Bank of Uganda announces increase in lending rate to arrest inflation

The Bank of Uganda (BoU) has announced an increase in the Central Bank Rate (CBR) by a one percentage point to 8.5 percent.

This is in response to the persistence inflation in the country.

Keep Reading

In a statement that was released on Tuesday, the bank said that this decision was taken at an extra-ordinary Monetary Policy Committee (MPC) meeting held on Monday, July 4, 2022.

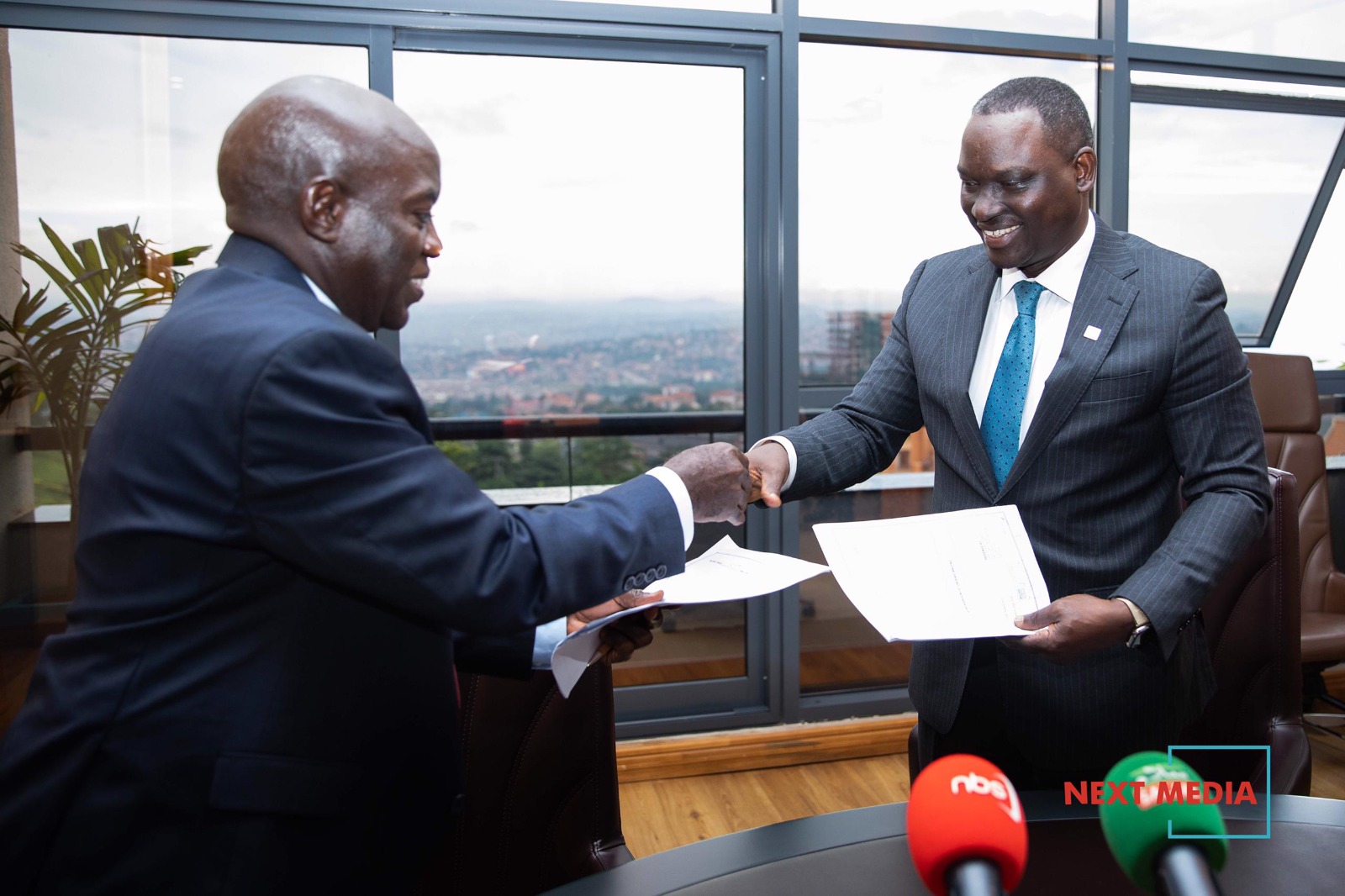

Michael Atingi-Ego, who is the bank's deputy governor said in the statement that has been seen by Nile Post that the increase was necessary to stabilise inflation.

"While the inflationary pressures are likely to be temporary, the MPC assessed that a markedly higher policy rate is needed to stabilise inflation around the target," Atingi-Ego said.

"Accordingly, the MPC raised the CBR to 8.5 percent and maintained the band on the CBR at +/- 2 percentage points. The margins on the CBR for the rediscount and bank rates remain at 3 percentage points and 4 percentage points, respectively. Consequently, the rediscount and bank rates are now 11.5 percent and 12.5 percent, respectively."

According to the statement, the central bank also increased the cash Reserve Requirement by 2 percentage points to 10 percent, effective June, 23 2022.

Atingi-Ego stated that inflation continues to rise in the country, largely influenced by external cost pressures stemming from higher global food and energy prices, persisting global production and distribution challenges, as well as rising domestic food crop prices due to dry weather across the country.

He said that the annual headline and core inflation rose to 6.8 percent and 5.5 percent in June 2022 from 6.3 percent and 5.1 percent in May 2022, respectively.

“Annual food crop inflation has sharply risen from 0.7 percent in February 2022 to 14.5 percent in June 2022,” Ego added.

According to the statement, the overall, economic activity is projected to remain modest as the shocks to commodity prices, production and distribution disruptions, and global inflation continue to dim the prospects for domestic economic growth.

“Economic growth is still projected in the range of 4.5-5.0 percent in 2022 and rising slightly to 5.0-5.5 percent in 2023, in part supported by public investments. Weaker external demand, high domestic inflation and resultant tighter domestic financial conditions will constrain exports, consumption, and investment.”

The BOU, while analysing June 2022 preliminary GDP which was estimated by the Uganda Bureau of Statistics (UBoS) indicated that the economy grew by 4.6% in Financial Year (FY) 2021/22 from a revised growth rate of 3.5 percent the previous year.

The central bank however said that households’ and businesses’ expectations about economic developments have grown more tepid, and the global economic outlook is highly uncertain.

"Indeed, the Composite Index of Economic Activity (CIEA), a high-frequency indicator of economic activity, continues to signal a slowdown in the pace of economic recovery in the second half of the financial year. The CIEA growth in the three months to May 2022 decelerated to 0.9 percent from 2.1 percent in the three months to February 2022," they said further in the statement.