Airtel targets informal businesses with new product for mobile money users

Telecom company, Airtel Uganda has launched a new product for its Airtel Money customers that will see ease of financial management for informal businesses.

Named the Airtel Micro Merchant, the new product launched on Tuesday at Nakawa market will see informal business owners like salon operators, market vendors, and boda boda riders among others able to separate their business money collections from personal money using their existing Airtel sim cards.

Keep Reading

- > Parliament questions government's Shs1.1 trillion supplementary budget

- > Salam TV elevates coverage of 11th international Quran competition 2024 in Rwanda

- > Electoral Commission budget expected to rise

- > PPDA asks districts to use use alternative procurement processes to avoid returning money to consolidated fund

This will be through creation of a business account on their existing Airtel Money accounts.

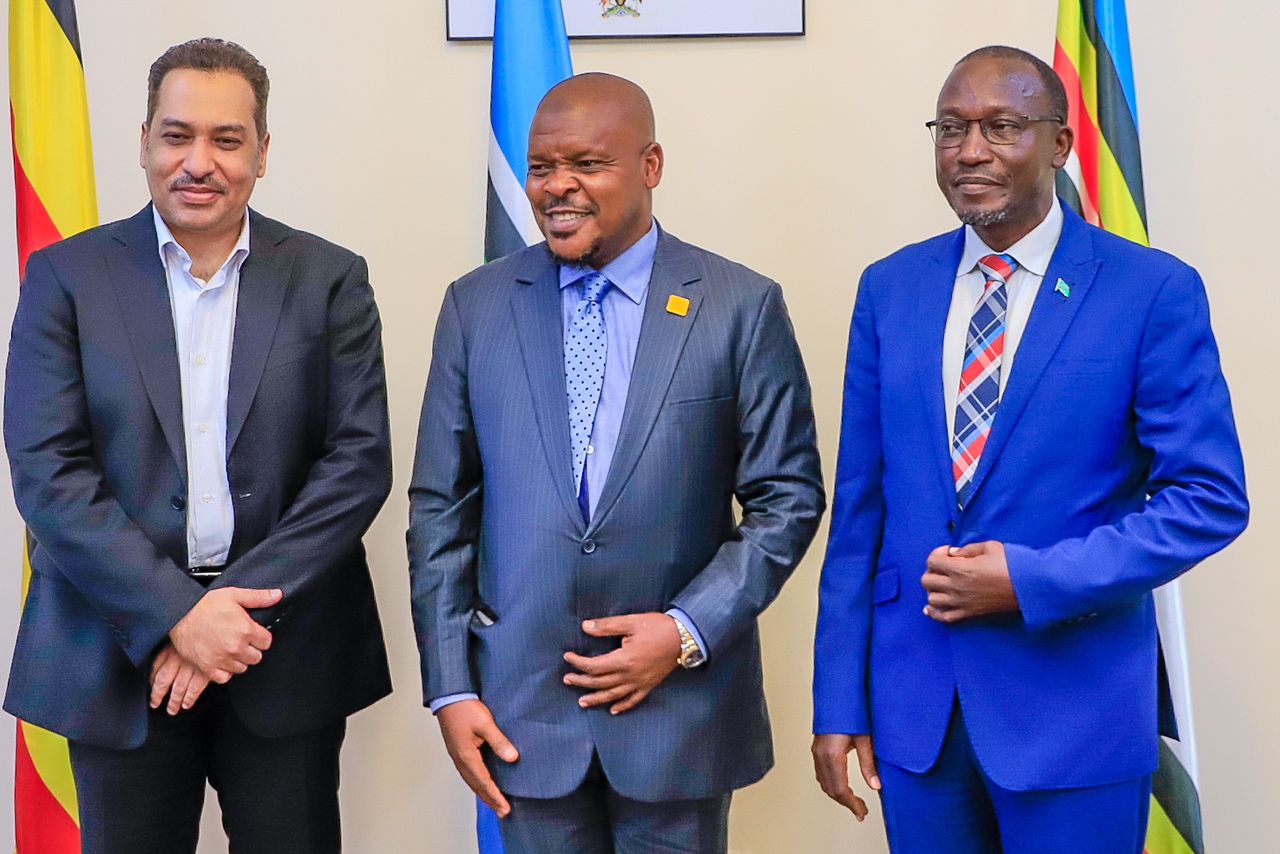

“ We are making a huge difference in the lives of small businesses which are always excluded in financial services .We have been listening to our customers and brought this new product. We also want your customers to pay for services using Airtel Money,” said Japhet Aritho, the Airtel Mobile Commerce Ugandan Limited, Managing Director.

He explained that with the new product, owners of small businesses can have two separate accounts including personal ones and ones for business and can decide where each money they get goes.

“You don’t need to have documents, buy another phone and another simcard and wait for registration. This is not the case anymore. You will use the existing simcard and phone to create another account . You will only be required to enter the business name you trade with and instantly you will get a merchant till. This is how we want to transform small businesses but also help them separate personal and business money. You will be able to view your personal business transactions any time you want but you will also be able to check personal balance and you can seamlessly transfer money from the business account to personal account .”

According to Uganda Communications Commission (UCC) 2021 quarter three report, the number of active mobile financial service agents grew by a factor of 11% from 285,371 in June 2021 to 315,895 by the end of September 2021.

This reflects a sustained increase in business activity that is gradually positioning the mobile as a financial tool. In comparison to 2020, the agent footprint across the country has grown by 39% and over 88,000 mobile money agents have been added to the distributed file system ecosystem over the last twelve months.

The Airtel Mobile Commerce Ugandan Limited, Managing Director noted that the new product will also help in driving financial inclusion in the country.

“The new Micro Merchant Till number service will boost business as the proprietors will have proper accountability and oversight of their business. They will know the income that is resultant of the business transactions separate from their personal transactions. The users will, using their current SIM cards, be able to monitor up to 10 different branches of their small businesses.”

He noted that to enjoy the service, their customers ought to dial USSD code *185*10*10# to create a unique merchant till number.