What you need to know about the government student loan scheme

JOEL OGWANG

Recognising the hardships parents and guardians of, especially, needy but brilliant students face in financing higher education off-pockets, the government, through an Act of Parliament, established the Higher Education Students Financing Board (HESFB) in 2014.

The Board is charged with providing loans and scholarships to Ugandan students to enable them pursue high education. Under the scheme, a total of 10 public and 10 private universities accredited by the National Council for Higher Education (NCHE) as well as 36 Diploma-awarding tertiary institutions, were selected.

Information obtained from HESFB indicates that each academic year, the Board awards scholarships to between 1, 200 to 1, 400 students.

Since 2014, at least 5, 259 students have benefited from the scheme, says CPA Michael O. Wanyama, the HESFB executive director.

"When a student gets a loan, it is an assured payment until he or she finishes. We signed Memoranda of Understandings (MoUs) with universities and tertiary institutions in which we agreed to remit all these monies directly to them to avoid interruptions (where a student may put the money to other uses if they were to receive the loan directly)," he said.

So far, he said, about 1, 700 students have completed their courses with about 1, 000 completing their grace period.

Enlisted students are charged 1% of the gross loan amount as Loan Protection Fee.

Here, the borrower of the funds subscribes to the fee which indemnifies him or her against repayment of outstanding debt to the fund as a result of death or permanent incapacitation.

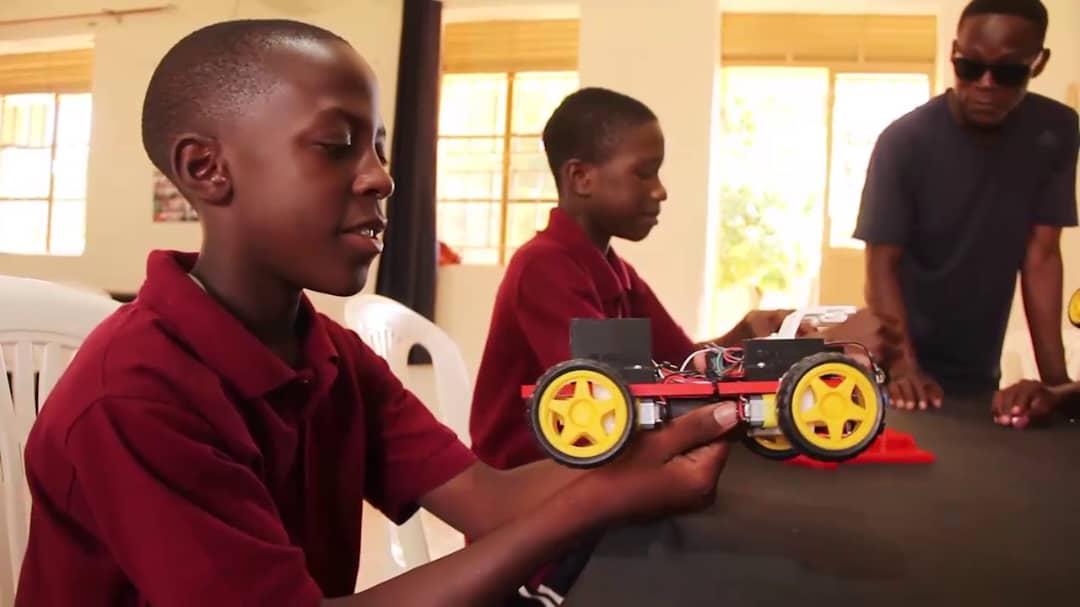

What it covers currently, the scheme supports students pursuing selected Diploma courses and undergraduate programmes in science and technology.

Plans are in the offing, with anticipated additional financial muscle, to cover other disciplines and other post-graduate programs and doctoral studies.

The loan covers tuition fees, functional fees, research fees, aids and appliances for PWDs pursuing science and technology courses.

Upon completion, graduates are accorded a one-year grace period after which they are expected to start repaying the loan, a revolving Fund.

"Last year (2018), we hit the mark of 5, 000 new applicants. We expect more in the coming years," Wanyama said.

MoU with FUE

In 2018, HESFB signed an MoU with the Federation of Uganda Employers (FUE) to create a channel through which enrolled students repay the loan upon completion of their studies.

Under section 26 (1), every employer who employs a person whose loan is due for repayment, shall, every month, deduct the amount specified by the Board from the salary or income of that person for purposes of repaying the loan scheme.

"The idea of HESFB signing the MoU with FUE is to ensure a good working relationship with employers aimed at ensuring adequate loan repayment by the beneficiaries," he said.

As well as ensuring sustainability of the Fund through a revolving fund can take action against loanees and employers who don’t comply.

"The law also requires employers, within 14 days of employment of any loan beneficiary, to inform the board, implying the beneficiary must also inform the employer that he or she is a beneficiary," Wanyama said.