Digital Tax Solutions reason for increase in production- Finance Ministry

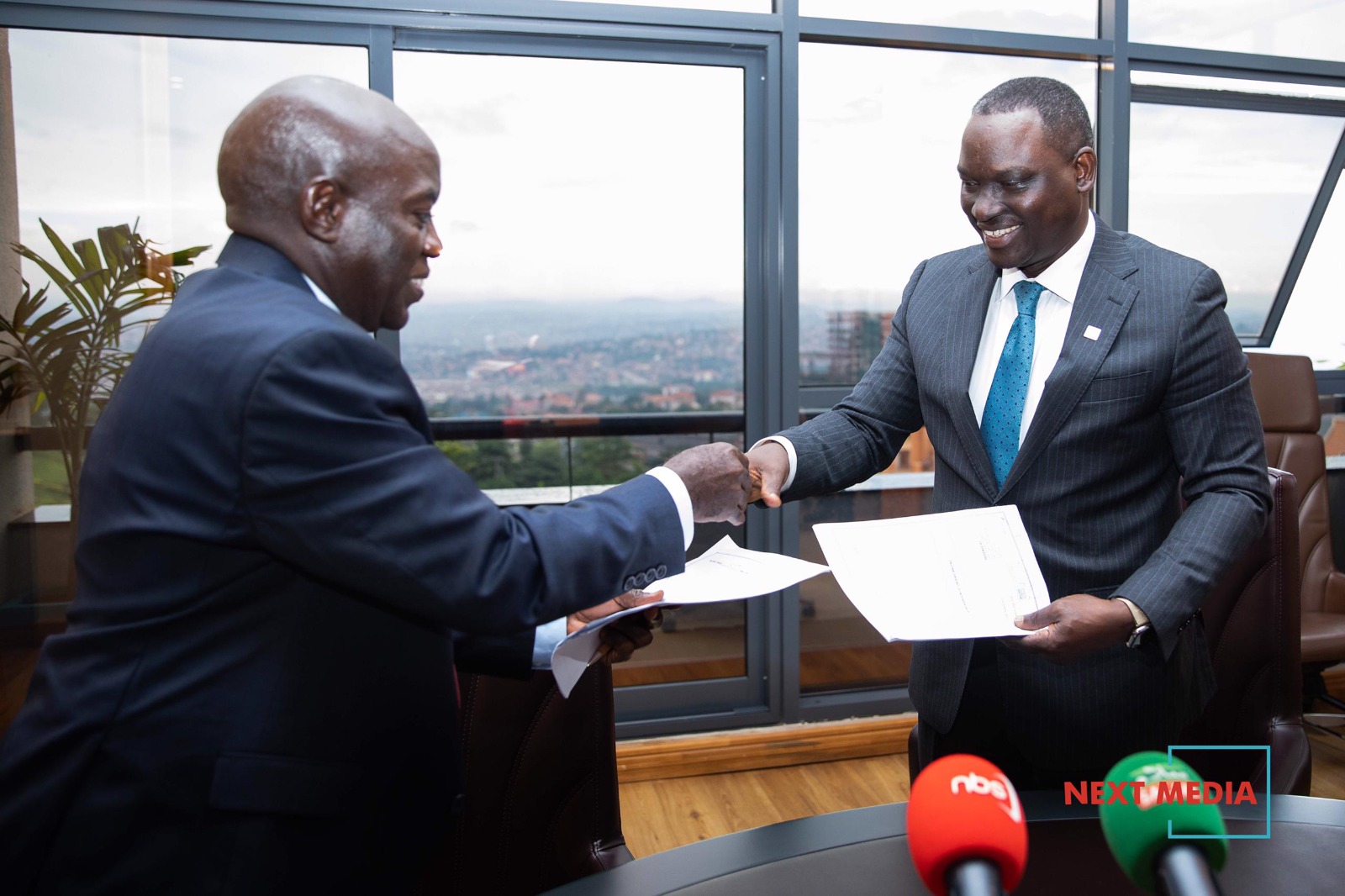

The Commissioner General of Uganda Revenue Authority, John Rujoki Musinguzi, has commended Treasury Secretary Ramathan Ggoobi for his support toward the rollout of the Electronic Fiscal Receipting and Invoicing System (EFRIS) and Digital Tax Stamps (DTS).

Rujoki, who was speaking at a workshop for the 'Review of Resource Envelope for FY 2024/25', said digital tax solutions have come as timely tools in optimizing revenue collection.

Keep Reading

"We are encouraged by PSST Ramathan Ggoobi's support for EFRIS & DTS,” Rujoki said.

“These solutions are vital to optimize revenue mobilization & curb tax leakages."

Ggoobi, who is also the permanent secretary at the Ministry of Finance and Economic Planning, has been pushing for URA toward the digital transformation, which has led to an improved tax-to-gross domestic product ratio, exceeding initial projections.

Digital tax stamps have been crucial in enhancing tax compliance and ensuring that products in the market meet required quality standards.

According to the ministry's "Background to the Budget" report, the adoption of digital tax systems, notably digital tax stamps and related enforcement mechanisms, has notably enhanced the declaration and payment of local excise duties.

Remarkably, the revenue from spirits saw a surplus of Shs36.44 billion due to these digital initiatives.

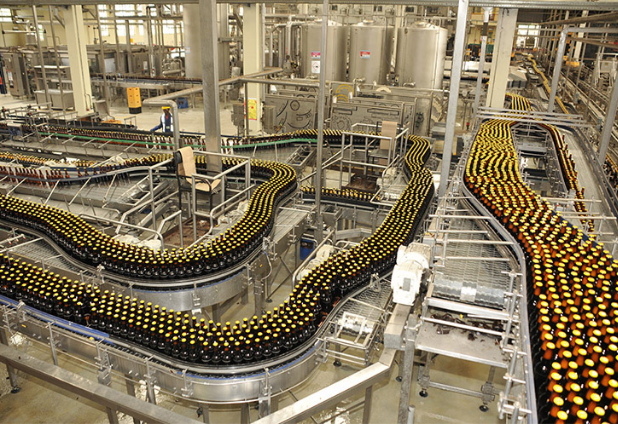

The report highlights remarkable growth in production volumes across several categories.

Beer production experienced an 81.30 per cent surge, escalating to 516.4 million litres, while soft drink production, encompassing soda and juice, increased by 25.64 per cent to 918.2 million litres.

The spirits sector also saw a 22.7 per cent rise, reaching 101.7 million litres.

Despite these gains, declines were observed in the volumes of cement, sugar, and wines.

Rujoki emphasised the commitment of Uganda's tax authorities to leveraging digital technologies for efficient tax administration.

In a report prepared by URA, Mr Ibrahim Bbosa, the assistant commissioner of corporate and public affairs, indicated that the growth in sales and production volumes had returned an increase in tax revenues, as a contribution of digital tax stamps, whose collection during the period rose by 30 per cent from Shs740.79 billion to Shs963.38 billion.

“The contribution of [digital tax stamps] to tax collection can be measured in terms of register growth and revenue growth,” Bbosa said.

“The number of taxpayers in the [digital tax stamps] register has increased from 40 to 1,201, which includes 886 manufacturers and 315 importers.”

He said the local excise duty register has grown from 127 to 662 taxpayers, specifically for digital tax stamps-gazetted manufacturers.

“As a result, the revenue generated by local excise duty from digital tax stamps manufacturers has risen 30 percent,” Bbosa added.

The government asserts that the benefits of increased tax collection and compliance far outweigh the costs associated with digital tax stamp implementation.

DTS is implemented by URA in partnership with SICPA Uganda.