Opinion: Interrogating the reliability of NSSF as a Social Security Scheme amid the Covid-19 pandemic

By Racheal Kyomuhangi

“If a free society cannot help the many who are poor, it cannot save the few who are rich.” These were the words of John F. Kennedy in his inaugural address on the 20th day of January, 1961.

Keep Reading

In times like this where the distinction between the majority poor and the minority rich is but a thin layer because both groups of people have been tied down from active employment; it is not surprising that someone would look into all options of getting money, including savings from the Social Security Fund

But are the citizens of Uganda actually aware of the law that governs social security? In addition, do they know the position of a beneficiary? Is the National Social Security Fund (NSSF) withholding citizens' money illegally or justified by their actions?

These and more questions need to be addressed especially in times like this where the whole world is dealing with the Covid-19. One would assume that we need to be sure that peoples' rights are not being infringed and neither is access to the Fund being illegally denied.

It should be noted that social security is a concept that predates the 1995 Constitution of the Republic of Uganda and all the laws subordinate thereto.

This is not a creature of the government of Uganda alone but rather a concept that is recognised worldwide.

In the Western world, this idea was launched by Franklin D. Roosevelt in 1935. Before 1935, it was customary for children to ignore their parents’ needs the moment parents hit non-productive years.

However, it is not stated anywhere that these parents ever died of hunger or that there was a general outrage that people could not survive without the social security fund.

Therefore, if there is no such evidence of hunger and malnutrition even in Uganda today, what is the importance of social security and what was the aim of the scheme in Uganda.

Going back into ancient times and analysing the history of this fund, we are to learn that NSSF’s roots can be traced as far back as the 1940’s.

After World War II, J. Harthorn Hall, then governor of the Uganda Protectorate, issued an ordinance in 1951 known as the “superannuation scheme”, which allowed for the establishment of a fund to provide for pension and gratuities on a contributory basis.

Notably, before the start of 1946, there were eligible workers who benefited from the European Officers Pensions Ordinance and the Asiatic Officers Pension Ordinance.

The proposal by Harthorn, however, did lead to amendment of the pension ordinances in existence at the time to give birth to the “first” Ugandan pension scheme.

By the 1960’s though, some organisations such as the Uganda Electricity Board (UEB) had their own private social security scheme where there were mandatory contributions.

In fact in 1961, UEB had a “Pension and Life Assurance Scheme, which focused on catering for employees who were considered old, had gone into retirement and were incapacitated.

All these were initiatives in pre-independent Uganda.

As Uganda approached independence, workers’ unions were getting stronger with influence over legislation and politics.

The workers' unions often demanded better welfare for its members. Uganda’s colonial masters, Britain were used as a benchmark for the establishment of a social security scheme.

In September 1963, government secured the expertise of Mr E. Turner from the British Ministry of Pensions and National Insurance in order to conduct a study on the feasibility of a national security scheme in Uganda.

His terms of reference were to explore the sustainability of a scheme that would minimise the expenses on government employees.

Additionally, he was supposed to explore a scheme that would cover for contingencies such as; sickness and unemployment. The initial scheme was supposed to cater for only the wage-earning population.

In his February 1964 report, Turner recommended that a National Provident Scheme be established for workers aged between 16 and 60 years.

The contribution, Turner noted, was expected to be 10 per cent of the cash paid to an employee. In order to get a second opinion specifically on the welfare of workers, the government sought the expertise of John Vass in 1965.

In 1966, he recommended that the 1948 workman’s compensation be replaced by the Industrial Insurance Scheme. His findings were combined with Turner’s and formed the first post-independence legislation for the establishment of a Social Security Fund.

On December 1, 1985, NSSF was established as an independent entity.

This was after the Parliament repealed the Social Security Act No. 21 of 1967 and the Social Security Amendment Decree No. 33 of 1972 and enacted the NSSF Act No. 8 of 1985.

The history of the NSSF should not just be a story that is told in passing but rather its history opens us to understand the minds of the legislators when the provident fund was set up.

We are to discover that whereas Uganda was on the right track when this scheme was introduced, we seem to have gotten off the radar of the intended aim sought by the draftsmen.

The intention of the initial bill was to help the wage earners in case of unemployment or sickness such as what we are facing with the Coronavirus pandemic, in addition, the bill aimed at reducing the burden of government in such instances as well as helping the retired workers

The long title of the National Social Security Fund Act Cap 222 states that this is “An Act to provide for the establishment of the National Social Security Fund and to provide for its membership, the payment of contributions to, and the payment of benefits out of, the fund and for other purposes therewith.”

The fund is a contributory scheme and is funded by contributions from employees and employers of 5% and 10% respectively of the employee’s gross monthly wage.

The Act provides for 5 major benefits; that is to say the Age Benefit (claimed at the age of 50), the survivor’s benefit (claimed by the immediate surviving family of a deceased member), exempted employment, emigration grant and the invalidity benefit.

In essence, what the Act says is that if you are not 50 years of age and above, deceased, haven't joined the public service or the army, haven't left the country or are disabled, then you are not eligible to access this fund!

In my considered opinion, this position is totally absurd! It does not meet the intended aim and in the end the problem does not rest on the shoulders of the workers in the fund but rather the law that governs the fund.

This entirely means that even though the board wanted to help Ugandans, its hands are tied.

