URA launches tax compliance campaign dubbed "KAKASA"

Uganda Revenue Authority (URA) has embarked on implementing a series of new resource mobilisation initiatives, aimed at identifying and facilitating eligible citizens and economic players to contribute to the revenue basket.

Officials said on Wednesday that the tax body is implementing two new smart business solutions, each rooted in their understanding of the concerns of the business community.

Keep Reading

These include: the Digital Tracking Solution, and the Electronic Fiscal Receipting and Invoicing System (EFRIS).

In addition, there is also the voluntary disclosure olive branch extended to fellow-citizens who do not pay tax, an invitation that they become part of URA growing tax-paying family.

It is for this agenda that an integrated communication and marketing Campaign dubbed “KAKASA which is translated as "You’re in charge" has been designed.

Through the promotion of the KAKASA campaign, URA will help usher in a new approach to doing business, allowing business men and women across Uganda to take full charge of their business destiny from production, importation, consumption and through to record keeping.

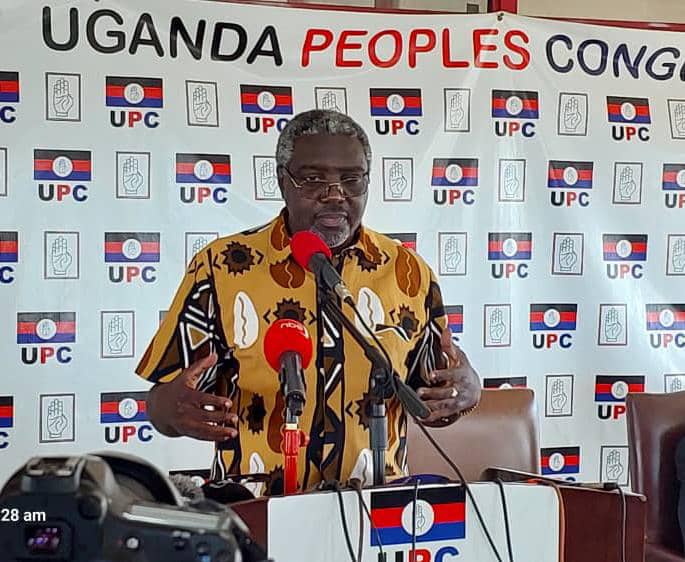

According to the Commissioner General URA, John Rujoki Musinguzi, the campaign is aimed at cementing the tax body's mission and positioning her as a trusted listening partner, business enabler and service centric organisation passionate about the growth and development of all Ugandans.

"Across the business community we aim to create awareness and then boost the adoption of the three business solutions of EFRIS, Voluntary Disclosure and Digital Tracking Solutions,"he said.

Musinguzi encouraged the business community to be tax-alert and look at tax as part of a legitimate business expense and not as a burden.

By embracing the three business solutions,Musinguzi said business men and women should no longer face tax-associated challenges.

The KAKASA business solutions are meant to level taxpaying landscape by identifying and facilitating all eligible citizens and economic players to join Uganda's growing family of compliant taxpayers.

URA pledged to pardon taxpayers through voluntary disclosure.

Musinguzi said voluntary disclosure is more flexible and cost-efficient because it does away with litigation costs, time-effective, and gives both parties more control over the process and the results unlike arbitration.

"Our aspiration is to mobilise enough revenue for comprehensive national development for this and future generations, a journey we are appealing to all Ugandans to take with us on this campaign,"he said.

KAKASA campaign is therefore a behavioural change campaign that will be revealed through a character called KAPO, set to inform, persuade and motivate behaviour changes among Ugandans.

According to the officials, URA currently funds 47% of the national budget with a tax to GDP ratio of 13%, which is below the average Sub-Saharan Africa performance of 16%.