Parliament approves tax on social media, mobile money, old vehicles

Parliament on Wednesday evening passed the Excise Duty (Amendment) Bill, 2018 which among others approve the proposed tax on social media, mobile money transactions and old vehicles.

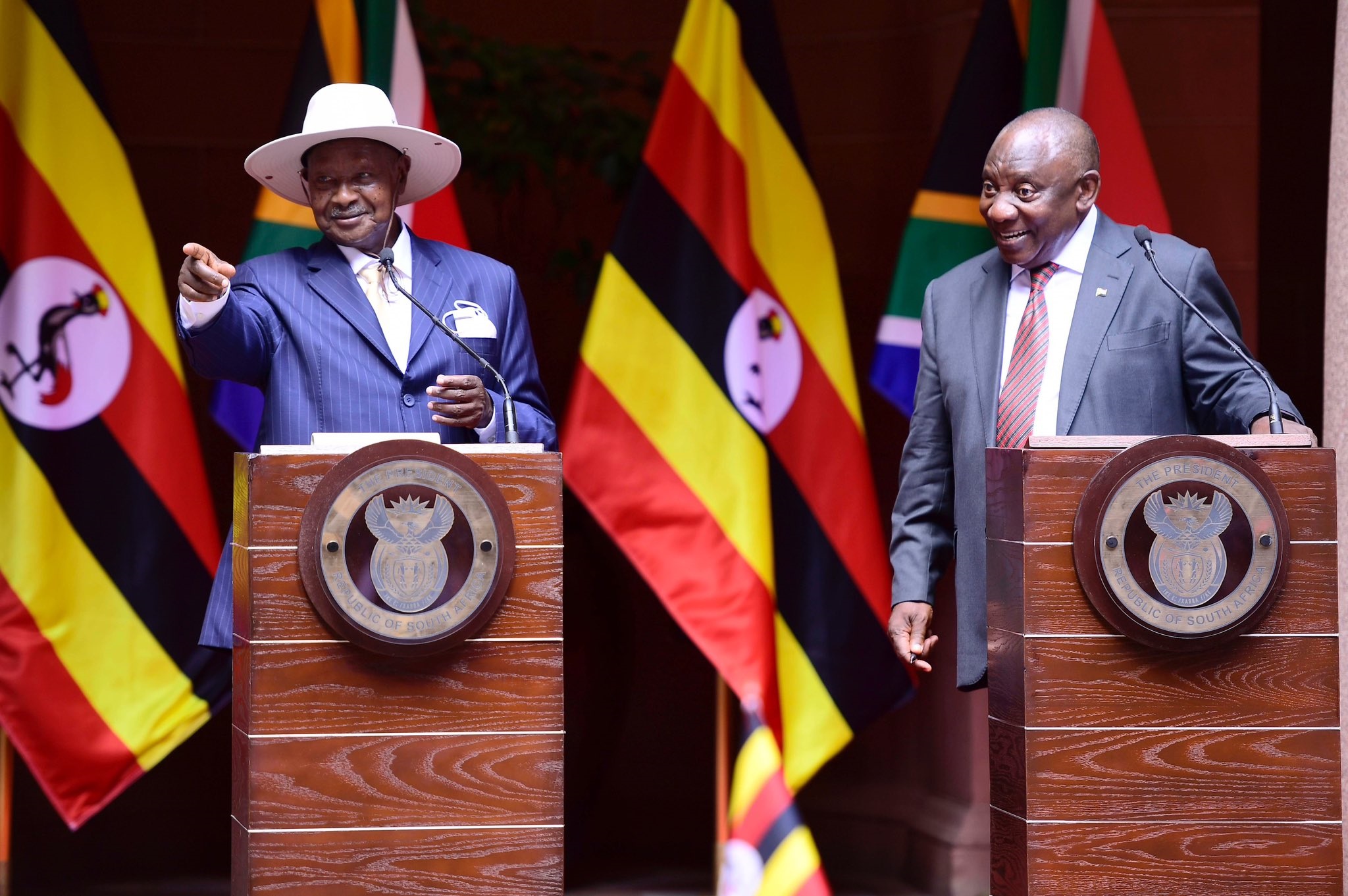

President Museveni in a March 12 letter directed the Ministry of Finance to introduce a tax on the usage of social media as one of the ways for government to raise revenue as well as curtailing gossip by Ugandans so as to reduce the country’s borrowing and be able to fulfill government’s obligations to people.