There is no one above the law and for that very reason, what government needs to consider at the moment is a total overhaul of the NSSF Act.

On the other hand, when NSSF was first created in 1967, it had been established as a department under the Ministry of Labour. This essentially means that it was aimed at helping wage earners.

However as fate may have it, in 2012 NSSF was placed under the regulation of the Uganda Retirement Benefits Regulatory Authority while the Ministry of Finance, Planning and Economic Development was made responsible for policy oversight.

This was later to manifest as an impediment to maximum benefit of an employee because the Worker’s benefit thus became a financial matter. It now only benefited the retired workers and the youth were left to fend for themselves.

The Fund which was initially set up to create a buffer to support the people and not necessarily as a retirement scheme changed its objective the very moment it was placed under the Ministry of Finance, planning and Economic Development.

So, where do we stand now?

In the midst of pleas by the people to redeem 20% of their saved up money, the fund says that there is no money.

Could there be an underlying issue that the masses are not aware of? Could the government only be using NSSF for its own benefit? From my analysis, the answers to these questions lie in the letter of the law. As a lawyer, I opine that the Act in place does not in any way support the pleas of Ugandans. The Act does not manifest the would-be objectives of the draftsmen. This is why a change in policy has to be considered to fit the current times such as this Coronavirus pandemic that threatens the very existence of mankind, a reality that Government should not be seen to ignore.

Secondly, the presumption that Ugandans are being selfish needs to change and access should be given to them to redeem the money they have been saving as contributions to NSSF.

The government of Uganda is aware that many people who are eligible to get their money have so many dependants and therefore, the fund will support and preserve life of many families. This is not an individual plea as we live in extended families.

Currently, there is low morale, a lot of fear, no income generating activities for most people and business as government has classified most businesses as nonessential services and those generating income are minimising costs; thus over 80% of the economy is suffering.

With a population of more than forty million Ugandans, approximately five million people contribute to the NSSF fund.

With an estimation of shs20,000 contribution from each member, we are then looking at about ten billion shillings per month .

This is about the same amount of money that Members of Parliament of Uganda were allocated to allegedly support the Covid-19 task force.

One wonders where the good faith of our esteemed legislators is in such a time as this when they should be voicing the cry of the very people they are supposedly representing.

It goes without saying that Ugandans have a right to access their NSSF funds as was the initial goal.

Giving 20% of an employee’s benefit will definitely not create inflation in Uganda because only a small portion of eligible Ugandans will be granted access to the said funds.

Be that as it may, even before the situation became dire, it was difficult to redeem the said benefit out of NSSF.

This is probably because of the loopholes in the law as stated above. However, the current situation should be a pushing factor for the decision makers (Board of Directors, NSSF) to sit down and make a criterion as to who can redeem their benefits.

As the legal profession therefore, we pause a question, is NSSF the right forum for us and fellow Ugandans to save money for times such as this or should the whole idea just be dropped?

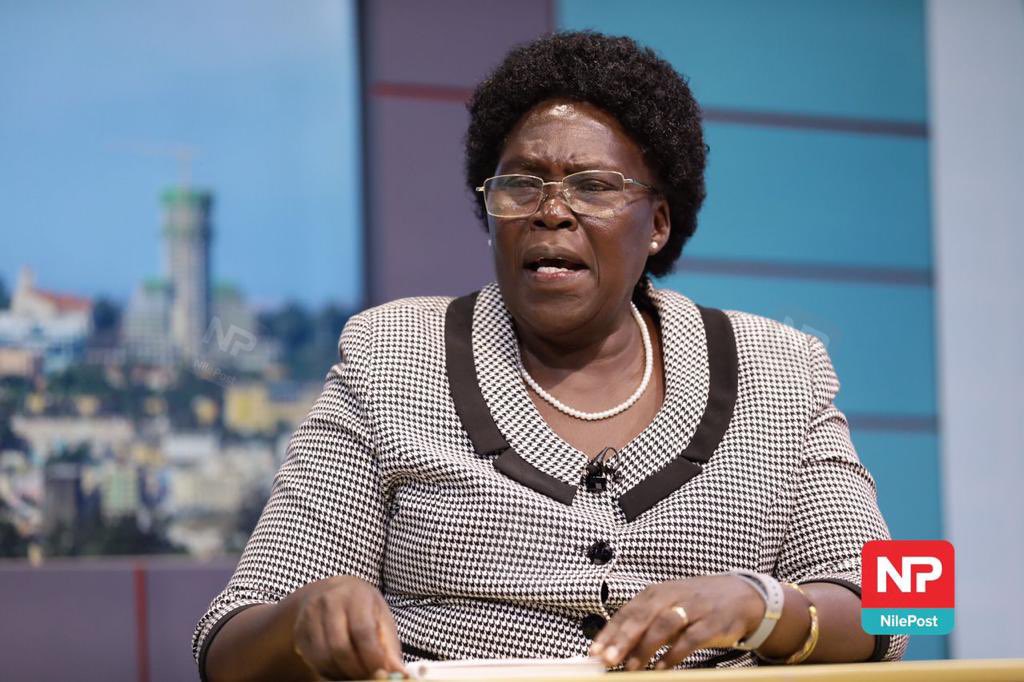

About the author

Rachael Kyomuhangi is a lawyer and an associate with Apio ,Byabazaire, Musanase & Co Advocates.