Uganda still attractive market for international retail companies, experts say

Following the exit of a couple of international retail companies in the past few years, several Ugandans opined that the country is no longer viable for business but experts have differed from this thinking.

Several retail chains including Shoprite, Nakumatt, Uchumi and Tuskys that have in the past seven years exited the Ugandan market after struggling with business

Keep Reading

Last year, South African retail giant Massmart, the parent company of Game Stores folded business in Uganda after failure to find local investors to buy it.

The company which is Africa’s third-largest distributor of consumer goods and one of the biggest retailers of general merchandise, liquor, home improvement equipment and supplies and wholesaler of basic foods had earlier announced it was selling 14 stores across Uganda, Ghana, Nigeria, Kenya and Tanzania as part of its exit plan from East Africa and West Africa.

However, many Ugandans opined that the country was no longer viable for business.

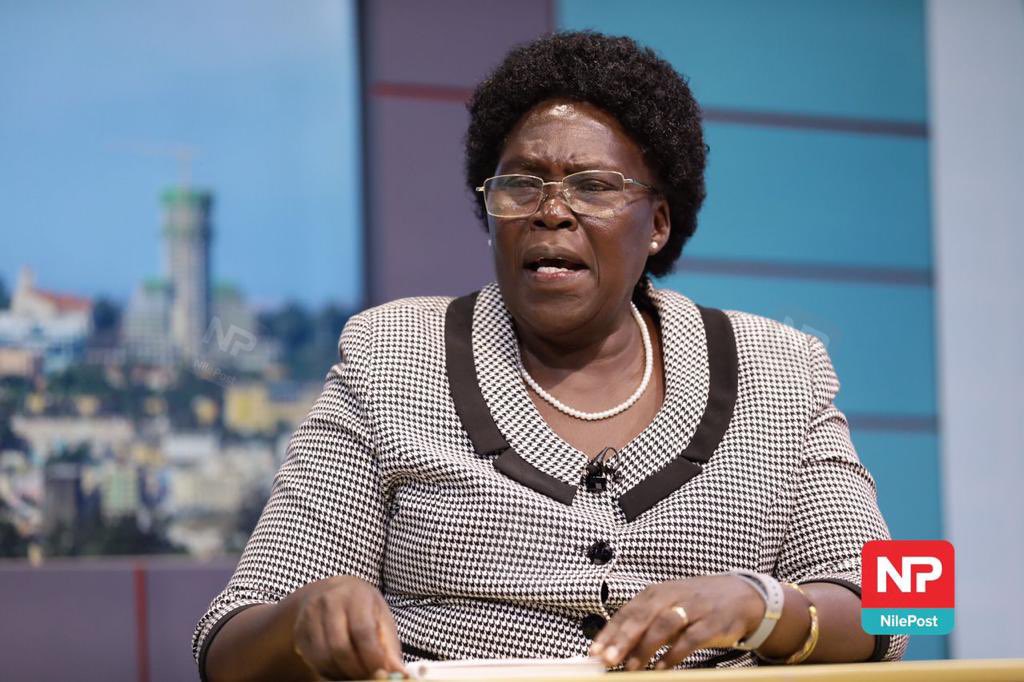

Speaking during the release of the Kampala real estate performance for the second half of 2022, Patience Taaka, a research analystKnight Frank Uganda said several international retail companies have set up business in Uganda in the past few months, a sign she said indicates viability of the market.

“We(Uganda) are still getting a lot of interest from international brands. New retailers entered the Ugandan market last year with brands such as Hummel(sportswear giant), U-Home and Optica establishing their presence while others like LC Waikiki, Yashika, FB Fashions and Woolworths expanded to other malls,” Taaka said.

She added that fashion retailers and restaurant owners who were either expanding or establishing their presence dominated the lease market .

“There is a rebounding retail sector and resilience amidst adversities and uncertain trading conditions after the long lockdown period.”

Performance of retail market

According to the research analyst from Knight Frank, whereas it was slow, there was a steady recovery in the retail sector with improvements in footfall, turnover and occupancies.

Knight Frank says that across its managed malls, average footfall improved by 40%, turnovers for general grocery recorded a 15% growth and average occupancies were up by 2.7% year on year.

The property consultancy, management, valuations and letting company attributed the recovery of the retail market in terms of footfall to the return of black Friday promotions by various companies as well as the steady recovery of the cinema industry with the return of blockbuster movies.

The report however indicates that the footfall figures remain 18% below the pre-covid pandemic performance particularly due to high inflation rates that saw consumers adopt conscious spending habits.

The outbreak of the Ebola virus also saw the footfall figures remain low.

Residential

The report indicates that residential land price growth in select prime areas slowed down in the second half of 2022 with increased supply of re-development plots against low demand.

“Developers who took up most of the land purchasers in the affluent suburbs were negotiating or forming joint ventures in an effort to reduce costs associated with redevelopment. This impacted sale prices, resulting in some vendors reconsidering their decisions to sell,” said Lucy Wamimbi, the head of residential and lettings at Knight Frank.

She noted that this state of affairs impacted the average land prices per acre in affluent suburbs which reduced by approximately 10% compared to the same period in 2021.

The report also indicates a 2% annual increase in occupancies as effective demand for middle and affordable housing continues to grow steadily.

Knight Frank indicates that the steady growth in residential nodes is seen in areas in Nakawa division, Kajjansi town council and Kira municipality.

The experts say over 500 units are expected in the next 12 to 24 months.