Keep Reading

“I am beginning to confirm that there is total lack of seriousness at the very least or collusion among your tax identifiers and collectors. Olugambo(gossip) on social media (opinions, prejudices, insults ,friendly chats) and advertisements by Google must pay tax because we need resources to cope with the consequences of their lugambo,” Museveni said in the directive.

Following a report by the Parliamentary Committee for Finance giving a green light to the taxes, the August House on Tuesday passed the proposal that would see a social media tax of shs200 per day levied on every mobile phone subscriber who uses Whats App, facebook and twitter.

Under the new arrangement, every social media user will pay shs70,000 per year starting with the financial year 2018/19 that starts in July.

However, the committee Vice Chairperson Joy Katali defended the new tax arguing that communication has now shifted from mere phone calls to using the internet.

“Voice and messaging traffic has migrated from conventional voice calls and messaging to voice over the internet and online messaging, through applications like WhatsApp, Viber and Skype referred to as over the top (OTT) service yet these services don’t attract excise duty unlike voice calls that attract VAT and excise duty,” said Katali.

“This is unfair and inequitable for consumers who buy airtime & use it to make voice compared to those who buy internet data and make voice calls.”

Mobile money

The Excise Duty (Amendment) Bill, 2018 passed by parliament on Wednesday also mean that a one percent tax on mobile money transactions was approved by the August House from which government will earn shs115 billion after its collection.

However, legislators blasted government for its desire to widen the tax base without considering the plight of poor Ugandans who are the majority.

“I have looked at this budget & is going to heavily depend on borrowed money. We need to take into consideration that the poorest of the poor are not burdened with taxation,” said Butambala MP Muwanga Kivumbi.

Bungokho County North MP Sizomu Gershom Wambedde argued that the taxes seem to be targeting the poor adding that they will only make the poor become poorer.

In response, Katikamu North MP, Abraham Byandala defended government on the tax which he said is one of the ways government earns revenue to provide services to its people.

“If you say we don't pay taxes, you are saying we reduce on the services we are offering. We must pay these taxes to get services,”Byandala noted.

Tax on old vehicles

Parliament also approved the Traffic and Road Safety Act 1998 (Amendment) Bill, 2018.

The bill will see an increase in the motor vehicle registration fees provided in the Finance Act, 2013 and also increase the environmental levy on motor vehicles in the Finance, Act,2006

The bill also see a ban on the importation of motor vehicles that are 8 years old or more from the date of manufacture.

According to the bill passed by parliament, the act that will come into force on July 1, 2018 will see anyone who imports a vehicle which is five years old or more from the date of manufacture pay an environmental levy for the vehicle charged by Uganda Revenue Authority before being cleared to enter the country.

Vehicles meant for transport of goods with a gross weight of at least six tonnes and special purpose vehicles have been excluded from the new arrangement.

Sedans, saloons and estate cars apart from dual purpose goods passenger vehicles will be required to pay shs 1.5 million as registration fees whereas this amount will be the same for passenger vehicles including omnibuses with a seating capacity not exceeding 28 passengers.

Estate and station wagon vehicles with engine capacities of 3500cc and above are expected to part with shs1.7 million for their registration in the new bill that is yet to be passed into act.

According to the bill passed by parliament, government will charge an environmental fee on vehicles which are five years old but do not exceed eight years from the date of manufacture excluding goods vehicles and this is expected to be 35 percent of the price quoted by a seller including all other charges as deemed by the seller.

A 50 percent fee will be charged on vehicles which are more than eight years old or more from the date of manufacture whereas vehicles that are five years or more old but are designed to carry goods will pay 20 percent of the price quoted by the seller as an environmental fee.

The state Minister for Finance, David Bahati defended the bill as one that will help save the environment.

The 10th Parliament has been given an opportunity to make a law that will save the environment,”Bahati argued.