URA says number of manufacturers embracing Digital Tax Stamps system has surpassed estimated target

Tax body, Uganda Revenue Authority has said the number of manufacturers to have embraced the Digital Tax Stamps System has surpassed the estimated target.

With effect from November 1 2019, government through Uganda Revenue Authority commenced the implemented the Digital Tracking Solution (DTS), a technology solution that was sought to aid tax administration to mitigate revenue losses.

Keep Reading

The digital stamp is a mark or label applied to goods and their packaging and contains security features and codes to prevent counterfeiting of goods and enable track and trace capabilities.

DTS provides for the application of Digital Tax Stamps by producers and importers, using both automated and manual processes of production but also provides for verification of goods from the factory or importation to the point of sale.

However, according to data from the tax body, the implementation of digital tax stamps currently stands at 257% in terms of taxpayers who have come aboard.

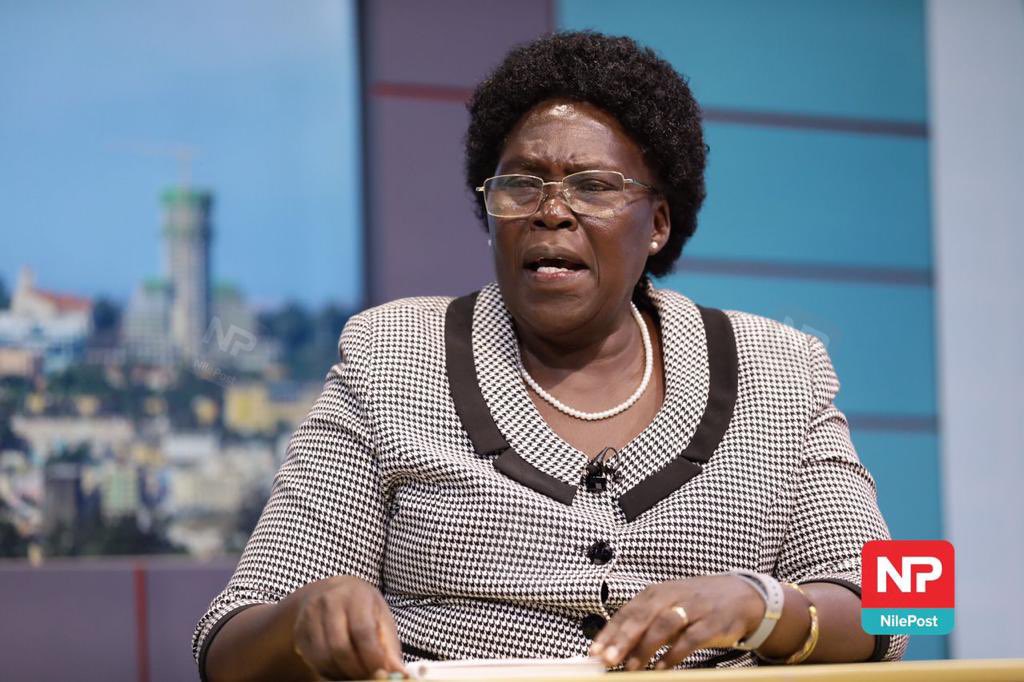

“A total of 406 sites have been registered out of the target of 140 sites whereas 317 manufacturers of the gazetted products have been registered against the 107 manufacturers scoped at inception, representing a 262% performance,” said Ian Rumanyika, the acting Assistant Commissioner for Public and Corporate Affairs at URA.

“Similarly, 89 importers of the gazetted products have been registered against the thirty-three 33 importers scoped at inception, representing 249% performance.”

According to the tax body, the implementation of the Digital Tax Stamp system for cement and sugar which was rolled out on April,1, 2021 currently stands at 55.5% with ten sites registered out of the 18 sites for local producers.

For the importers, the implementation is still down with only one out of the 69 sites supposed to implement the system.

“The number of taxpayers using DTS and contributing to Local Excise Duty (LED) collections has increased significantly with 109 taxpayers on DTS paying LED in April 2021 compared to 43 taxpayers in April 2020, a year-on-year growth of 153%.”

In terms of revenue performance in the financial year 2020/21, URA has registered an 11.6% growth in Local Excise Duty collections from 211 manufacturers using the Digital Tax Stamp System.

URA however noted challenges in implementation the Digital Tax Stamp system in alcoholic substitute products beyond the scope of Excise Duty and the DTS.

“The alcohol products prescribed for DTS as well as those listed in the second schedule of the Excise Duty Act do not fully exhaust all alcoholic beverages in the market for example Kombucha products. This has led some local producers to hide behind this product and compete unfavourably with a cost advantage due to non-payment of Excise duty or Tax Stamp fees,”Rumanyika said.

The tax body is however hopeful new policy changes will help address the challenge.

Stamp forgeries

The tax body also noted incidents of forgery of the Digital Tax Stamps that they say are mostly manifested in the stamps for spirits.

“This has led to a lot of fake products being found in the market which is a major revenue leakage. URA has increased its surveillance and a number of have been apprehended and fined.”