NSSF declares 9.65% interest payment to savers

National Social Security Fund (NSSF) members will get 9.65% as interest for theirs savings which translates into Shs1.38 trillion and this will be credited to their accounts, the Ministry of Finance has announced.

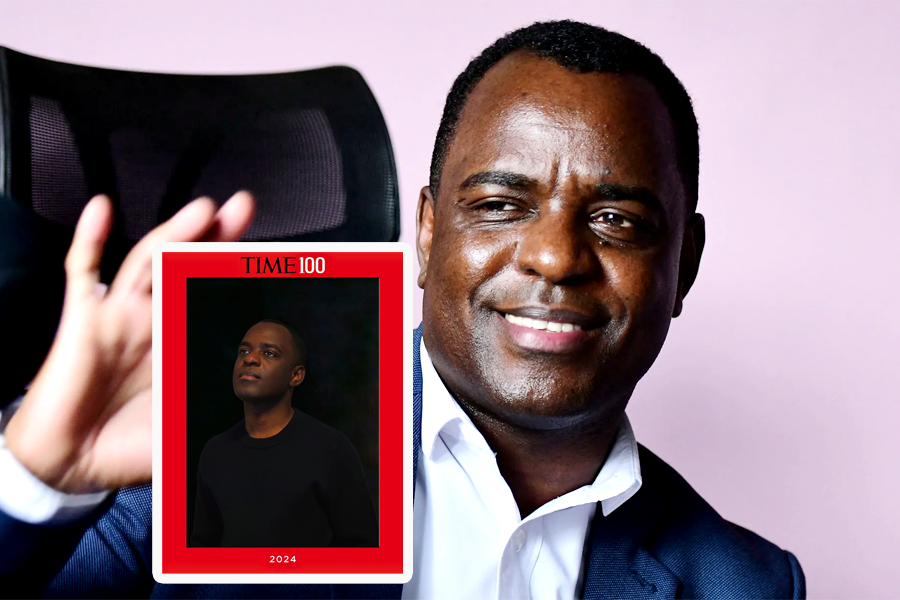

"In exercise of the powers conferred on me by section 35 of the NSSF Act, I have the pleasure to declare an interest rate of 9.65% to be paid as interest to the members of the fund for 2021/22,” the State Minister for Finance, Henry Musasizi said on Tuesday during the NSSF member’s Annual General Meeting at Kampala Serena Hotel.

Keep Reading

The 9.65% is however, lower than the 12.15% paid out to members last year and this has been attributed the global economic turbulence.

The minister however commended NSSF for the stellar performance .

“We have seen turmoil in business world on global and domestic stages but the fund has registered 11% growth in assets and a year on year growth in contributions. This is commendable.”

According to the NSSF Managing Director Richard Byarugaba, the amount paid out to members in interests depends on the net income and expenses.

"The amount of value we create through interest we pay is as a result of the expenses and the total income we create .The less the expenses and the more income, the more the interest we pay out to members,”Byarugaba said.

He noted that the proportion of benefits paid to members against contributions collected has grown from 27% in 2013/4 to 80% in 2021/22 which means that almost all that was collected was paid out to members.

Performance

He noted that the fund currently boasts of 1.3 million members, 620,000 of these being active whereas 695,000 are dormant.

The NSSF asset base has grown from 15.5trillion in the previously year to 17.25 trillion whereas member fund has increased to shs16.96 trillion.

Speaking about the year ended, June 30, Byarugaba explained that since the pandemic was ending, there was increased spending and meant increase in inflation.

“There was a higher than expected inflation worldwide but also the negative spillovers from the war in Ukraine had negative impacts on all economies. There was also a worse than anticipated slowdown in China(due to Covid) which has seen a slowdown in the supply chain. Generally, there was slowed global economic growth. This meant that what happens in the global economy affection the regional and local economy,”Byarugaba said.

He said this state of affairs globally meant that NSSF growth was slower on contributions whereas the fund’s real estate projects became more expensive.

“Last year was a tough year but one of opportunity. We tried everything that should and must work out in an environment which was tough. The fund came out shining as usual. The fund paid out shs1.9 trillion to members,”Byarugaba said.

Midterm payments

The National Social Security Fund (Amendment Act) 2022, that allows midterm access of accrued contributions to eligible members.

Byarugaba explained that the fund performed well during the midterm payments by paying out shs1.9 trillion to eligible members.

Future plans

“We will continue committing ourselves to giving members a better life, have a mass registration of membership, we believe we will continue using technology and financial literacy to members,”Byarugaba said.

He said they have now introduced an enforcement unit but will also make partnerships with URSB, NIRA and UNRA to ensure compliance as well as sensitization of members of the public.