Ecobank becomes the 20th bank licenced to sell insurance in Uganda

Ecobank has become the 20th bank to get a licence from the Insurance Regulatory Authority to be able to sell insurance services in Uganda.

The Financial Institutions Act 2016 was a few years ago amended to allow banks engage in insurance services and sell insurance products.

Keep Reading

- > Parliament questions government's Shs1.1 trillion supplementary budget

- > Salam TV elevates coverage of 11th international Quran competition 2024 in Rwanda

- > Electoral Commission budget expected to rise

- > PPDA asks districts to use use alternative procurement processes to avoid returning money to consolidated fund

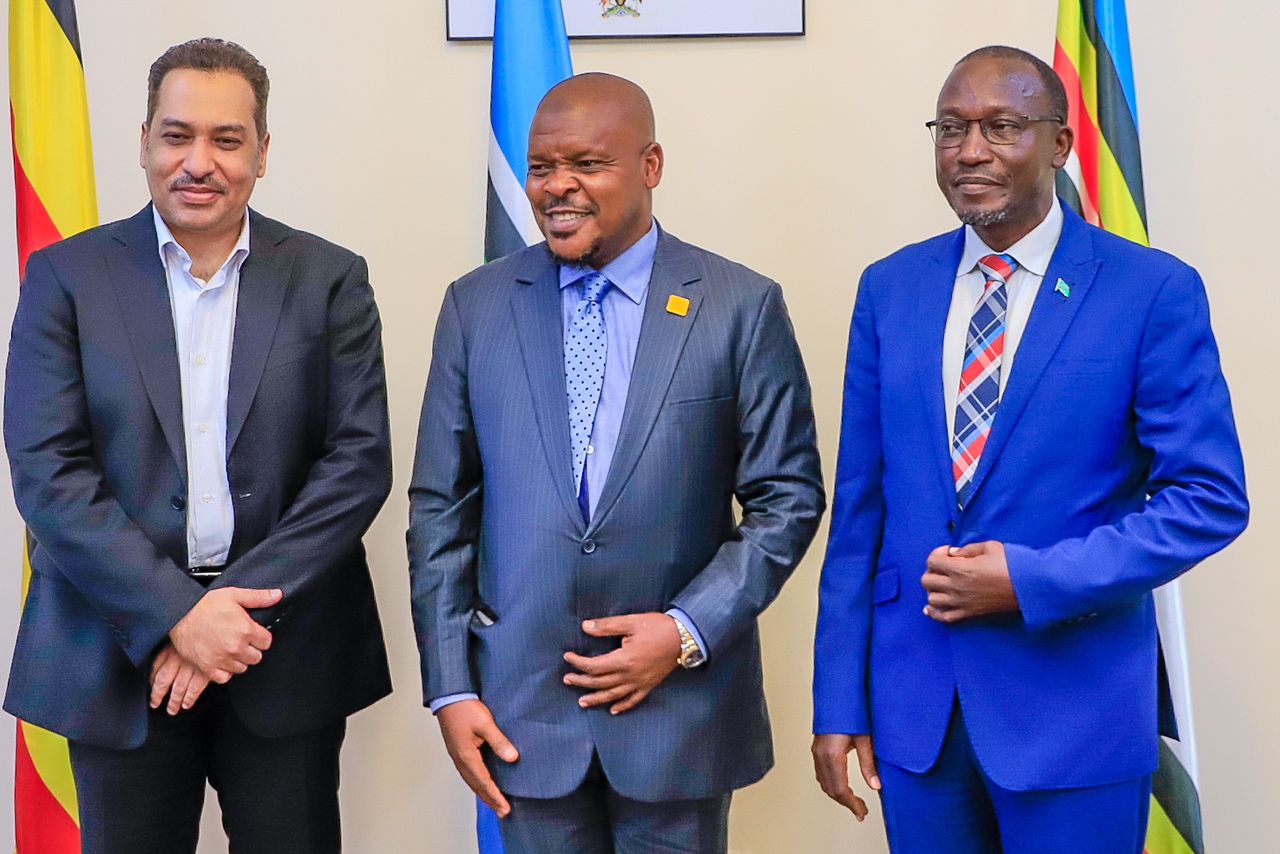

On Tuesday, Ecobank Executive Director, Annette Kihuguru said this was a great opportunity for them to contribute something to the insurance sector in Uganda.

“We believe our digital platforms will be used to ensure insurance penetration throughout the country. We are lucky that we are a bank with a number of customers with whom we shall start with convincing to take up insurance,”Kihuguru said.

“We shall not be starting from zero and as a bank, we believe we are in the right position to drive this.”

According to the bank Executive Director, they already have partnerships with Britam, Sanlam, ICEA, Prudential and UAP Old Mutual insurance companies and that it is a good start for them.

Albert Kaakwa, the head of Bancassurance at Ecobank said the financial institution has been providing the services in 20 other countries, noting that they would borrow knowledge to be applied in Uganda.

“Uganda is the 21st country where Ecobank will be using its digital platforms to avail insurance services to customers. We shall, therefore, copy and paste the idea from those other countries and we believe it will be a game-changer in Uganda,”Kaahwa noted.

Bernard Obel, the director in charge of supervision at the Insurance Regulatory Authority welcomed Ecobank on board, noting that it is another opportunity to increase insurance penetration in the country.

“This is another opportunity that will see development of the financial sector and increase penetration and I hope the banks can leverage on agency banking and telecom companies,”Obel said.

He added that of the 24 commercial banks in Uganda, 20 have already got licences to offer insurance services, noting that the remaining four are soon coming on board.

According to Sande Protazio, the director in charge of planning and market research at the Insurance Regulatory Authority, the insurance sector has been growing and last year, premiums worth shs856 billion were written, from shs728 billion on 2017.

He noted that they expect the premiums to reach one trillion shillings soon.