Agather Atuhaire

The recent introduction of taxes on social media and mobile money has provoked outrage within a section of the population with many saying it will make a bad economic situation worse.

Keep Reading

- > Politicians hiring goons to attack traders who refuse to participate - police

- > URA Urged to Address 15% Withholding Tax on Members' Dividends

- > URA to open an operational office in the Kikuubo business area aimed at educating traders about EFRIS services

- > Politicians planning to hijack Kampala traders’ protest on e-receipts- police

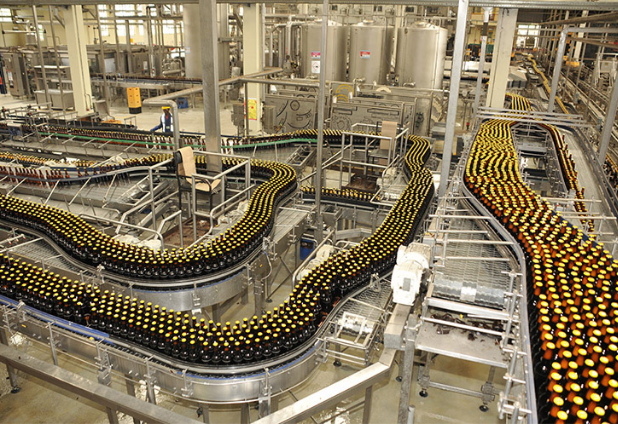

The 2018/19 budget introduced a shs 200 per day tax on social media and a 1% tax on mobile money in addition to other new taxes like shs 200 per litre tax on cooking oil, shs 100 tax on diesel and petrol fuels and shs 200,000 tax on motorcycles upon first registration.

A section of the population feels this is overtaxation given the dire economic conditions.

When Uganda Revenue Authority (URA) held a public budget breakfast on June 18, the angry tax payers saw the opportunity to vent accusing the tax body of making their lives difficult.

“Why are you people insensitive to our plight?” asked one participant. “More taxes on fuel when fuel is already unaffordable to many people are you trying to ban driving cars in this country?”

Another participant who identified himself as Mugerwa lamented that Ugandans are going through so much pain as even putting food on the table is becoming hard.

Some are even saying that instead of working towards the growth and development of the economy, the government and URA are jeopardizing it by overtaxing areas that would contribute to economic growth.

“I wonder if this mobile money tax was thought through,” said another taxpayer Charles Mugisha. “This tax is a bad move. It will discourage mobile banking which had accommodated our highly unbanked population.”

However, while this presupposes a highly over-taxed population, it does not reflect what is in URA’s coffers as the body has continued to struggle to hit targets.

Despite President Museveni’s continued rhetoric that his government has increased revenue collection from just above shs100 billion in 1986 to the current shs14.5 trillion, the tax to GDP ratio has stagnated.

At 12.6%, Uganda’s tax to GDP ratio is the lowest in the region and below the sub-Saharan average of 16%. Uganda is far behind its East African counterparts with Tanzania’s tax to GDP ratio standing at 21%, Kenya’s at 20% and Rwanda at 14.7%.

The biggest problem, tax experts say, is a narrow tax base and a large untaxed informal sector. A study by the African Development Bank revealed that close to 50 per cent of Uganda’s economy is informal.

For instance Pay as You Earn (PAYE) is Uganda’s biggest contributor to domestic direct taxes contributing about shs. 2 trillion but is largely drawn from the small fraction of the country’s formally employed labour force.

Regional comparisons show that Uganda has a higher level of informality than all the other EAC countries which has impacted negatively on tax collection and retarded business growth, according to a 2017 report titled widening the tax base by the Civil Society Budget Advocacy Group (CSBAG).

A World Bank report revealed that in 2013, over 95% of firms were competing against unregistered or informal firms in Uganda compared 59 per cent for Kenya.

Analysts say this, coupled with the fact that the largest sector of the economy- agriculture is not taxed, makes the bad situation worse.

Godfrey Akena, a lawyer and tax expert, says the reason Ugandans feel over taxed is because government wants to get as much tax revenue as possible from a small fraction of Ugandans.

“The problem we have here is that those who are paying taxes are very few,” says Akena. “There are guys who operate under the radar and don’t pay any tax and they are the majority. The reason why the few who are paying the tax are feeling the pinch is because they are carrying the burden for almost everybody.”

Akena proposes that agriculture which is the economy’s biggest sector should be taxed because government puts a lot of money in it.

Godfrey Akena

Godfrey Akena

He says the argument that taxing agriculture would discourage activity in the sector is baseless arguing that many developed countries like the Netherlands get most of their revenues from agriculture.

“I think what URA does when they are given a target is tax the few people they have in the system and they keep adding taxes on the same people.” Akena says.

Wilson Tukamuhabwa, the Economic Advisor Ministry of Finance, Planning and Economic Development agrees that there is a large informal sector. He says there are some things the government has not been doing right but has started to correct to reach the target of 18% by 2020.

“The government is carrying out domestic resource mobilization strategy which will look at a number of reforms.” Tukamuhabwa says.

The other problem hindering growth of revenues studies show, is the unregulated tax exemption practice.

A study by the African Development Bank in 2010 estimated that Uganda was losing at least 2 per cent of GDP ($272 million) in revenues due to tax exemptions.

URA in 2015 reported that total revenues foregone as a result of tax exemptions in FY 2013/14 amounted to UGX 1.6 trillion.

The Auditor General in his latest report also noted that the unregulated tax exemptions were problematic and not necessarily creating value in terms of investment and job creation.

Akena agrees with the Auditor General. He advises government to encourage investment through other incentives but not necessarily exemptions. For example, Akena says, government can encourage investment by allowing an investor to deduct all the costs he has incurred before he starts paying taxes.

“This would give the investor breathing space to pay all the bank loans and the shareholders loans before they start paying taxes.” Akena says.

“That is better than giving a blank exemption which hasn’t been of value because most of the companies close shop when the period of exemption elapses," Akena said.

But Tukamuhabwa says exemptions have benefitted the economy especially those in agriculture and industry.

“You can’t measure exemption returns in one year,” he says, “It must be over time.”

The main cause of frustration among taxpayers Akena believes is the feeling that their taxes are not being put to good use.

Akena is not wrong. At the June 18 budget breakfast, many expressed anger that they are paying a lot of taxes yet they are not getting services.

“It is not that we don’t want to pay taxes,” said one of the participants, “but it’s hard to continue paying takes when there are no roads, no schools and no drugs in the hospitals.”

What do you people do with our taxes?” Another asked, the roads where some of us stay are in a dire state, the security is alarming. Why do you want us to continue paying high taxes when we are getting very little in return?”

This, experts say, is the reason for little willingness to pay taxes and not necessarily because they are unaffordable.

Accountable

Studies on taxation show that tax payers are more willing to pay taxes when governments are accountable.

According to the African Development Bank report of 2011, willingness improves ‘tax morale’ and reduces collection costs and facilitate tax administration.

However, various studies on taxation in Uganda have revealed that “fiscal contract” does not exist in Uganda and, as a result, tax morale is either non-existent or very low.

This, studies show, is due among other things, to high levels of corruption and mismanagement of tax revenues; uncertainty about the use of tax revenues, and poor delivery of public services.

Uganda’s tax system seems to still fall short of some of the basic principles of taxation which require that taxes should be adequate to generate enough revenue required for provision of essential public services, broad based; that is spread over as wide a section of the population and sectors as possible to minimize the individual tax burden and restricted exemptions to avoid giving some parties undue advantage.