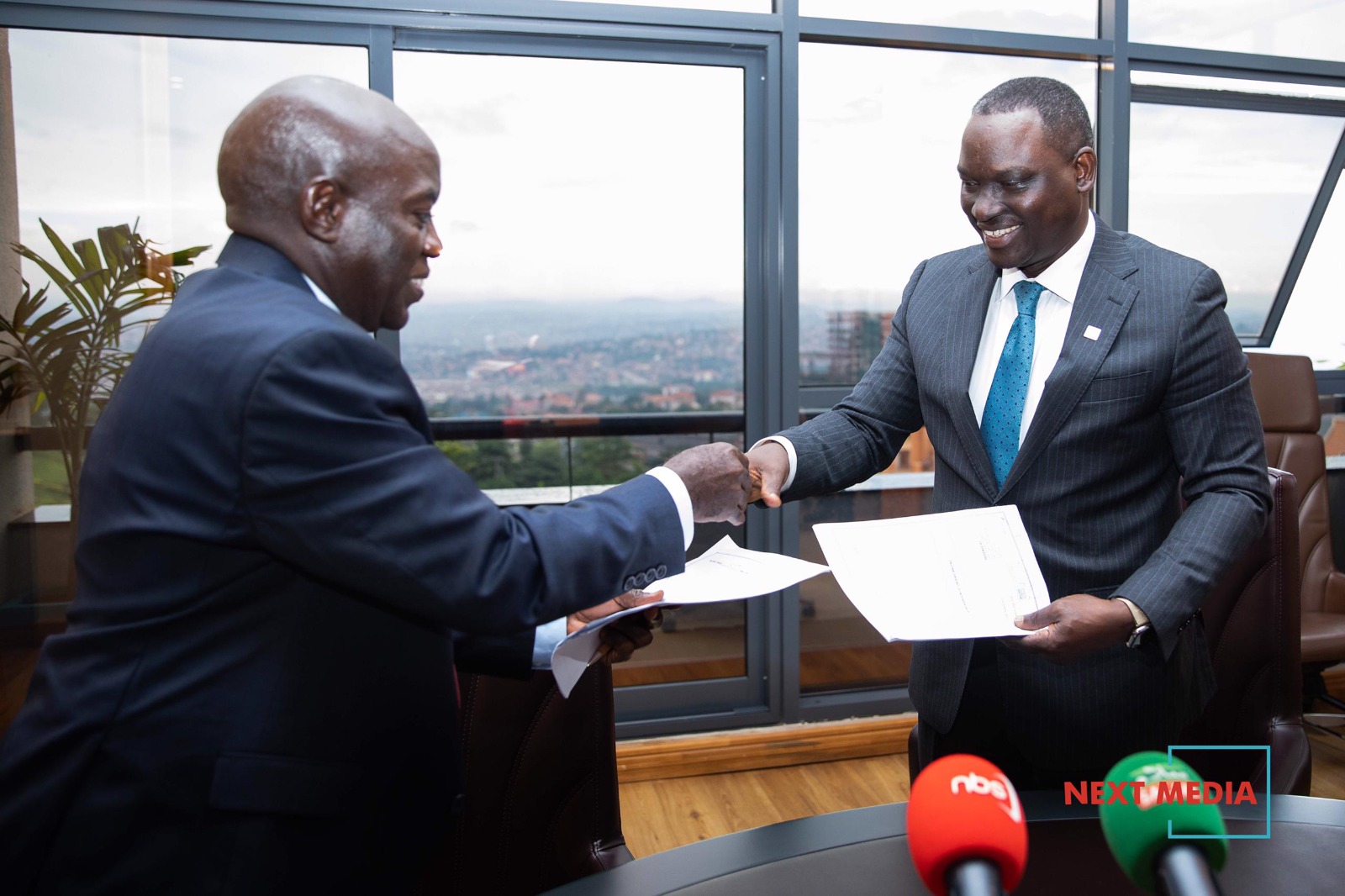

Leaders like Col. Fred Joseph Onata (Wazalendo SACCO) highlight the confusion this situation creates, especially regarding regulations for capital growth and expansion. Stakeholders recommend SACCOs focus on internal capital growth and avoid risky external borrowing. Atwijukire John Bosco (KYAPS) further emphasizes the need for caution, advising against branch openings without proper feasibility studies.

To ensure effective operation and continued promotion of financial inclusion, stakeholders urge the Ugandan government to establish a single, clear regulatory framework for SACCOs. This would eliminate the current confusion and guide SACCOs in their operations. Until the regulatory situation is resolved, SACCOs face an ongoing challenge as they navigate conflicting rules.