Govt has no plan to take overfunds on dormant bank, mobile money accounts, says Minister Kasaija

Government has explained the rationale behind the move to have funds which have stayed long on dormant bank and mobile money accounts moved to the consolidated fund.

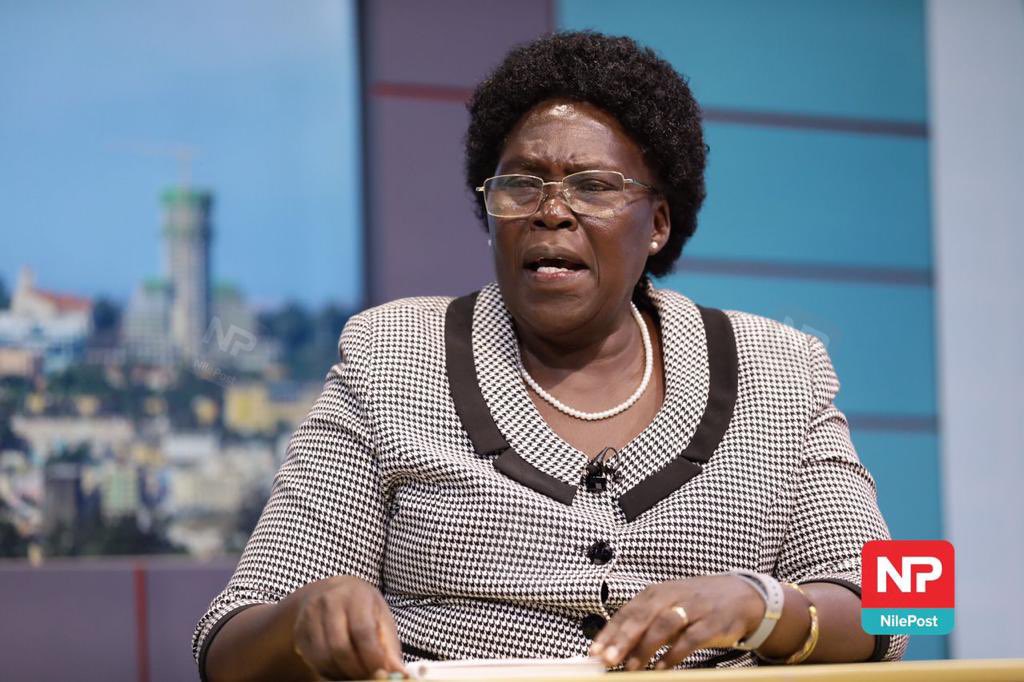

Addressing journalists on Wednesday, the Finance Minister, Matia Kasaija said government has no intention of taking unclaimed balances lying idle on people’s accounts held either with banks or on mobile money.

Keep Reading

“According to section 119 of the Financial Institutions Act 2004 and section 83 of Microfinance and Deposit taking Institutions Act 2003, a dormant account is one that has not had any activity for a period of two years in a supervised financial institution. This excludes fixed deposit accounts that have not had any activity for two years following the maturity date,”Kasaija said.

Many people, especially those working and living abroad complained that the move would greatly affect them since many have accounts in Ugandan banks where they deposit money and stays there for a long time.

However, according to minister Kasaija, the move will only target money on dormant accounts.

The minister said that after two years of inactivity, financial institutions transfer the dormant accounts to a separate register where after three years, the bank may advertise in the media before giving away the account.

“Any account may be transferred out of the register of the dormant accounts if the depositor or his representatives makes such a request. Unclaimed balances shall after a period of five years from the date of advertisement be transferred to Bank of Uganda,” Kasaija said.

Section 57(i) of the National Payment Systems Act 2020 says that an electronic money account which doesn’t have a registered transaction, either depositing or withdrawing for nine consecutive months will be deemed dormant.

The act also says that electronic money users like MTN, Airtel or any other company will be mandated to close any account which is not re-activated within six months after being blocked.

In this regard, a dormant account is one where there has not been any activity including deposit or withdraw for a period of nine months consecutive, save for fixed deposit accounts.

“A dormant account is one which has not had any activity in nine consecutive months and the electronic money issuer(bank) will give notice to the customer at least one month before the expiry of the nine months,”Kasaija said.

“After expiry of nine months, the account will be suspended and subsequently blocked. Five days after blocking the account, the electronic money issuer will give a notice to the customer that the account is blocked and provide instructions on how it can be reopened.”