Stanbic Bank Post Budget discussion: The key lessons

There were many takeaways from the televised Stanbic Post-budget analysis panel discussion held last week where the government’s Parish Development Model (PDM) dominated both attention and mentions.

In keeping up with its tradition—sharing thought leadership around the budget, Stanbic Uganda assembled a high-level panel of thought leaders that included Allan Muhinda, the Bank’s Head of Global Markets.

Keep Reading

- > Stanbic appoints Mwogeza, Dokoria as interim Chief Executive, Executive Director

- > Stanbic basks in earns Shs412bn profit after tax

- > Stanbic Bank's national schools championship hailed for role in improving learners' performance

- > Stanbic, UN Women commit to supporting more female-owned businesses in Uganda

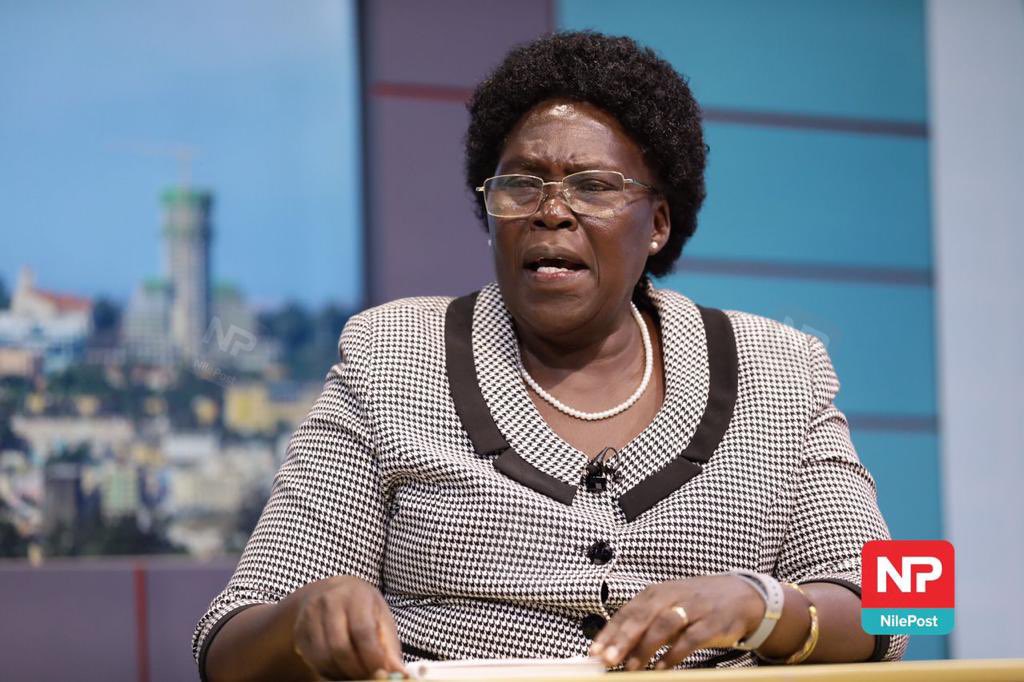

Other panelists included consulting economist, Dr. Fred Muhumuza, Josephine Mukumbya, the executive director of Agribusiness Development Center and Daniel Birungi, the Executive Director of the Uganda Manufacturers Association.

PDM hailed

Panelists described the PDM as a huge statement of intent by the government to lift several million Ugandans into the monetary economy.

However, they also cautioned that its success would hinge on how well it is implemented as one of the cornerstones of the UGX48.1trillion 2022/23 National Budget presented by finance minister, Matia Kasaija on June 14.

For starters—the government earmarked Shs 1 trillion targeted at people living at subsistence level and the scheme will involve the disbursement of Shs 100 million to each parish across the country.

The money is specifically intended to assist an estimated 39% of Uganda’s population to start cottage industries or small enterprises organized in SACCOs, which will enable them to earn regular incomes.

"It is a huge statement of the government’s intent," said Stanbic Bank’s Muhinda explaining that the Shs 1 trillion being committed is about four percent of the country’s annual tax revenues.

He added: "I think this is the first time we are seeing such an amount of money being committed at the lowest level possible. it’s about $100 for each of the three million households across the different parishes. Yes, it may not be enough, but I think it sends the right message. The issue then, is one of coordination of the activities and actually delivering the programme."

Building on Muhinda’s point, Dr. Muhumuza said frequently the government has come up with good policies on paper, but the outcomes have not always been as projected due to gaps in implementation.

As an example, he said the government is yet to recruit all the required parish chiefs necessary to provide direct oversight for PDM.

Dr. Muhumuza stressed the importance of creating linkages in the ecosystem that will enable effective implementation, including research, provision of extension services and marketing outlets.

He said exploiting market opportunities arising from the example of disruptions of commodity supplies from Ukraine, can only be exploited if the appropriate systems are in place.

He cited Uganda’s potential to expand production of soya beans and India’s high demand for the commodity which the country usually purchases from Ukraine.

In his budget speech, Matia Kasaija, the minister of Finance said the government plans to increase funds towards promoting agro-industrialisation.

This will mean expanding storage and processing capacity for agricultural commodities within the 18 zones of the country; enhancing the use of the Warehouse Receipt System to improve commodity storage, reduce post-harvest losses, improve value-chain management, and consequently increase income to farmers.

Mukumbya said they are happy about this proposal, but cautioned that the devil is in the details.

"It is how the allocation of that industrialisation programme is like. What kind of sub-sectors are involved, and oilseeds quickly come to mind. The how is not very clear," she said.

Birungi said the average industry in Uganda is operating at less than installed capacity due to lack of markets.

He said UMA would have wanted the budget speech to give a deeper focus on market development in light of the non-tariff barriers that continue to hinder Ugandan companies’ exports to neighbouring countries.

However, he welcomed the renewed commitment by Kasaija to return to cash-basis accounting for firms supplying the government.

He said there had been a cash flow crisis amongst many companies supplying the government where they had to wait up to two years before being paid and yet the tax collector is at the door.

Birungi expressed concern that despite the knock-on effects due to war in Ukraine and recovery from the Covid-19 pandemic, the government is expecting a substantial increase in tax collection.

"Why this worries me is that the usual targets are the formal entities. This means that the cow that has been struggling to give milk is going to be squeezed even further. We are seeing a lot of businesses falling along the wayside and when you say you are going to raise the target by Shs 3 trillion it means URA is going to squeeze taxpayers even more," he said.

Muhinda said the Ukraine conflict is already impacting the economy with a rise in inflation from two percent in January to 6% now. There is also a global trend in raising interest rates to cope with price rises which will eventually be felt in Uganda as well with higher borrowing costs.

"Affordability becomes an issue. The cost of financing the budget will come into play and may impact on the budget estimates," he said.