Are Ugandan taxpayers ready for the airline experiment?

The government of Uganda recently announced that it had ordered six planes and is on the verge of reviving the defunct Air Uganda with an ambitious debut set for November 2018.

There are obvious advantages to having our own carrier. Bragging rights, reliable transport for our perishable agricultural products and good manners in ticket pricing.

Keep Reading

As President Museveni has said, our neighbours have mistreated us since the collapse of Air Uganda in 2001 and maybe that is a squabble we can finally settle.

Air Uganda was established in the 1970s as one of many Idi Amin survival moves after the collapse of the East African Community and international sanctions against him.

Although the urgency was to keep Uganda exporting coffee, passenger aircrafts was eventually included and by 1999, we were airborne heading to Arua, Nairobi or Brussles.

Inevitably, an irreconcilable debt led the carrier nosediving. Blistering regulatory demands chased away Alliance Air, the final shareholder and Air Uganda was dumped, six feet straight and buried; for a decade and some.

For a long time, Entebbe International Airport was a ghastly caricature of ill-fitting hangars emblazoned with signage of arrivals and departure.

Until recently, the Crane Bank Building, the United Nations base and State House overshadowed the panorama of Uganda’s most important portal. Even with the unfortunate incidents of flooding, recent renovations and extensions could save Entebbe International Airport from looking like the Old Taxi park.

A while back, British Airways left the country, the United Nations, one of the leading users of the airport, I surmise; is on the verge of shifting its airbase to Nairobi; a move which will hurt the airport significantly.

Ugandans have long decried the monopoly of Entebbe Handling Services (ENHAS) in cargo handling at the airport and whether it is a creature of nepotism and one chocking fair competition.

Other issues around trafficking and customs at Entebbe airport are best whispered!

Government will spend heavily to revive the airline but it will need more from the Ugandan taxpayer to sustain it.

There is no indication that air traffic is increasing in the country or the region even for the existing airlines. The entry of Jambo Jet has given travellers a disruptive Mc Donald’s option which is biting traditional airlines already.

Even if Uganda were to get the birds in time and into the air, we will require some mileage and consistence of service delivery to attract frequent fliers who are hooked to bigger brands leeching off struggling aviation in Uganda.

One wonders if we fully appreciate the economics and what the numbers look like for African airlines in the industry. Not too long ago, we lost expensive fighter jets in Kenya and now we are importing different types of planes. Do we have a pool of relevant expertise and crew to?

Can we afford sending Ugandans for overseas training as licensed aircraft engineers? Without a transparent bidding process, are we certain that the taxpayer is getting the best deal? Can we justify the cost of negotiations and brokerage in such deals? How strong is our local content policy in the aviation sector?

We must be pragmatic about the initiatives that the industry needs rather than play a public relations game and lose trillions of tax payers money in the process.

On the African continent, only Ethiopian Airlines teeters close to break even point and that could be because of its antiquity in comparison to the likes of South Africa Airlines, Kenya Airways and RwandAir.

Rwandair is not yet profitable

Rwandair is not yet profitable

It is unlikely that Entebbe will soon become a hub for flights on to the continent as is Addis Ababa.

Other airlines including South Africa’s require excruciating government injection to keep afloat in a fluffy venture called airline infrastructure.

If RwandAir and Kenya Airways cannot agree a monopoly in the region, they will still struggle against other African Airlines, not to mention the likes of Qatar Air, Emirates, Fly Dubai and British Airways. It is reported that RwandAir, the most ambitious airline in the region since 2002 had by 2016 accumulated US$222 Million in losses.

To plug this bottomless pit, Rwanda’s government has reportedly pumped US$430 in loans and grants between 2013 and 2016. Add another US$100 external loan and you complete the Conundrum.

For a country with a GDP of US$ 8.3 Billion and a per capita income of US$ 702, this is no slight problem.

Uganda Airline would inevitably compete with local Ugandan airlines, Kenya Airways and RwandAir for the same flights and that can only exacerbate challenges in the business.

Airlines like the Virgin Atlantic are testament to the fact that we can have heavily invested private airlines which become profitable in the long run.

A public private partnership might be more adroit at gliding across the murky waters.

If government partnered with local private airlines with industry standards in place, experience with the market and technical expertise, these airlines would easily scale by dominating regional routes without compromising quality.

Even if (mis)management concerns contributed to the collapse of Air Uganda, it is a common challenge in the region with similar rhetoric voiced about Kenya Airways and RwandAir in the recent past.

The revival of Air Uganda seems to have originated from a Presidential directive rather than an opportunity in the market.

With government interference in running of the restored carrier, bureaucracy and micromanagement might blur critical decisions that should be left to the judgement of technical staff.

We have always wondered if a government institution can independently and effectively audit and regulate a government project.

Whether it be energy, health, agriculture or works, there are dotted lines in reporting, conflicting strategy and we are not even referring to glaring corruption indices.

The challenges Uganda National Road Authority (UNRA) faced with Dott Services Ltd recently is not strange to other sectors. Qualitative standards and integrity of systems is an expensive venture for most sectors to maintain and I reckon, it must be worse in aviation.

What is to stop national airline from flouting regulatory demands and running to the Presidency claiming that it is being frustrated by civil servants?

We should ask the question, if East Africa is smaller than the East Coast of the United States of America, why doesn’t each state in that region have its own airline? Could it be that the reason we are far from harnessing the potential of the East African region is because we are not looking long term as a region? How do we get beyond unsustainable selfish ambition amongst the EAC countries?

If it is not too late, we should consider strengthening existing airlines to scale up to bigger business or even consider a regional airline which can leverage the stronger market in Kenya, the booming Tourism and vastness of Tanzania and oil interest as a springboard for frequent interconnections at subsidised rates.

Rather than sink more money into failed projects, we should expand the scope of the feasibility study as a region and explore opportunities of not business in the region but also, collective bargaining and central points for flights in and out of the region.

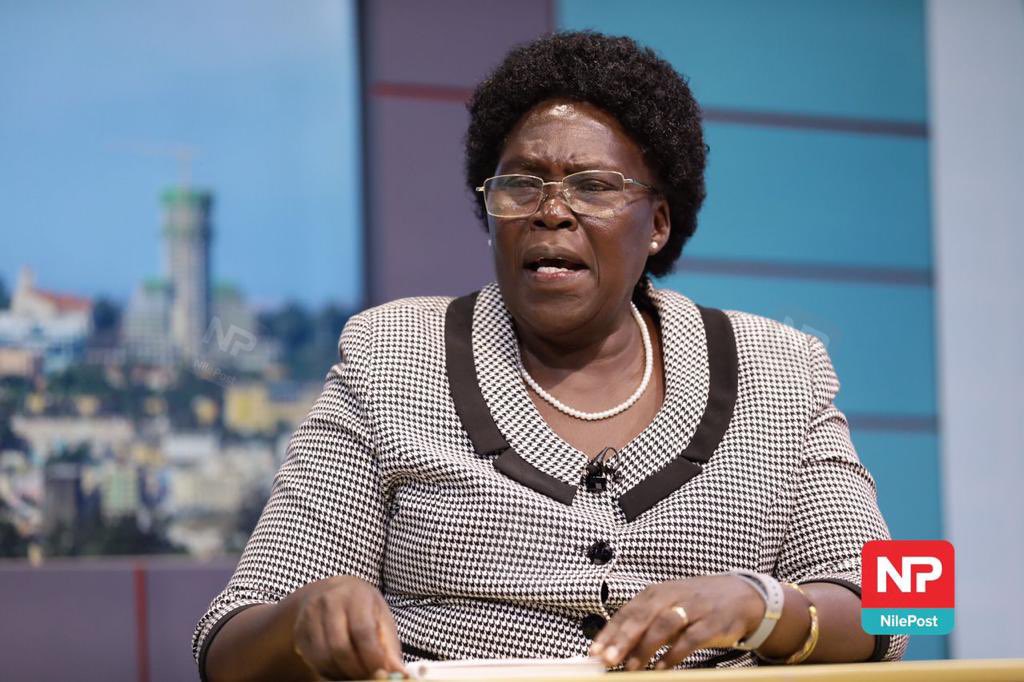

The writer is a Lawyer and Author.